The gas storage business in France, as with most other North West European markets, has been in the doldrums in recent times, but now state-led changes are proving to be a boon for the beleaguered sector. Overbuilding, liberalisation and low demand across North West Europe resulting in lower summer-winter spreads have all taken their toll on the industry. Increased competition has also resulted in market participants seeking to minimise the cost of flexibility and avoiding entering into long term contracts for storage but rather seeking flexibility from a portfolio of sources; spot market purchases, LNG, contract flexibility as well as storage. Long term fixed price storage contracts have also come to an end and storage operators (SOs) have been forced to adjust seasonal storage prices to align with the value of the summer-winter spreads. However, summer winter spreads have been very low for a number of years due to overbuilding of gas storage across Europe and depressed demand which has failed to recover since the financial crisis of 2008. This difficult trading environment has led to serious challenges for all storage operators, including Engie owned Storengy who were forced to write down the value of their assets by nearly half a billion Euros at the end of 2017.

In an attempt to support the ailing industry, the French government has intervened to ensure the financial viability of France’s storage businesses. The French regulator, the Commission de Régulation de l’énergie (CRE) has introduced a support mechanism for SOs, using an auction based contract for difference system which also incorporates a national storage obligation threshold and is similar to the Italian storage scheme.

Figure 1: Schematic of SOs compensation

Source: CRE

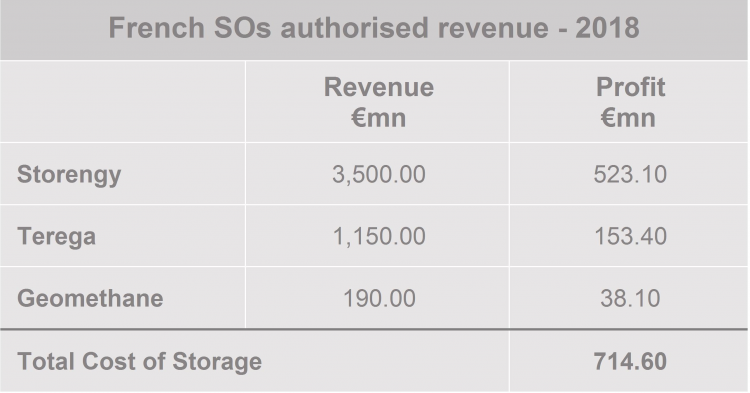

Under this new support mechanism, the CRE calculates an appropriate level of return, on the asset base (BAR), for the SOs in France, Storengy, Terega and Geomethane (Storengy operate the Manosque facility on behalf of Geomethane). This level of return incorporates the SOs initial capital expenditure on their facilities, their operating expenses, depreciation attributed to the facilities and other costs. The CRE uses a weighted average cost of capital (WACC) of 5.75% in their calculations. This is slightly above the 5.25% (currently under review) WACC used for similar calculations for the gas transmission system and below the 7.25% used for regasification facilities in France. The level of return also sees the SOs compensated for the value they provide to the French gas system through securing the country’s supply and ensuring France can meet its seasonal demand.

Source: CRE

The CRE has termed the authorised profit earned by the SOs as the “total cost of storage”, the cost the country must pay for storage to ensure security of supply.

The auction process itself is a pay as cleared system. Each participant submits their desired price (€) quantity (MWh) pairing that must exceed the reserve price (set in this year’s auctions at €0 MWh). The auctions were held between the 5th and 28th of March and were a success. Awarded prices ranged from €0 – €2.02MW/h and subscribed capacities amounted to 2,134 GWh/d, exceeding the 1,990 GWh/d threshold set by the CRE.

The CRE has also incorporated a bonus mechanism into the new policy to encourage SOs to maximise revenue and capacity from the auctions. If a SO sells over 75% of the capacity they have offered to auction participants they are entitled to keep 0.2% for every percentage they exceed 75%, a maximum of 5% of auction revenue.

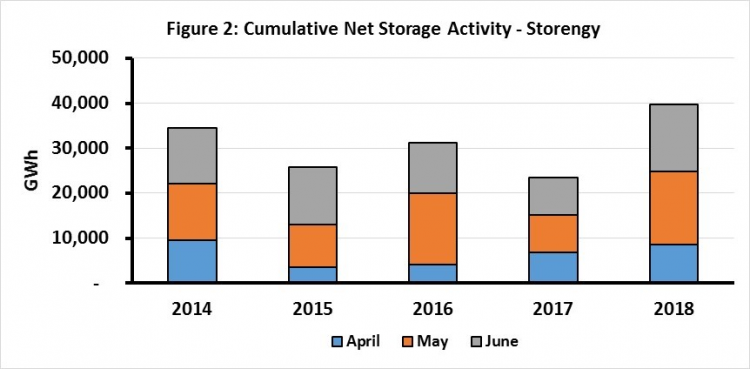

Gas Strategies has been watching gas storage developments across Europe and followed the new French policy with interest. As filling of the storage facilities began on the first of April as a result of the initial round of auctions we were keen to see what, if any, change there would be in injection rates into storage facilites across France. The figures point towards a significant improvement in injection rates compared to recent years. In Figure 2 below we can see the cummulative net storage activity for Storengy facilities since the start of April (which accounts for ca. 80% of storage capacity in France) and this year has seen the highest injection rates in the previous 5 years. An alternative explanation for these high injection rates could be increased temperatures, resulting in a reduction in gas demand, however monthly temperatures haven’t deviated significantly from the average seen in previous years, while demand has also been relatively constant. These results suggest that the new support mechanism is working and driving the utilisation of storage capacity as well as providing an economic lifeline to storage operators.

Source: Gas Strategies and Thomson Reuters

If you would like more information about how Gas Strategies can help your business with Consulting services across the value chain or provide industry insight with regular news, features and analysis through Information Services or help with people development through Training Services, please contact us directly.