European gas and carbon prices hit fresh record highs on Thursday, with gas prices rising on lower pipeline flows from both Norway and Russia, and ongoing concerns over winter supply due to low gas inventories.

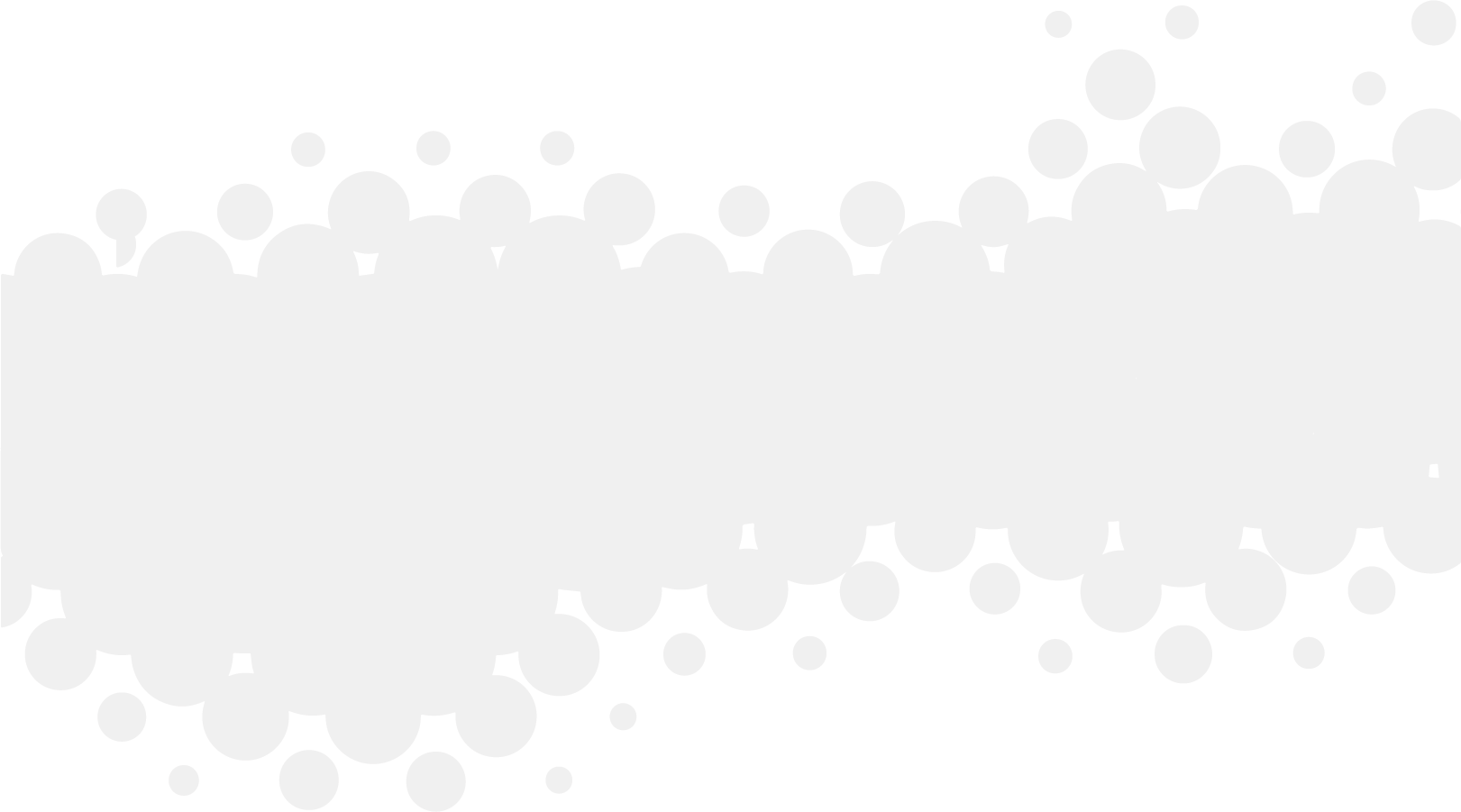

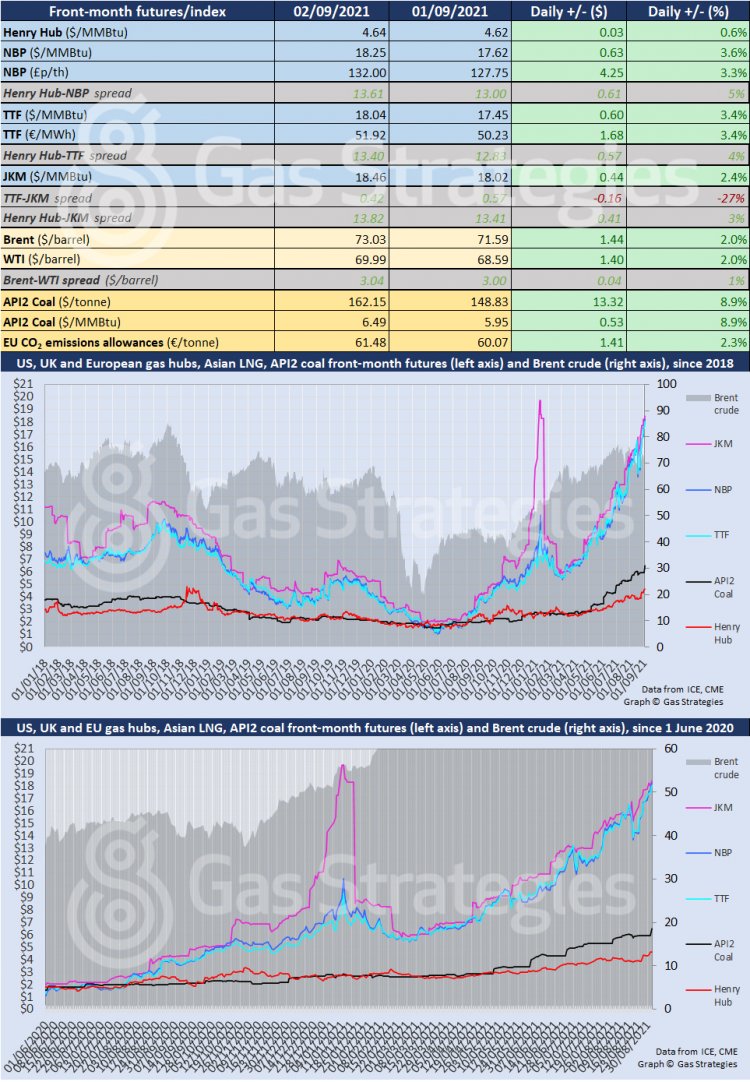

The front-month NBP and TTF contract rallied by ~3.5% on Thursday, with the UK marker maintaining its premium over TTF after closing at USD 18.25/MMBtu – USD 0.21/MMBtu higher than the Dutch gas benchmark.

Lower pipeline imports helped lift European prices, with flows from Norway and Russia falling day-on-day. In Norway, pipeline exports were averaging 292 MMcm/d on Thursday compared to 314 MMcm/d on Wednesday, according to EnergyScan, with flows impacted by planned maintenance.

Prices also continue to be supported by ongoing supply concerns over the coming winter due to low gas inventories in Europe, which are currently 67% full, according to GIE data.

The rally by the European gas markers helped lift the European carbon price to a fresh record high. The September-dated carbon contract settled at EUR 61.48/tonne on Thursday, up 2.3% compared to Wednesday. The benchmark December contract settled at EUR 61.52/tonne.

The uptick in European gas prices also helped reduce JKM’s premium, with the Asian LNG marker rallying by 2.4% to close at USD 18.46/MMBtu.

In the US, gas benchmark Henry Hub hit fresh 33-month high, closing 0.6% higher at USD 4.64/MMBtu on Thursday.

Henry Hub rallied on the ongoing production shut-ins across the US Gulf of Mexico following Hurricane Ida, which have amplified concerns over gas storage levels ahead of the winter.

As of Thursday, 91% of US GoM gas supply was shut-in, with 93% of US GoM oil supply still offline, according to data compiled by the US Bureau of Safety and Environmental Enforcement (BSEE). The level of shut-ins increased day-on-day with 83% of gas production and 80% of crude production offline on Wednesday.

The US Energy Information Administration (EIA) reported on Thursday that injections into gas inventories totalled 20 Bcf for the week ending 27 August. The level was below the mid-20s Bcf build that analysts had expected.

US gas storage levels are currently ~2.8 Tcf, a level below the five-year average of ~3 Tcf.

The ongoing US GoM outages helped lift crude prices on Thursday, with Brent and WTI up 2%. Prices were also supported by continued draw downs on US crude inventories and a weakening US dollar.

US crude storage fell by 7.2 million barrels last week, the EIA reported, with US oil inventories at their lowest since September 2019.

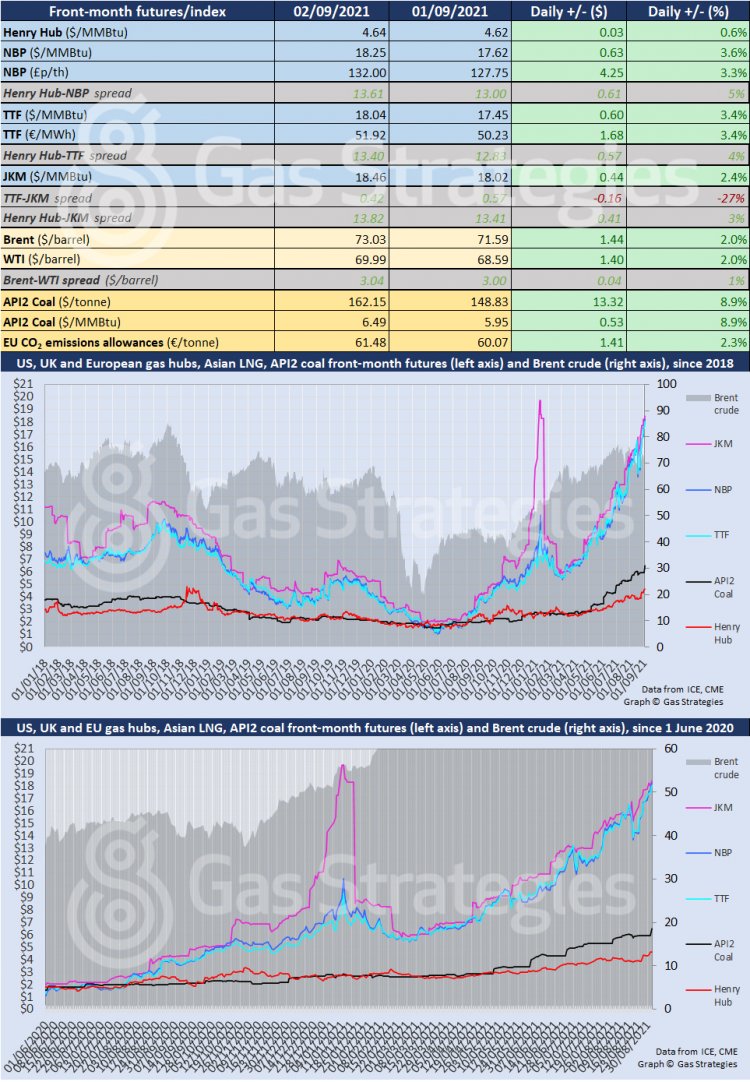

Front-month futures and indexes at last close with day-on-day changes (click to enlarge):

Time references based on London GMT. Brent, WTI, NBP, TTF and EU CO2 data from ICE. Henry Hub, JKM and API2 data from CME. Prices in USD/MMBtu based on exchange rates at last market close. All monetary values rounded to nearest whole cent/penny. Text and graphic copyright © Gas Strategies, all rights.