The first quarter of 2020 has seen some major upheavals in European gas markets brought about by a combination of COVID-19, an ongoing LNG supply glut, the oil price crash and the development of new infrastructure.

Some of the effects of this upheaval will be short lived whilst others, in combination with pre-existing issues, will have long-term implications. Perhaps most importantly COVID-19 has upset the existing policy and economic status quo – increasing uncertainty about the future trajectory of energy markets. This creates a new imperative for operators and investors to test their strategies against a range of market scenarios that could emerge post COVID-19.

First a few facts on what we have seen in Quarter 1

Demand

European gas demand in Quarter 1 appears to be down relative to 2019 partly as a result of warmer temperatures in January and February and, partly, particularly in March, as a result of the impact of COVID-19. The picture is complex with weather, pre-existing economic headwinds and variations in the power generation mix making it difficult to isolate the COVID-19 impact. Nonetheless, in those countries most affected by COVID-19 the impact seems clear – in Italy for example, March gas demand in Industry and Power was down 16% and 18% respectively on the same month last year with residential and commercial demand increasing by 13% as people were required to stay at home.

Supply

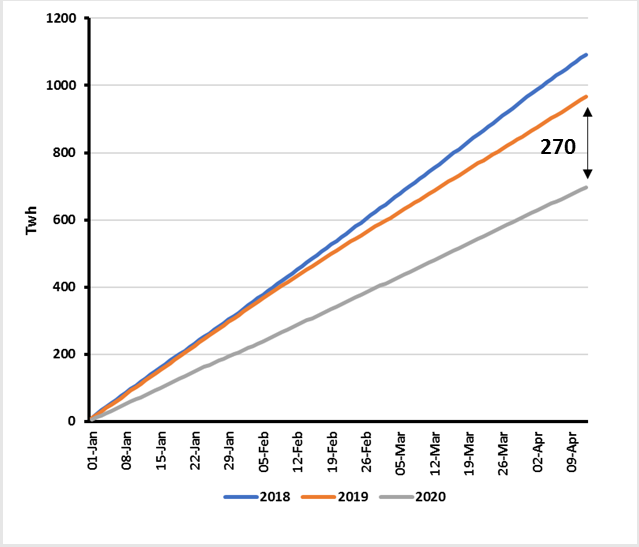

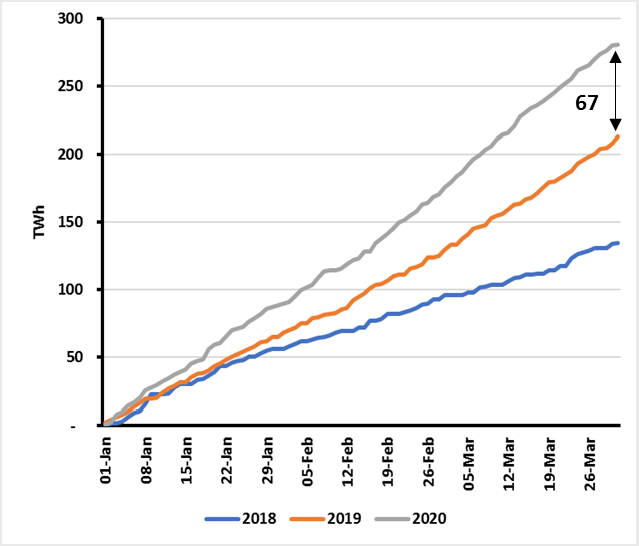

Not all supply sources were hit equally by falling demand, cumulative pipeline imports to the EU were down by approximately 25% versus 2019 while LNG supply has increased by 25%. Russian, Norwegian and Algerian imports were all down versus the same period last year.

EU and UK Quarter 1 International Pipeline and LNG Deliveries (Cumulative) TWh

Cumulative Pipeline

Cumulative LNG

Source: Enstog, Reuters & Gas Strategies Analysis

Gas Prices

Gas prices are also at an all-time low, with the May contract for TTF at $2.34 and NBP at $2.10. Whilst forward curves show some recovery toward the end of this year and into next, with the January 2021 contracts for TTF and NBP currently trading at $4.19 and $4.65 respectively, this is well below the average of recent years[1].

Gas Infrastructure

In January we saw the start-up deliveries to South East Europe of Russian gas from Turkstream which has seen the virtual cessation of deliveries to the region via Ukraine – and the near completion (subject to the finalisation of NordStream II) of Gazprom’s Ukraine by-pass strategy.

So what, if anything, do these dramatic developments of Q1 2020 tell us about the coming months and years?

Gas Demand Outlook

Economists are divided over the long-term economic impact of COVID-19 but the divisions seem to range from the outcome being a very bad short-term recession to the worst recession since the second world war. Both outcomes will lead to demand destruction in the current year and into next and it serves to remind us of how important macro factors, beyond the narrow world of energy, are to our industry’s success. Looking beyond the next year the picture becomes extremely complex – governments have yet to formulate their national economic responses to COVID-19, let alone form any kind of co-ordinated international response. Policies that we still can’t see will therefore be the most important factors affecting the speed and trajectory of the economic recovery and its implications for energy markets.

As an example, prior to COVID-19 the EU was pushing its New Green Deal targeting net zero by 2050 and proposing robust intermediate emissions goals to secure the delivery of the target. How will these climate related policies now play out in a prolonged recession? On the one hand we might see a vision led surge of EU and national government backed “green investment”, supported by private capital, to build Europe out of recession. On the other we could see a relaxation of ambition, prolonged austerity and an acceptance that climate goals may need to take second place to societal and economic stability – this might also be a world in which cheap gas helps to fuel economic recovery. The results of these different potential policy outcomes, which are only two of a number of credible scenarios, could deliver radically different gas demand outcomes over the next 10 years lets alone in the next 30.

Gas Supply Outlook

The outlook for the future gas supply mix is also deeply uncertain. It would be easy, for example, to see a world in which LNG is established as the supplier of up to 25% to 30% of the EU’s gas supply for the foreseeable future. However, where and how Europe sources its gas results from a very wide range of factors. These include the individual strategies adopted by European gas buyers and Gazprom, gas pricing and competition between global markets for supply and political and geo-political considerations relating to energy security. Taken together with the significant uncertainty on demand, these factors lead to a very different potential outcomes for the future supply mix and pricing levels. Indeed, in some recent scenario work conducted by Gas Strategies which looked at an accelerated trajectory toward a NetZero Europe, we saw LNG playing a diminishing role in European supply from the 2030s and virtually disappearing from the mix by 2040.

Gas Infrastructure Outlook

The uncertainty with respect to the future trajectory of demand and the European gas supply mix creates significant challenges for European gas infrastructure operators and investors. We are beginning to see them re-assessing their long-term plans for existing businesses and with respect to new investments or acquisitions putting a much greater emphasis on testing business plans against, what might have seemed a few months ago, some quite radical scenarios. Robust scenario thinking, and the development of quantitative representations of those scenarios has proved to really help connect the many competing and contradictory drivers into concrete “what if” scenarios that can bring real insight into the extent to which a business or asset is really robust.

Final thoughts

There is of course a risk that mid-crisis we are overcome by doom and gloom and uncertainty about the future and can fail to remember that economies are cyclical and with every trough there comes a recovery. However, the economic recovery, whenever it comes, will not necessarily signal a recovery of the gas and LNG business as we knew it. Battening down the hatches and waiting for the storm to pass may not be enough this time round.

[1] Prices correct as of 9th April

***

If you would like more information about how Gas Strategies can help your business with Consulting services across the value chain or provide industry insight with regular news, features and analysis through Information Services or help with people development through Training Services, please contact us directly.