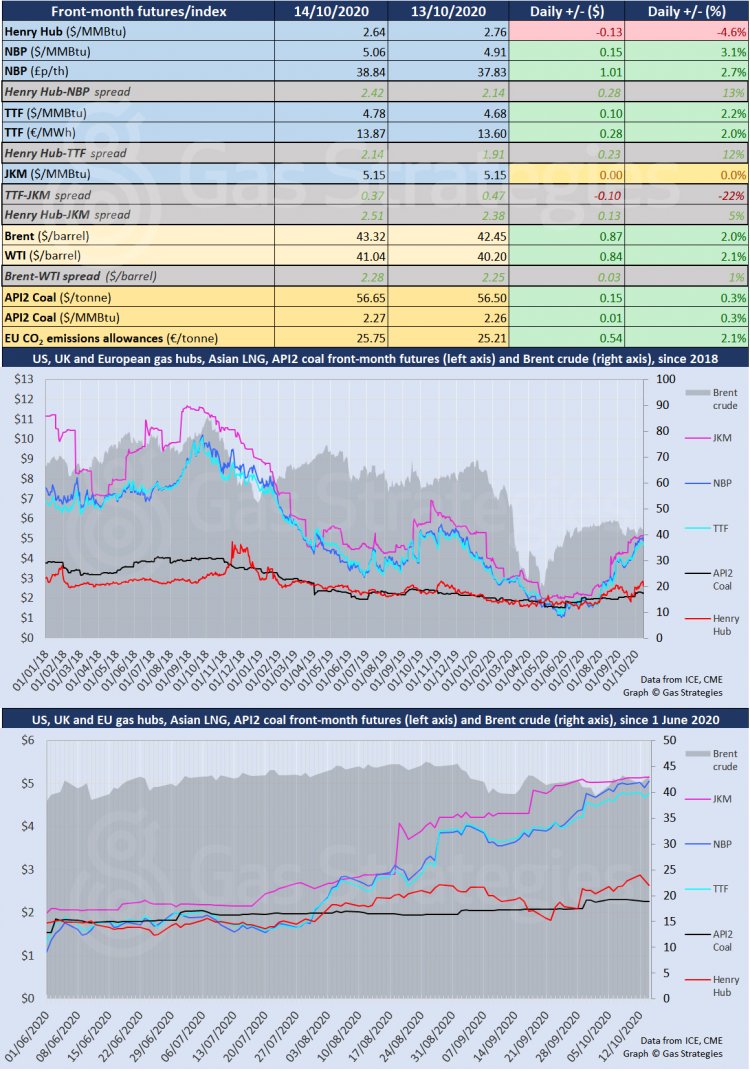

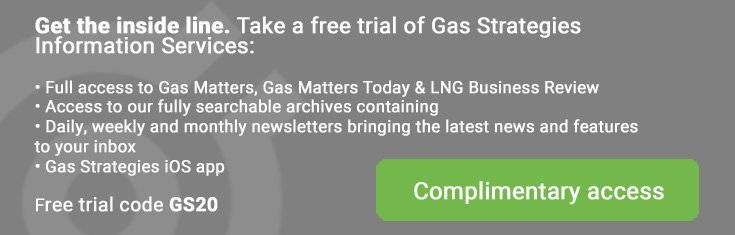

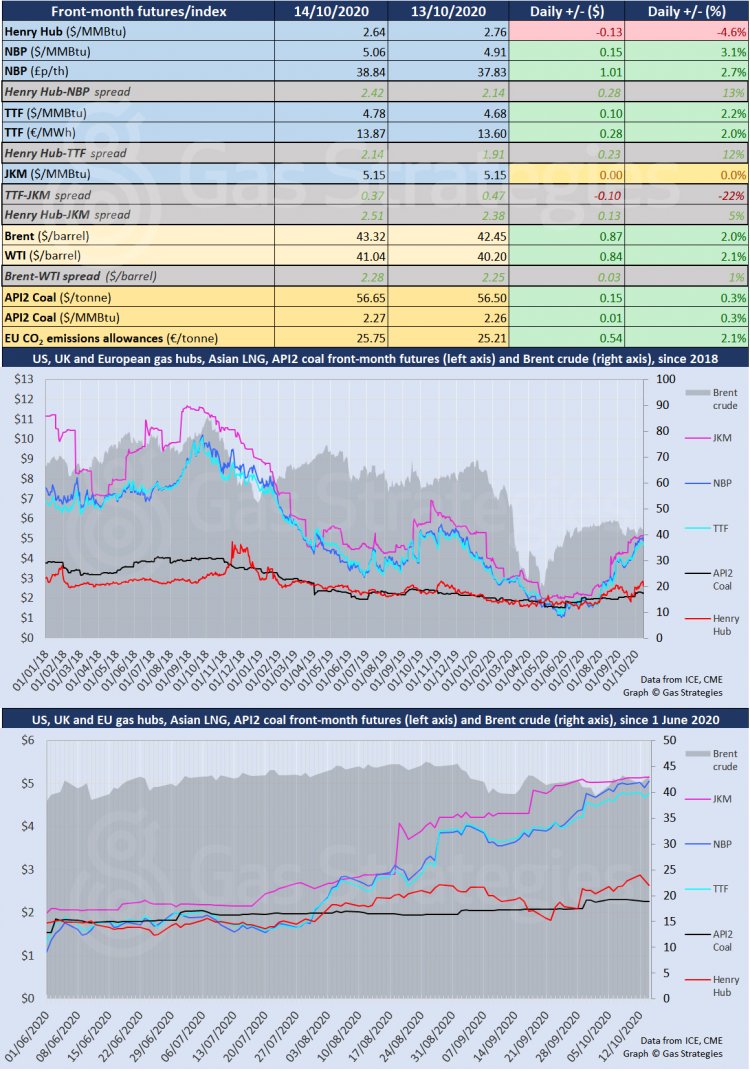

US gas benchmark Henry Hub yesterday completed its correction of the prior week’s gains, with the front month contract falling another 4.6% to hit USD 2.64/MMBtu – the same price it held last Thursday. The losses came as production was restored in the Gulf of Mexico post-hurricane Delta and on forecasts of milder weather over the next fortnight, dashing hopes of a heating demand uptick. These bearish factors outweighed a continued strong recovery in US Gulf Coast LNG exports.

European hubs were buoyant on Wednesday, with NBP and TTF both rising more than 2% to settle at the equivalent of USD 5.06/MMBtu and USD 4.78/MMBtu, respectively. CME’s November-dated JKM futures was unchanged at USD 5.15/MMBtu.

Crude oil prices maintained upward momentum, with Brent closing the session up 2% at USD 43.32/barrel and WTI rising 2.1% to USD 41.01/barrel. Both month-ahead contracts were trading up down by more than 2% on Thursday morning.

The European carbon price stopped the rot, as month-ahead ETS allowance (EUA) futures gained 2.1% to close the session at EUR 25.75/tonne.

Front-month futures and indexes at last close with day-on-day changes (click to enlarge):

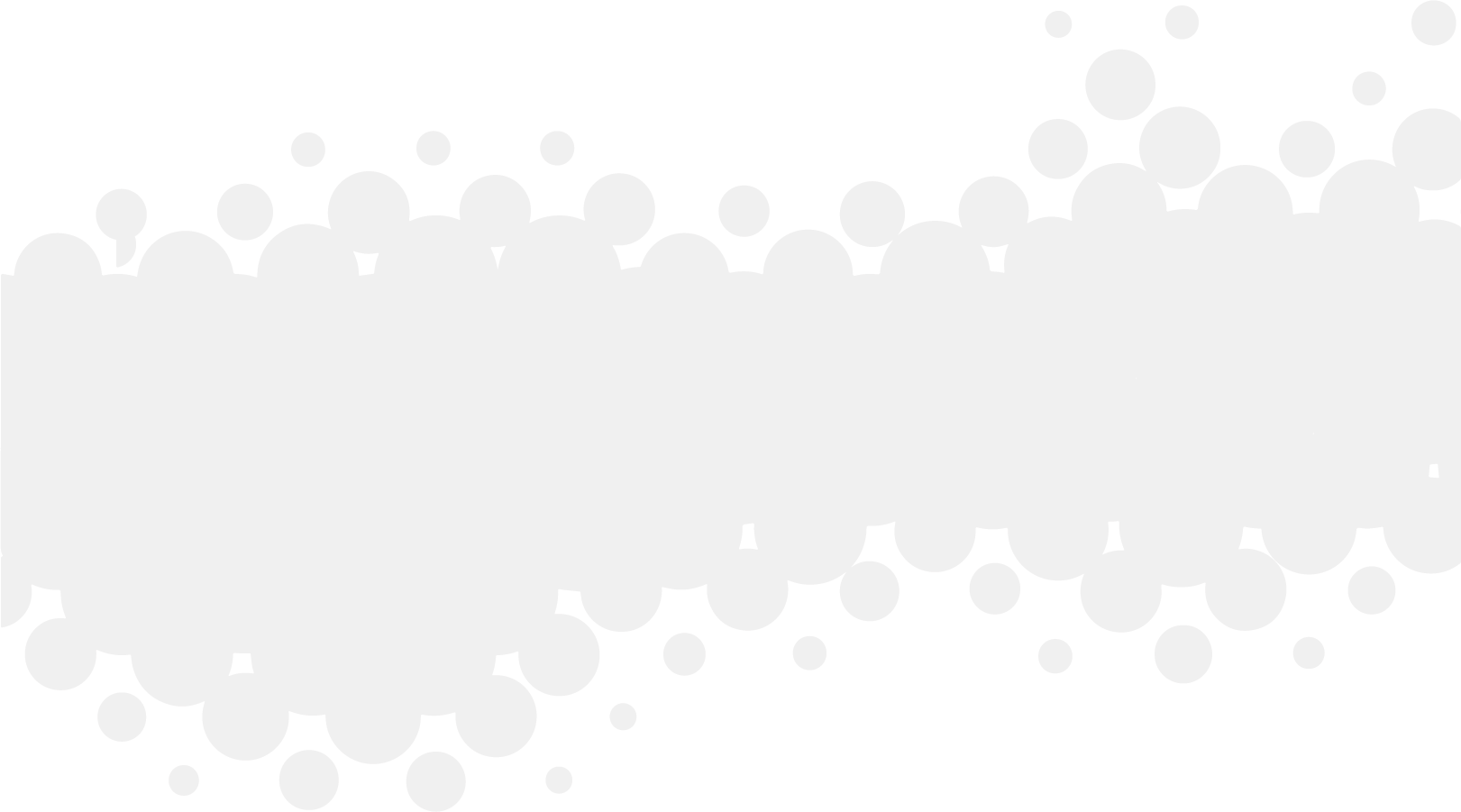

Time references based on London GMT. Brent, WTI, NBP, TTF and EU CO2 data from ICE. Henry Hub, JKM and API2 data from CME. Prices in USD/MMBtu based on exchange rates at last market close. All monetary values rounded to nearest whole cent/penny. Text and graphic copyright © Gas Strategies, all rights reserved.