US gas benchmark Henry Hub hit a 33-month high on Wednesday, lifted by ongoing production outages across the US Gulf of Mexico following Hurricane Ida, with the shut-ins weighing on supply concerns heading into winter as gas storage levels in the US remain below the five-year average.

The front-month Henry Hub contract surged by 5.4% on Wednesday to settle at USD 4.62/MMBtu – the marker’s highest close since December 2018.

The rally was pinned on ongoing outages in the US Gulf of Mexico, with operators having shut-in ~95% of oil and gas production ahead of Hurricane Ida making landfall in Louisiana last Sunday. The majority of US GoM production remains shut-in, with 83% of gas production – equating to 1.8 Bcf/d – still offline as of Wednesday, according to data compiled by the US Bureau of Safety and Environmental Enforcement (BSEE). As for oil, 80% of US GoM crude production remains offline.

The outages, are weighing on supply concerns heading into the winter, with US gas storage levels standing at 2.8 Tcf as of 20 August – a level 189 Bcf below the five-year average, according to the US Energy Information Administration (EIA). The EIA will provide a gas storage update on Thursday.

Across the pond, European gas prices diverged on Wednesday, with UK marker NBP hitting a fresh record high after recording a minor gain. The front-month NBP contract settled at the equivalent of USD 17.62/MMBtu, increasing its premium over Dutch marker TTF.

The Dutch benchmark fell from a record high in EUR/MWh terms, with the marker recording a minor gain in USD/MMBtu terms to settle at USD 17.45/MMBtu.

The European carbon price, which has tracked gas, fell 1.1% on Wednesday to settle at EUR 60.07/tonne.

CME’s JKM futures contract fell for the first time in nine days, closing 1.1% lower at USD 18.02/MMBtu.

Oil prices diverged on Wednesday, with the November-dated Brent contract down 1.9% compared to the Tuesday’s close, which marked the final day of trading of the October contract. US benchmark WTI was up 0.6% to close at USD 68.59/barrel.

As expected OPEC+ agreed to stick with plans to increase production by 400,000 barrels/d each month through to the end of the year during the crude cartel’s meeting on Wednesday. The decision came despite the Biden administration last month calling on OPEC to increase production further in a bid to stabilise petroleum prices.

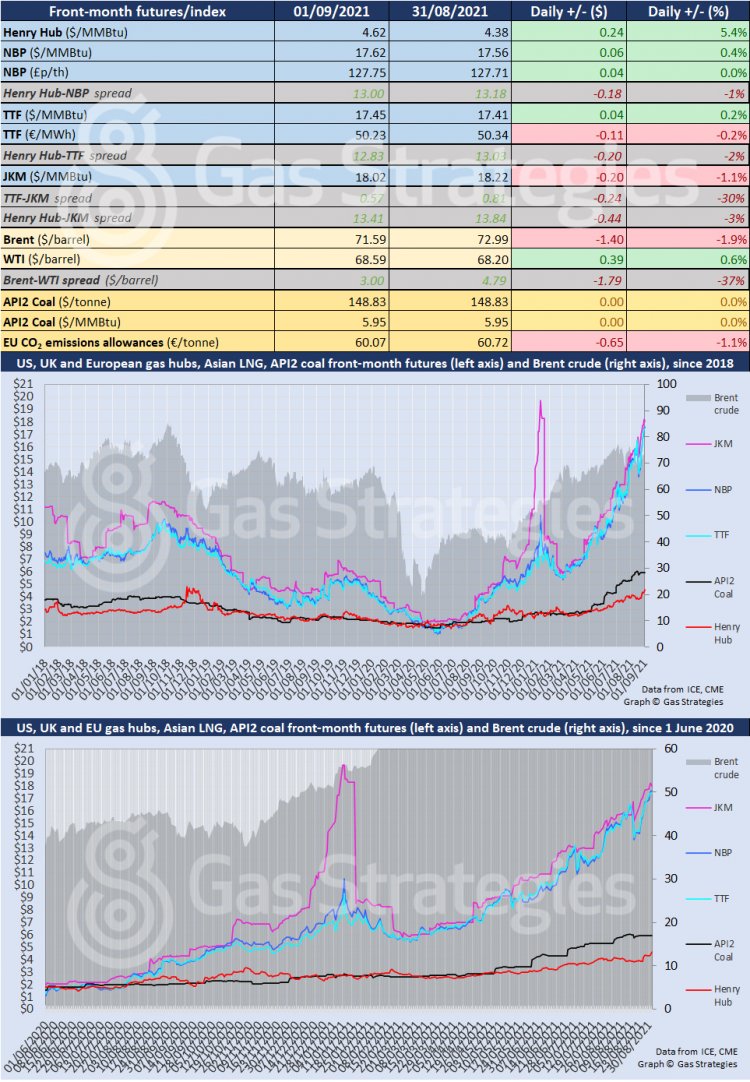

Front-month futures and indexes at last close with day-on-day changes (click to enlarge):

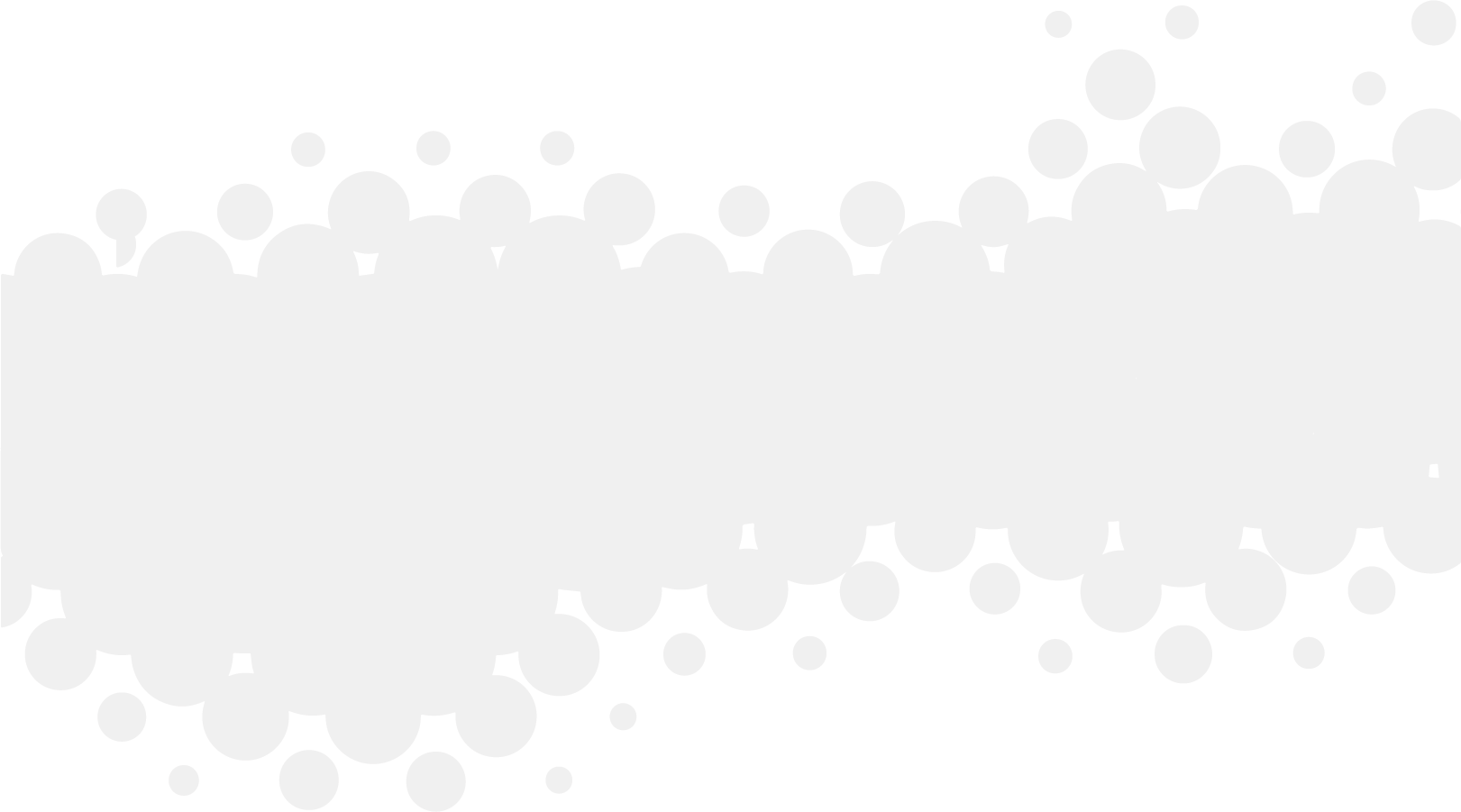

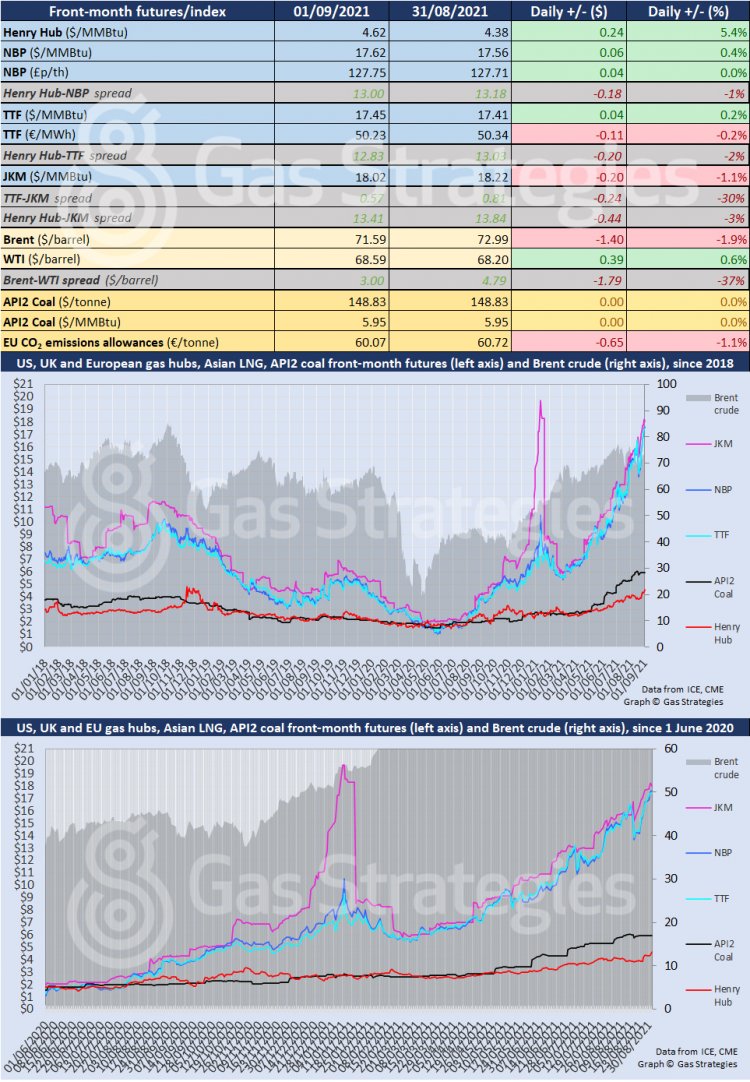

Time references based on London GMT. Brent, WTI, NBP, TTF and EU CO2 data from ICE. Henry Hub, JKM and API2 data from CME. Prices in USD/MMBtu based on exchange rates at last market close. All monetary values rounded to nearest whole cent/penny. Text and graphic copyright © Gas Strategies, all rights.