Just when you thought LNG markets could not be more challenging!

Shipping has moved quickly from the logistical mechanism for transporting LNG from point-to-point to being deeply integral to LNG value. This is yet another game-change in a world of flexible supply, decreasing margins and volatility in both LNG prices and charter rates. Both existing and new players to LNG shipping are challenged to navigate this steep development curve.

Focus on charter rates in a world of flexible LNG

Historically, with the majority of LNG sales contracts being Delivered Ex-Ship (DES) and vessels often being part of liquefaction project financing, little attention or value was placed on spot market charter rates for LNG vessels. But the push for flexibility, led by buyers seeking to escape from destination restrictions and enabled by a wave of projects selling Free on Board (FOB) or with tolling structures coming online in the US and Australia, has seen the amount of LNG traded on a spot or short-term basis reach almost 100 mt in 2018. This trend to larger volumes traded on a spot basis can be reasonably expected to continue into this winter and 2020 as LNG facilities in the US and Australia continue to ramp up to full capacity.

This structural change in the way LNG is traded has in turn impacted the LNG shipping market. The increased demand for shipping, exacerbated by an oversupplied global LNG market which has seen players use vessels for floating storage, saw spot charter rates soar to record highs at the end of 2018 and show significant volatility throughout 2019 to date.

Factors currently driving the spot market

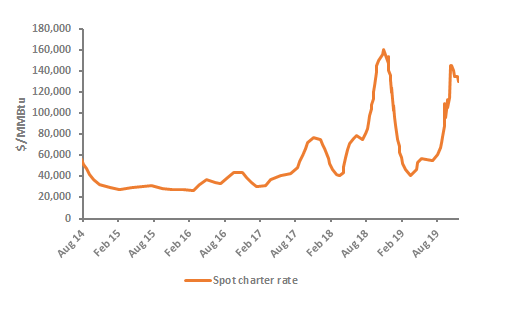

The spot rate has risen in recent weeks to over $145,000 per day, from lows of $40,000 per day observed in the northern hemisphere summer.

Figure 1 – Spot charter rate ($/day)

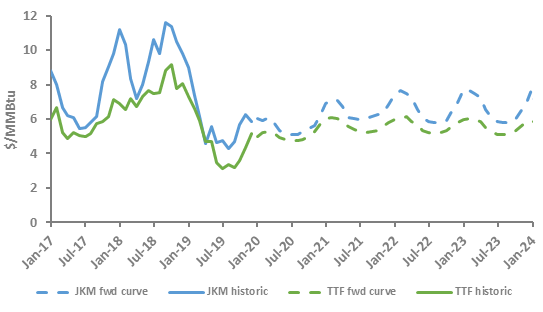

A number of reasons are behind this increase. Firstly as demonstrated by the well-publicised sanctions imposed by the US on Cosco, the LNG shipping market is not immune to shock events. Further, the behavior of LNG market participants is influencing rates as value is maximized from short term optimisation. Both TTF and JKM have been in steep contango as the market moved from the shoulder months into the premium northern hemisphere winter months see Figure 2. Players with open cargoes and the shipping capability to do so have been incentivised to hold cargoes on the water to take advantage of the contango by delivering the cargoes later in the winter, further decreasing ship availability and driving prices.

Figure 2 – TTF and JKM forward curves

Shrinking margins

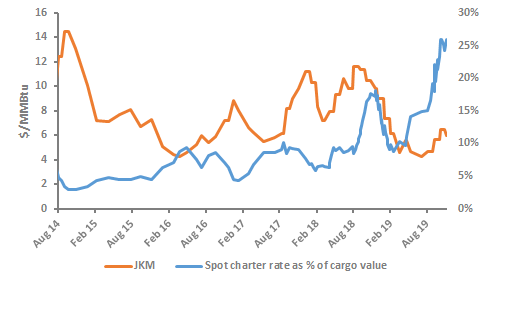

Historically, the variable shipping costs represented by the spot charter rate equated to approximately 3-6% of the total value of an LNG cargo[1]. Even in late 2018 when charter rates reached historic highs, this percentage value never exceeded 18%. However, new LNG supply entering the market in 2019 has pushed global gas hub prices to record lows and charter rates are now once again surging; voyage costs at current levels equate to around 25% of the value of a cargo.

This brings a new challenge for value optimisation and risk management in LNG trade, in many cases to players in LNG that are very new to shipping and logistics. With a lack of financial hedging instruments currently available to mitigate such volatility, both additional depth of shipping management and longer-term strategic thinking are necessary to ensure shipping plays an effective role in LNG business management.

Figure 3 – JKM monthly close vs spot charter rate as a % of cargo value

Implications for market participants

To operate a profitable LNG business model, the tight integration of shipping into the portfolio is now essential. But significant barriers to achieving this remain:

- The business of LNG is strongly influenced by a senior management that brings vast experience from utility and oil companies, shipping commodities such as coal and oil, where shipping has been regarded as a relatively minor sunk cost. A mindset change is necessary in order to recognise shipping management in the LNG space as a key component of LNG value realisation.

- Whether a player is well established in the industry or a new entrant, to operate a successful and profitable portfolio model now requires an appreciation of shipping as a strategic asset that is key to unlocking optionality and margin in the LNG value chain.

- Senior management and Boards of many LNG shippers have been unwilling to commit to capital-intensive long-term time charters, above and beyond what is necessary to transfer cargoes from A to B. A new understanding of LNG trade and market dynamics needs to be attained at Executive level, including the value role of shipping in the business model, if the opportunities for short-term optimisation are to be realised.

At Gas Strategies we bring together our world leading capabilities across LNG markets and operations, LNG shipping planning and management, and portfolio optimisation to support clients addressing these business challenges.

[1] Assuming a 3.9 TBtu vessel, a 45-day round trip voyage representative of US Gulf to North Asia and end market pricing represented by JKM

If you would like more information about how Gas Strategies can help your business with Consulting services across the value chain or provide industry insight with regular news, features and analysis through Information Services or help with people development through Training Services, please contact us directly.