Oil prices continued to climb on Wednesday despite data showing US crude inventories increasing last week for the first time since May.

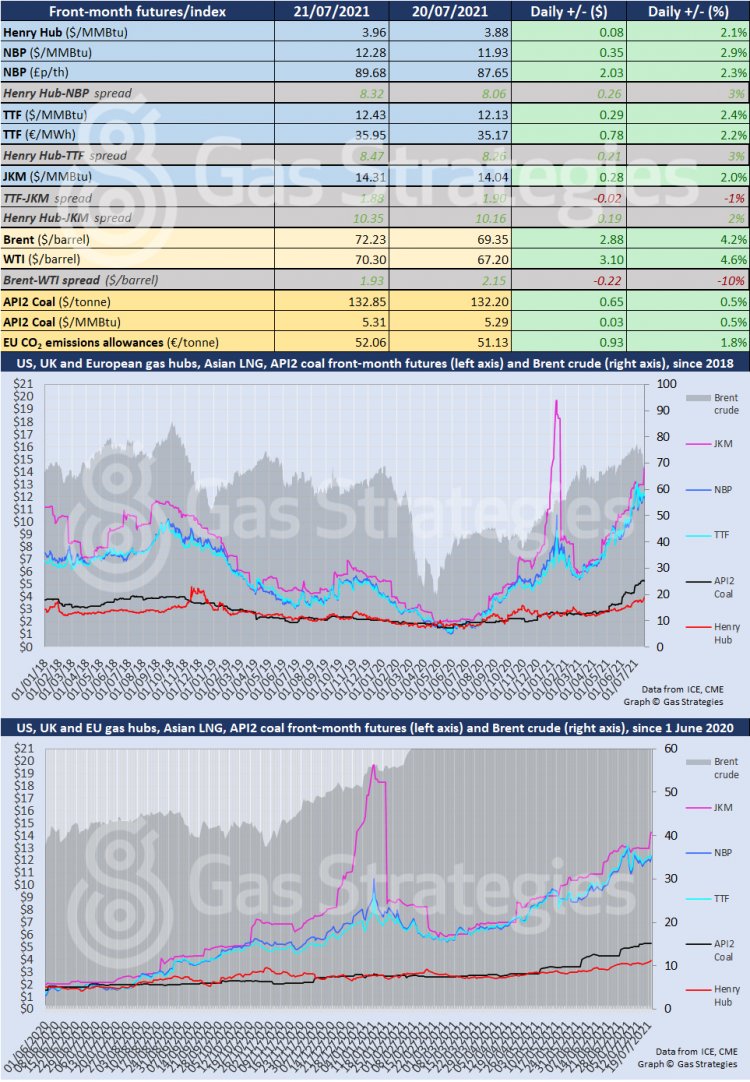

Wednesday’s rally by the front-month WTI and Brent contracts erased nearly all the losses the benchmarks recorded on Monday. Both crude markers rallied by over 4% yesterday, with WTI settling at USD 70.30/barrel and Brent hitting USD 72.23/barrel.

The rally was pinned on technical buying after an excessive sell off on Monday following news that OPEC and its allies agreed to increase production starting next month. The rise of Covid-19 cases globally also weighed on oil prices at the start of the week.

Wednesday’s gains came despite data from the US Department of Energy (DOE) showing US crude inventories increased by 2.1 million barrels/d for the week ending 16 July – marking the first weekly increase since May. Analysts had expected another drawn down on US storage.

However, prices ticked higher as the DOE data showed draws on crude products including gasoline and distillate for the week ending 16 July.

As for gas, US gas benchmark Henry Hub hit its highest close since December 2018. The front-month contract rallied by 2.1% on Wednesday to close at USD 3.96/MMBtu. Henry Hub has been rallying amid forecasts for warmer weather over the second half of July, which is expected to drive gas demand for air conditioning, and subsequently reduce the availability of gas for injection into US storage sites.

In Europe, prices continued to climb, with the month-ahead TTF and NBP contracts up by over 2% on Wednesday. The gains saw NBP return to the USD 12/MMBtu range. The UK benchmark has been rallying due to a tight supply outlook, amid lower domestic production and a lack of LNG imports.

Europe is struggling to compete with Asia for cargoes amid higher prices and strong demand in the latter, with the front-month JKM contract rallying by 2% on Wednesday to close at USD 14.31/MMBtu.

Front-month futures and indexes at last close with day-on-day changes (click to enlarge):

Time references based on London GMT. Brent, WTI, NBP, TTF and EU CO2 data from ICE. Henry Hub, JKM and API2 data from CME. Prices in USD/MMBtu based on exchange rates at last market close. All monetary values rounded to nearest whole cent/penny. Text and graphic copyright © Gas Strategies, all rights.

Subscription Benefits

Our three titles – LNG Business Review, Gas Matters and Gas Matters Today – tackle the biggest questions on global developments and major industry trends through a mixture of news, profiles and analysis.

LNG Business Review

LNG Business Review seeks to discover new truths about today’s LNG industry. It strives to widen market players’ scope of reference by actively engaging with events, offering new perspectives while challenging existing ones, and never shying away from being a platform for debate.

Gas Matters

Gas Matters digs deep into the stories of today, keeping the challenges of tomorrow in its sights. Weekly features and interviews, informed by unrivalled in-house expertise, offer a fresh perspective on events as well as thoughtful, intelligent analysis that dares to challenge the status quo.

Gas Matters Today

Gas Matters Today cuts through the bluster of online news and views to offer trustworthy, informed perspectives on major events shaping the gas and LNG industries. This daily news service provides unparalleled insight by drawing on the collective knowledge of in-house reporters, specialist contributors and extensive archive to go beyond the headlines, making it essential reading for gas industry professionals.