After dropping to a 13-month low earlier in the week, European futures saw a modest uplift on Tuesday as a cold spell continues engulfing the continent.

Yesterday, prices climbed amid signs that the cold spell across the continent will last a bit longer than previously anticipated. This supported contracts across the curve, with prices to continue rising on Wednesday as the cold weather forecasts are confirmed, particularly for Germany, reported Energi Danmark.

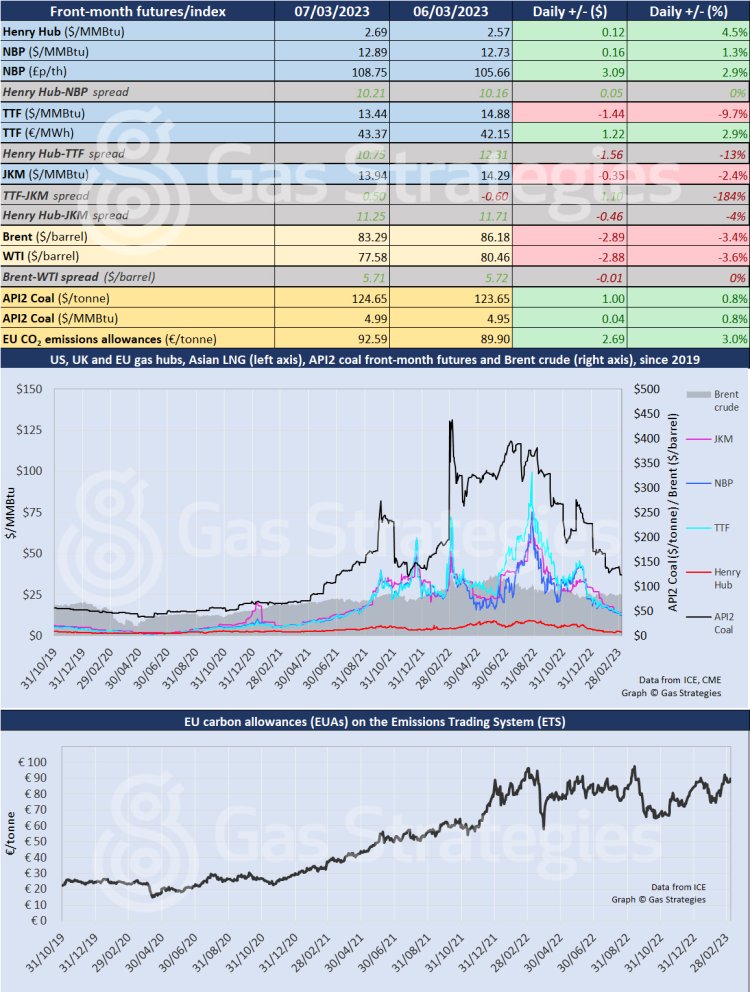

NBP saw a 1.3% uptick to USD 12.89/MMBtu, while TTF fell 9.7% to USD 13.44/MMBtu. The slide in USD/MMBtu terms was due to a strengthening in USD against GBP seen on Tuesday.

Reports suggest that Britain's National Grid Electricity System Operator (ESO) said two coal units at EDF's West Burton coal plant had been synchronised to the grid on Tuesday afternoon, following the notices issued on Monday that reserve power generation might be needed as a cold snap sweeped the nation. Contracting some coal plants to remain available is part of its tool box to help prevent power cuts.

Meanwhile, in France, strike action continued and the country's four LNG terminals are currently not operating, operators Fluxys and Elengy confirmed to Gas Matters Today.

In addition, wind power generation picked up in Europe over the past days, with Tuesday’s share of wind energy in electricity demand at 20.1%, up from 10.8% the day before.

Meanwhile, Henry Hub continued ascending, with the front-month contract on Tuesday climbing 4.6% to USD 2.69/MMBtu. This comes as the US Energy Information Administration (EIA) in its new Short-Term Energy Outlook report forecast Henry Hub natural gas spot prices will drop from almost USD 5.0/MMBtu in January to around USD 3.0/MMBtu in 2023.

Crude oil slid by almost 4% on Tuesday after comments from US Federal Reserve Chair Jerome Powell stoked rate hike fears, the USD strengthened and top crude importer China issued weak data, Reuters reported.

Brent crude futures dipped 3.4% to settle at USD 83.29, barrel, while the US WTI dropped by 3.6%, to close at USD 77.58/barrel.

Those were the biggest single day percentage declines for both contracts since 4 January.

Front-month futures and indexes at last close with day-on-day changes (click to enlarge):  Time references based on London GMT. Brent, WTI, NBP, TTF and EU CO2 data from ICE. Henry Hub, JKM and API2 data from CME. Prices in USD/MMBtu based on exchange rates at last market close. All monetary values rounded to nearest whole cent/penny. Text and graphic copyright © Gas Strategies, all rights.

Time references based on London GMT. Brent, WTI, NBP, TTF and EU CO2 data from ICE. Henry Hub, JKM and API2 data from CME. Prices in USD/MMBtu based on exchange rates at last market close. All monetary values rounded to nearest whole cent/penny. Text and graphic copyright © Gas Strategies, all rights.

Subscription Benefits

Our three titles – LNG Business Review, Gas Matters and Gas Matters Today – tackle the biggest questions on global developments and major industry trends through a mixture of news, profiles and analysis.

LNG Business Review

LNG Business Review seeks to discover new truths about today’s LNG industry. It strives to widen market players’ scope of reference by actively engaging with events, offering new perspectives while challenging existing ones, and never shying away from being a platform for debate.

Gas Matters

Gas Matters digs deep into the stories of today, keeping the challenges of tomorrow in its sights. Weekly features and interviews, informed by unrivalled in-house expertise, offer a fresh perspective on events as well as thoughtful, intelligent analysis that dares to challenge the status quo.

Gas Matters Today

Gas Matters Today cuts through the bluster of online news and views to offer trustworthy, informed perspectives on major events shaping the gas and LNG industries. This daily news service provides unparalleled insight by drawing on the collective knowledge of in-house reporters, specialist contributors and extensive archive to go beyond the headlines, making it essential reading for gas industry professionals.