The European gas price bull run came crashing down on Thursday, with prices collapsing amid increasing pipeline gas imports into Europe and profit taking.

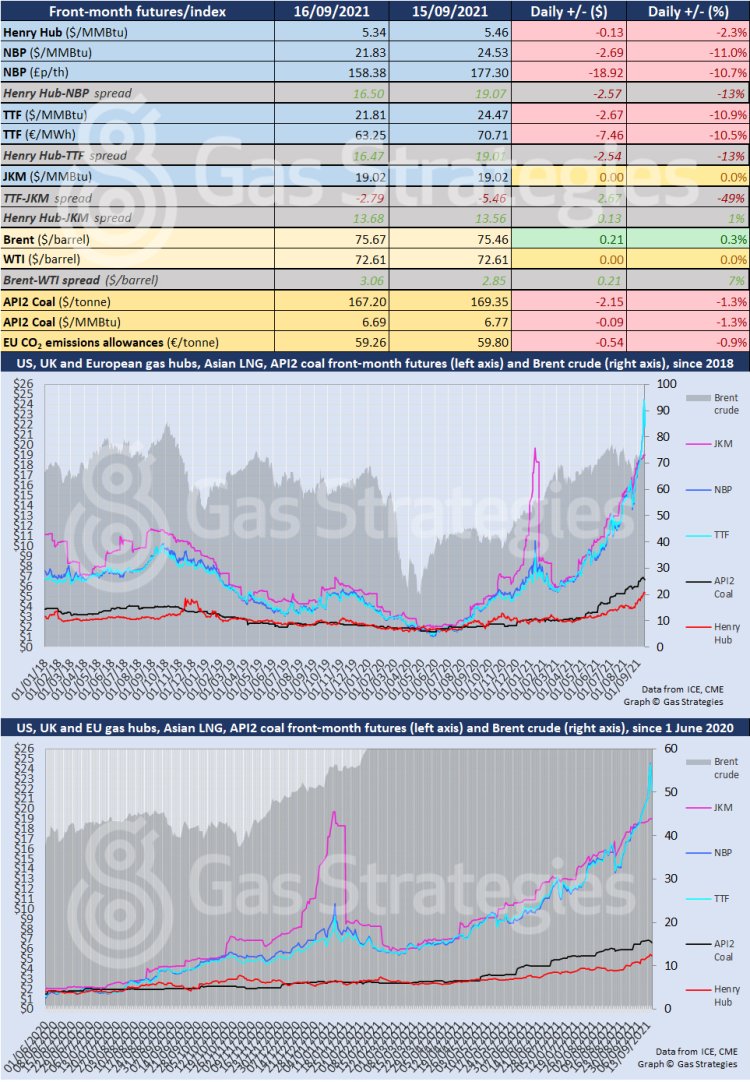

The front-month TTF and NBP contracts fell by ~11% on Thursday after nine days of gains. The benchmarks closed at the equivalent of ~USD 21.8/MMBtu.

Profit taking played a part in the price collapse, with a stronger pipeline supplies also helping end the bull run.

Flows from Norway picked up yesterday as planned maintenance work ended, with flows averaging 288 MMcm/d on Thursday, up 8 MMcm/d compared to Wednesday, according to EnergyScan. As for flows from Russia, they were stable at ~318 MMcm/d, according to EnergyScan.

This week has seen some demand destruction due to record gas prices in Europe, with fertiliser producers Yara and CF Industries announcing that they are halting production at sites across the continent due to soaring gas prices. Further demand-side response could help lower European gas prices.

That said, prices may spike again in the short term as Europe’s gas storge levels remain below the five-year average ahead of the winter withdrawal season next month.

The price plunge on Thursday weighed on the European carbon price, which fell 0.9% to close at EUR 59.26/tonne.

Whilst TTF and NBP collapsed, the JKM front-month contract remained unchanged – at USD 19.02/MMBtu – as the October contract is about to expire. The losses by TTF and NBP saw their premium over JKM cut to ~USD 2.8/MMBtu.

In the US, the front-month Henry Hub contract fell from a seven-year high, closing 2.3% lower at USD 5.34/MMBtu.

The loss was pinned on a larger-than-expected injection into US gas storage and forecasts of cooler weather.

There was an 83 Bcf build in US gas storage for the week ending 10 September, the US Energy Information Administration (EIA) reported yesterday. Analysts had expected an injection of ~70 Bcf last week, according to reports.

In addition to the storage build, lower feed gas volumes to US LNG plants also weighed on Henry Hub. Freeport LNG remains offline due to power issues following Hurricane Nicholas. Flows to the facility fell from ~1.9 Bcf/d on Monday to 0.26 Bcf/d on Thursday, according to data compiled by RonH Energy.

Production outages in the US Gulf of Mexico, which have been supporting US oil and gas prices, remain in place across the US GoM following Hurricane Ida which made landfall in Louisiana on 29 August.

As of Thursday, ~39% of US GoM gas production remained offline, according to data compiled by the US Bureau of Safety and Environmental Enforcement (BSEE). As for oil, ~28% of production remained shut-in.

Oil prices remained steady on Thursday. Brent was up 0.3%, with WTI remaining unchanged.

Front-month futures and indexes at last close with day-on-day changes (click to enlarge):

Time references based on London GMT. Brent, WTI, NBP, TTF and EU CO2 data from ICE. Henry Hub, JKM and API2 data from CME. Prices in USD/MMBtu based on exchange rates at last market close. All monetary values rounded to nearest whole cent/penny. Text and graphic copyright © Gas Strategies, all rights.

Subscription Benefits

Our three titles – LNG Business Review, Gas Matters and Gas Matters Today – tackle the biggest questions on global developments and major industry trends through a mixture of news, profiles and analysis.

LNG Business Review

LNG Business Review seeks to discover new truths about today’s LNG industry. It strives to widen market players’ scope of reference by actively engaging with events, offering new perspectives while challenging existing ones, and never shying away from being a platform for debate.

Gas Matters

Gas Matters digs deep into the stories of today, keeping the challenges of tomorrow in its sights. Weekly features and interviews, informed by unrivalled in-house expertise, offer a fresh perspective on events as well as thoughtful, intelligent analysis that dares to challenge the status quo.

Gas Matters Today

Gas Matters Today cuts through the bluster of online news and views to offer trustworthy, informed perspectives on major events shaping the gas and LNG industries. This daily news service provides unparalleled insight by drawing on the collective knowledge of in-house reporters, specialist contributors and extensive archive to go beyond the headlines, making it essential reading for gas industry professionals.