Energy prices across the board staged a rally on Tuesday even more dramatic than Monday’s decline, with European natural gas prices up between 8% and 10%.

The bullish moves were a reminder that, while declining gas prices may be the underlying trend, short-term volatility remains high amid concerns about stresses in the financial system brought on by rising interest rates.

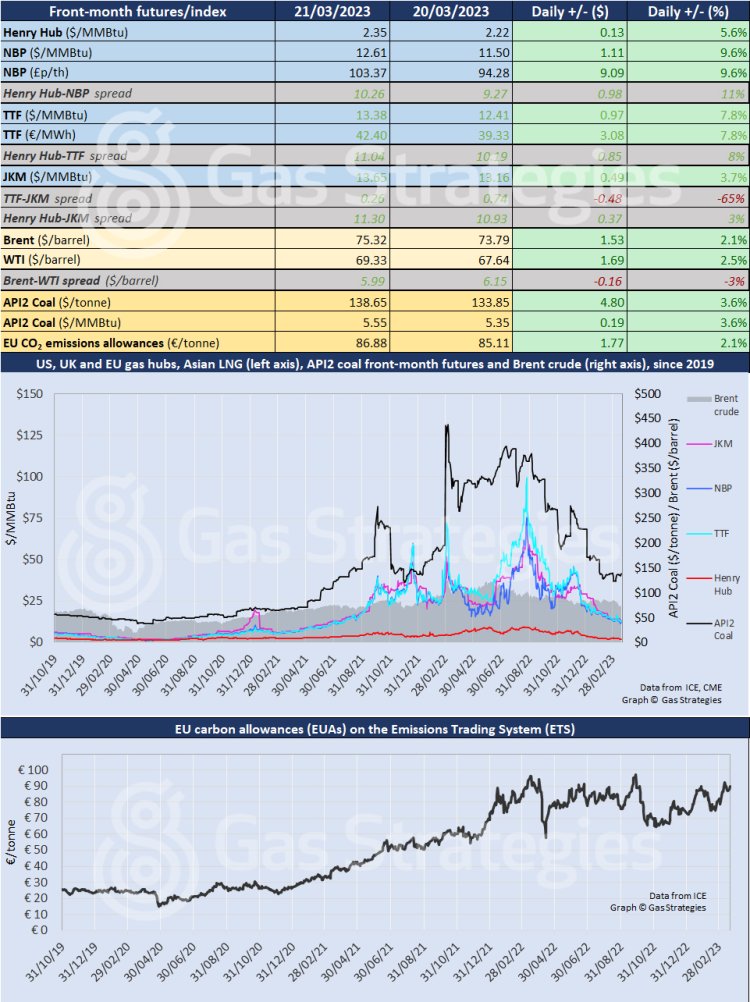

In continental Europe, the Dutch TTF marker rose 7.8% on Tuesday, from Monday’s close of EUR 39.33/MWh (USD 12.41/MMBtu) to EUR 42.40/MWh (USD 13.38/MMBtu). In the UK, NBP was up 9.6% from 94.28 p/therm (USD 11.50/MMBtu) on Monday to 103.37 p/therm (USD 12.61/MMBtu).

The rally came despite several factors exerting downward pressure on European prices including high storage levels, lessening concern over French nuclear reactors, and the prospect of an end to industrial action at French LNG import terminals. Weather played a role as forecast temperatures return to seasonal averages over coming days after a mild spell.

Talks between the Russian and Chinese leaders ended yesterday with reports that they had discussed the proposed Power of Siberia 2 pipeline, which Russia hopes will facilitate China replacing Europe as its major customer. However, at best the proposed pipeline is unlikely to flow gas this side of 2030. The first Power of Siberia line is still years away from ramping up to full capacity.

In Asia, the JKM LNG marker rose by 3.7% on Tuesday, from USD 13.16/MMBtu on Monday to USD 13.65/MMBtu. The TTF-JKM spread narrowed to USD 0.26/MMBtu.

In the US, Henry Hub was up 5.6% from USD 2.22/MMBtu on Monday to USD 2.35/MMBtu, with colder weather expected over the coming weekend and into next week, and concern over stresses in the financial system lessening.

The continuing ramp-up of the Freeport export facility, following last year’s accident, is being watched closely given that at full pelt it will be exporting over 2% of US gas production, which has fallen below 100 Bcf/d in recent days as producers respond to falling prices. The EIA’s weekly inventory report, due out tomorrow, will also be watched closely.

Oil prices rose again yesterday, with Brent up 2.1% from USD 73.79/barrel on Monday to USD 75.32/barrel, and WTI up 2.5% from USD 67.64/barrel to USD 69.33/barrel.

Front-month futures and indexes at last close with day-on-day changes (click to enlarge):

Time references based on London GMT. Brent, WTI, NBP, TTF and EU CO2 data from ICE. Henry Hub, JKM and API2 data from CME. Prices in USD/MMBtu based on exchange rates at last market close. All monetary values rounded to nearest whole cent/penny. Text and graphic copyright © Gas Strategies, all rights.

Subscription Benefits

Our three titles – LNG Business Review, Gas Matters and Gas Matters Today – tackle the biggest questions on global developments and major industry trends through a mixture of news, profiles and analysis.

LNG Business Review

LNG Business Review seeks to discover new truths about today’s LNG industry. It strives to widen market players’ scope of reference by actively engaging with events, offering new perspectives while challenging existing ones, and never shying away from being a platform for debate.

Gas Matters

Gas Matters digs deep into the stories of today, keeping the challenges of tomorrow in its sights. Weekly features and interviews, informed by unrivalled in-house expertise, offer a fresh perspective on events as well as thoughtful, intelligent analysis that dares to challenge the status quo.

Gas Matters Today

Gas Matters Today cuts through the bluster of online news and views to offer trustworthy, informed perspectives on major events shaping the gas and LNG industries. This daily news service provides unparalleled insight by drawing on the collective knowledge of in-house reporters, specialist contributors and extensive archive to go beyond the headlines, making it essential reading for gas industry professionals.