CORRECTION: WTI drop third steepest in history, closing price lowest since 2002

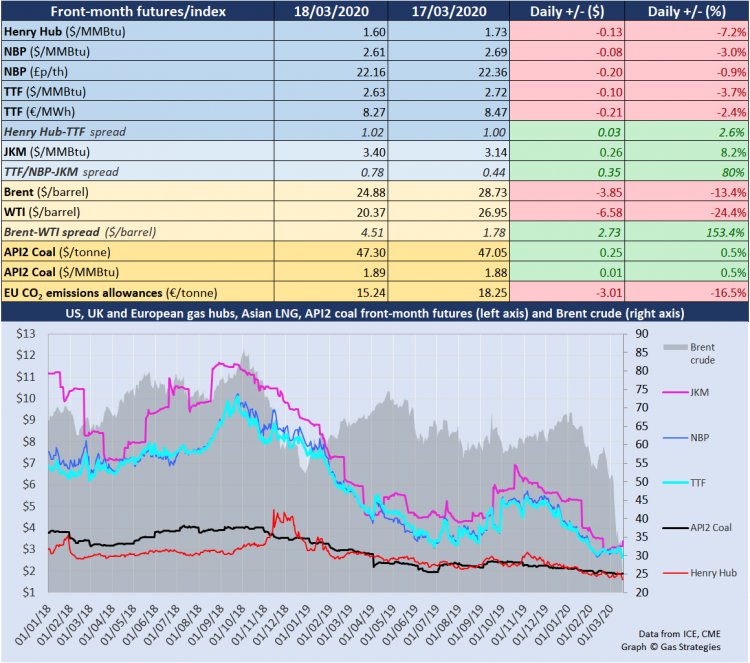

Wednesday, 18 March 2020 will go down in history as one of the steepest single-day US crude oil selloffs in history – which also saw US gas benchmark Henry Hub plunge to prices not seen in more than a decade. Month-ahead WTI futures crashed a staggering 24% – the contract’s third biggest day-on-day loss – to close at USD 20.37/barrel, its lowest closing price since January 2002. Month-ahead Brent was also punished, collapsing 13% to USD 24.88/barrel, amid forecasts of global crude over-supply accelerating in April just as demand implodes from coronavirus pandemic economic shutdowns across the US and Europe. Oil prices promised to recover some losses today, with Brent and WTI rising as high as 6% and 13% above yesterday’s extreme lows during intraday trading on Thursday morning (GMT).

Amid yesterday’s extreme stock market volatility, the British pound fell to USD 1.16 and EUR 1.07 per GBP as the US dollar index – a measure of the greenback against a basket of other currencies – soared above 101 points, a three-year high.

The European carbon price also accelerated its freefall, with month-ahead carbon allowances (EUAs) collapsing 17% day on day to hit EUR 15.24/tonne – a fresh 18-month low. The collapse is raising the prospect of a possible reversal in coal-to-gas switching in some European power markets, with Rotterdam API2 coal also languishing at USD 47.30/tonne (USD 1.89/MMBtu).

European natural gas hubs also remain depressed, with front-month NBP and TTF losing another 1-2% to close at the equivalent of ~USD 2.62/MMBtu. But with limited scope for further losses, the ongoing competitiveness of gas-fired power against coal could be threatened by the carbon price collapse.

In the US, natural gas benchmark Henry Hub crashed 7% yesterday to USD 1.60/MMBtu – its lowest closing price in more than a decade. The collapse is expected to weigh against US shale operators with gas-heavy portfolios, which enjoyed counter-cyclical gains last week on forecasts that a crash in associated gas output in the Permian due to the oil rout would boost wellhead prices for non-associated gas wells across other US shale plays.

Front-month futures and indexes at last close with day-on-day changes (click to enlarge):

Time references based on London GMT. Brent, WTI, NBP, TTF and EU CO2 data from ICE. Henry Hub, JKM and API2 data from CME. Prices in USD/MMBtu based on exchange rates at last market close. All monetary values rounded to nearest whole cent/penny.

Subscription Benefits

Our three titles – LNG Business Review, Gas Matters and Gas Matters Today – tackle the biggest questions on global developments and major industry trends through a mixture of news, profiles and analysis.

LNG Business Review

LNG Business Review seeks to discover new truths about today’s LNG industry. It strives to widen market players’ scope of reference by actively engaging with events, offering new perspectives while challenging existing ones, and never shying away from being a platform for debate.

Gas Matters

Gas Matters digs deep into the stories of today, keeping the challenges of tomorrow in its sights. Weekly features and interviews, informed by unrivalled in-house expertise, offer a fresh perspective on events as well as thoughtful, intelligent analysis that dares to challenge the status quo.

Gas Matters Today

Gas Matters Today cuts through the bluster of online news and views to offer trustworthy, informed perspectives on major events shaping the gas and LNG industries. This daily news service provides unparalleled insight by drawing on the collective knowledge of in-house reporters, specialist contributors and extensive archive to go beyond the headlines, making it essential reading for gas industry professionals.