Crude prices crashed on Tuesday, with front-month prices falling by USD 3.80/barrel amid fresh Covid-19 related lockdowns across Europe and sluggish vaccination rates across much of the region.

Front-month Brent and WTI prices fell to their lowest since 8 February, with Brent settling at USD 60.79/barrel and WTI closing at USD 57.76/barrel.

Prices slumped amid Germany – Europe’s largest oil consumer – and the Netherlands following European peers France and Italy in imposing fresh Covid-19 related lockdown measures in a bid to curb soaring Covid-19 cases.

Berlin said lockdown measures, which were set to end on 28 March, will now be extended until 18 April. In the Netherlands, Prime Minister Mark Rutte announced that lockdown measures will remain in place until 20 April. The government also extended its advice against international travel until mid-May.

Sluggish vaccination rates in Europe are also weighing on the economic and crude demand recovery. Only three nations in Europe – Malta, Serbia and the UK – have managed to give a single dose of a covid-19 vaccine to over 30% of their population. As for the 27 EU member states, only 10% of the adult population has received a first dose of a covid-19 vaccine, according to the European Centre for Disease Prevention and Control (ECDC). In comparison, approximately 25% of the population in the US had received at least one dose of a covid-19 vaccine, as of 22 March.

Also weighing on oil prices was news that crude inventories in the US increased for a fifth straight week. The American Petroleum Institute (API) reported on Tuesday that crude storage increased by ~2.9 million barrels for the week ending 19 March. The increase was much higher than the 272,000 barrels increase that analysts had predicted.

Oil prices were rallying on Wednesday amid news of the Ever Given containership running aground in the Suez Canal on Tuesday morning. Efforts to re-float the containership could take two days, according to reports, with the canal handling around 10% of total seaborne oil trade and 8% of LNG trade.

With Brent and WTI falling by ~USD 8/barrel and ~USD 7/barrel respectively over one week, all eyes will be on the OPEC+ meeting next week. Reports suggest Saudi Arabia may again decided to maintain its unilateral production cut in light of the bearish demand-side outlook.

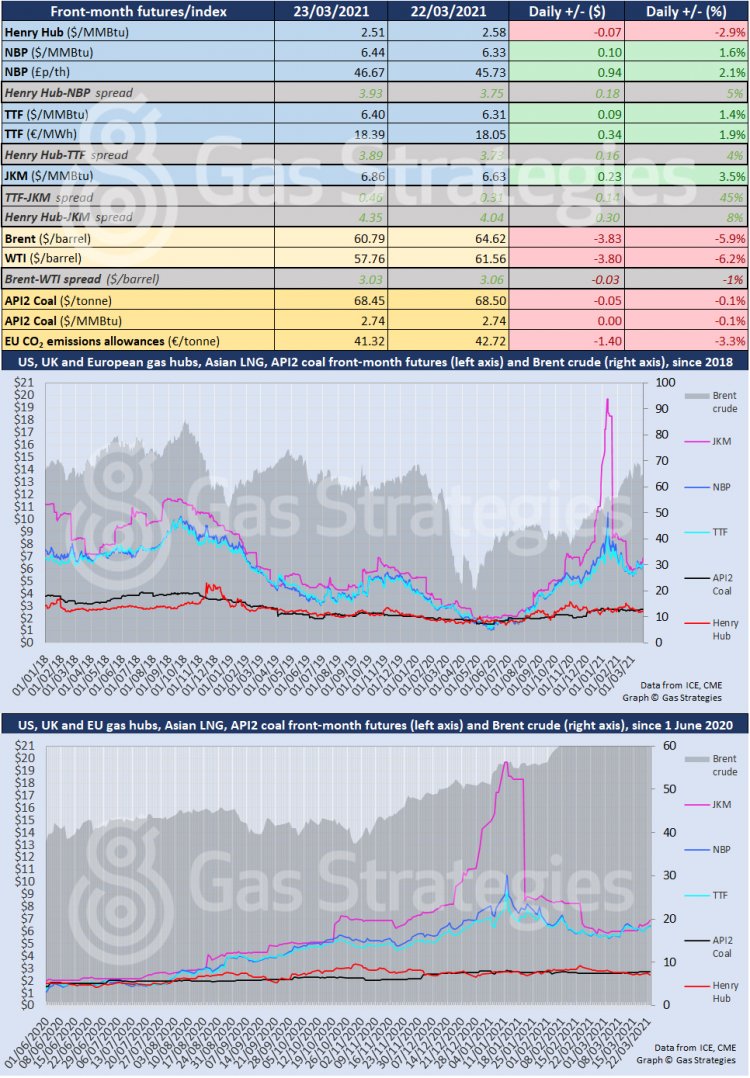

Whist oil slumped on Tuesday, European gas prices rallied for a second day. The front-month NBP and TTF contracts rallied by over 1%, with both markers settling at the equivalent of ~USD 6.4/MMBtu.

The European carbon price, which has been rallying in line with rising gas prices, slumped by 3.3% on Tuesday to settle back in the EUR 41/tonne range.

US gas benchmark Henry Hub failed to maintain gains recorded on Monday, with the marker falling by 2.9% to close at USD 2.51/MMBtu.

JKM continued to rally, rising by 3.5% to settle in the USD 6.8MMBtu range. The rally may extend on Wednesday due to blockage in the Suez Canal.

Front-month futures and indexes at last close with day-on-day changes (click to enlarge):

Time references based on London GMT. Brent, WTI, NBP, TTF and EU CO2 data from ICE. Henry Hub, JKM and API2 data from CME. Prices in USD/MMBtu based on exchange rates at last market close. All monetary values rounded to nearest whole cent/penny. Text and graphic copyright © Gas Strategies, all rights.

Subscription Benefits

Our three titles – LNG Business Review, Gas Matters and Gas Matters Today – tackle the biggest questions on global developments and major industry trends through a mixture of news, profiles and analysis.

LNG Business Review

LNG Business Review seeks to discover new truths about today’s LNG industry. It strives to widen market players’ scope of reference by actively engaging with events, offering new perspectives while challenging existing ones, and never shying away from being a platform for debate.

Gas Matters

Gas Matters digs deep into the stories of today, keeping the challenges of tomorrow in its sights. Weekly features and interviews, informed by unrivalled in-house expertise, offer a fresh perspective on events as well as thoughtful, intelligent analysis that dares to challenge the status quo.

Gas Matters Today

Gas Matters Today cuts through the bluster of online news and views to offer trustworthy, informed perspectives on major events shaping the gas and LNG industries. This daily news service provides unparalleled insight by drawing on the collective knowledge of in-house reporters, specialist contributors and extensive archive to go beyond the headlines, making it essential reading for gas industry professionals.