The US crude oil price accelerated away from negative territory yesterday, as the expiring June-dated contract on WTI gained 2.1% to close at USD 32.50/barrel, dispelling any fears that the market would witness a repeat of last month’s sub-zero pricing. July WTI, which settled up 1% at USD 31.96/barrel and now becomes the front month, was already trading at much higher volumes after investors fled the front-month amid fears that they would get caught short when the June contract expired.

Upon expiry of WTI contracts, positions must be settled physically at Cushing, Oklahoma, the world’s largest crude oil storage facility. When the May-dated contract expired a month ago, a lack of available storage capacity and vanishing demand forced the price deep into negative territory, settling at minus USD 37.63/barrel.

The global oil price recovery since then has been strong, with Brent gaining 44% on deep supply cuts and a gradual return of demand as lockdowns are eased, but fragility remains: Brent fell 0.5% yesterday to USD 34.65/barrel, ending a three-day rally.

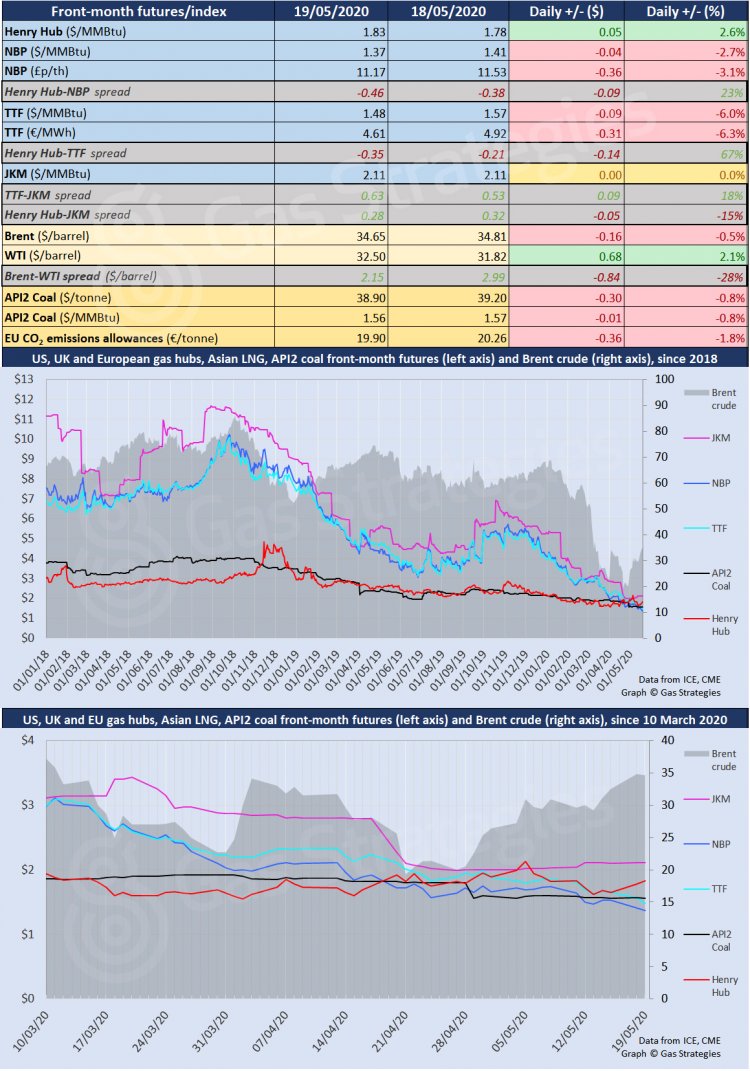

US natural gas price Henry Hub again rose strongly against falling European benchmarks, gaining 2.6% to USD 1.83/MMBtu. Dutch TTF fell by a hefty 6.3% to close at the equivalent of USD 4.61/MMBtu, while UK NBP fell 3.1% to USD 1.37/MMBtu. These movements widened the ‘American premium’ over both UK and continental European wholesale natural gas prices, which is further undermining the economics of US LNG exports.

Front-month futures and indexes at last close with day-on-day changes (click to enlarge):

Time references based on London GMT. Brent, WTI, NBP, TTF and EU CO2 data from ICE. Henry Hub, JKM and API2 data from CME. Prices in USD/MMBtu based on exchange rates at last market close. All monetary values rounded to nearest whole cent/penny. Text and graphic copyright © Gas Strategies, all rights reserved.

Subscription Benefits

Our three titles – LNG Business Review, Gas Matters and Gas Matters Today – tackle the biggest questions on global developments and major industry trends through a mixture of news, profiles and analysis.

LNG Business Review

LNG Business Review seeks to discover new truths about today’s LNG industry. It strives to widen market players’ scope of reference by actively engaging with events, offering new perspectives while challenging existing ones, and never shying away from being a platform for debate.

Gas Matters

Gas Matters digs deep into the stories of today, keeping the challenges of tomorrow in its sights. Weekly features and interviews, informed by unrivalled in-house expertise, offer a fresh perspective on events as well as thoughtful, intelligent analysis that dares to challenge the status quo.

Gas Matters Today

Gas Matters Today cuts through the bluster of online news and views to offer trustworthy, informed perspectives on major events shaping the gas and LNG industries. This daily news service provides unparalleled insight by drawing on the collective knowledge of in-house reporters, specialist contributors and extensive archive to go beyond the headlines, making it essential reading for gas industry professionals.