As 2018 dawns and the LNG world turns its attention to the supposed short-term supply glut, it is useful to pause and look back on what happened to LNG demand in 2017. Using provisional figures for full-year imports, Gas Strategies has compiled a summary of market movements.

The basics

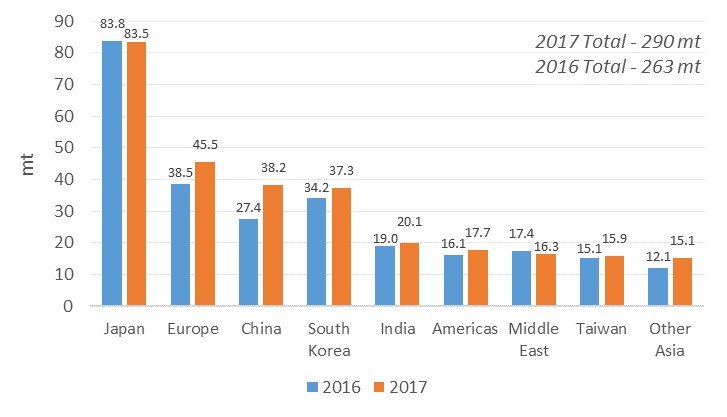

- Worldwide LNG imports were up, with 290 mt imported in total, representing a ~10% increase year-on-year (27 mt)

- China became the second largest importer of LNG in 2017, overtaking South Korea for the first time

- Demand growth was driven primarily by China, with an increase of 10.8 mt (up 39% on 2016)

- European LNG demand continued to bounce back, with a 7.0 mt (18%) year-on-year increase

- The Middle East was the only region which saw a decline, with Zohr production and increased pipeline imports reducing Egyptian (1.3 mt, 17%) and UAE (1.1 mt, 30%) imports respectively

- Following strong growth in 2016, Indian demand was relatively flat (+1 mtpa, 6%), likely reflecting sensitivity to higher prices

LNG Imports by Country/Region

Source: Thomson Reuters, GIIGNL and Gas Strategies

Looking deeper

In China, the policy drivers for cleaner energy are now supported by action, with more than 3 million new residential gas connections in 2017. The environmental statistics are validating the gasification efforts – PM2.5, a key pollution indicator, dropped by 33% overall in Q4 2017 compared to the same time in 2016 across 27 major cities in central China. The increase in gas demand was such that infrastructure constraints led to gas shortages in some parts of the country. This was evidenced by CNOOC hiring a convoy of 100 trucks to ship LNG 2,400 km from Southern China to colder Northern cities. CNPC is forecasting a further 10% growth in gas consumption in 2018.

Turning the focus to Japan, demand was up over the first half of 2017, particularly in January and February. Over the course of the rest of the year, however, demand remained below 2016 levels, impacted by the mid-year start-up of the Takahama 3 and 4 nuclear reactors. Even without further nuclear restarts LNG demand in the world’s biggest market could decline right at the time that LNG supply is significantly increasing.

In Europe, the increased demand came primarily in southern markets (Italy, Spain and Portugal). The increase in imports was demand rather than LNG supply driven, with this being evidenced by the fact Russian pipeline imports to Europe achieved a record level in 2017 (191 bcm) and European gas demand overall was up ~9%. Drivers for increased demand included increasing price competitiveness of gas over coal for power, the reduced hydro output in Spain and extended maintenance outages in the French nuclear sector.

Looking forward

As reported in Gas Strategies 2018 LNG Outlook there could be up to 37mt of additional supply coming online in 2018 and concerns remain of a supply glut (accompanied by lower pricing). Turning our attention to this year (and beyond):

- Consensus forecasts agree Chinese natural gas demand, including LNG imports, will continue to grow. Chinese LNG demand has grown by an average of 10 mt per year in the last two years and whether this continues, or even increases, will remain a key watch point. In line with other North Asian markets, Chinese demand has shown to be seasonal and this could drive increased seasonal spreads in LNG pricing

- Middle East demand is expected to continue to fall with increased Zohr gas production significantly reducing Egyptian LNG imports, and this will only partially be offset by expected growth in Kuwait

- India remains a price sensitive import destination and depressed pricing from excess supply could well lead to a greater uptick in LNG demand

- In the other large markets, nuclear restarts in Japan and recently commissioned coal-fired power generation plants in South Korea could lead to flat or declining LNG demand in those countries

- The Shell LNG Outlook in 2017 highlighted South Asia as a key market to balancing the increasing LNG supply over the short term and we expect emerging markets such as Pakistan and Bangladesh will be key watch points

If you would like more information about how Gas Strategies can help your business with Consulting services across the value chain or provide industry insight with regular news, features and analysis through Information Services or help with people development through Training services, please contact us directly.