European gas and carbon prices dipped on Friday after hitting record highs the previous day, with prices slumping amid profit taking. However, prices were hitting intra-day record highs on Monday as gas pipeline exports from Russia into Germany halved on Monday morning.

The front-month NBP contract fell by 0.9% on Friday to close at the equivalent of USD 18.08/MMBtu. The UK marker maintained its premium over Dutch gas benchmark TTF, which recorded a 0.6% loss to close at USD 17.94/MMBtu.

The losses were pinned on profit taking ahead of the weekend, with the slump weighing on the European carbon price, which fell by 0.3% to settle at EUR 61.28/tonne.

The slump may be short-lived as European gas and carbon prices hit fresh intra-day highs on Monday morning, lifted by Russian pipeline gas flows into Germany – via the Mallnow entry point – halving during the morning. The event helped lift TTF over EUR 53/MWh for the first time ever during trading on Monday morning.

As for the European carbon price, it hit a new record high of EUR 63/tonne on Monday morning.

Whilst European gas and carbon dipped on Friday, US gas benchmark Henry Hub hit a 33-month high, closing 1.5% higher at USD 4.71/MMBtu.

Henry Hub rallied on the ongoing production shut-ins across the US Gulf of Mexico following Hurricane Ida, which have amplified concerns over gas storage levels ahead of the winter.

As of Sunday, ~83% of US GoM gas supply was shut-in, with 88% of US GoM oil supply still offline, according to data compiled by the US Bureau of Safety and Environmental Enforcement (BSEE).

The ongoing US GoM outages helped lift crude prices on Thursday, however the shut-ins were outweighed on Friday by the publication of a weaker than expected US employment report, which is seen as indicating a slower economic recovery from the Covid-19 pandemic. A slower recovery is expected to hit crude demand.

The front-month Brent contract was down 0.6% to settle at USD 72.61/barrel, with WTI down 1% to close at USD 69.29/barrel.

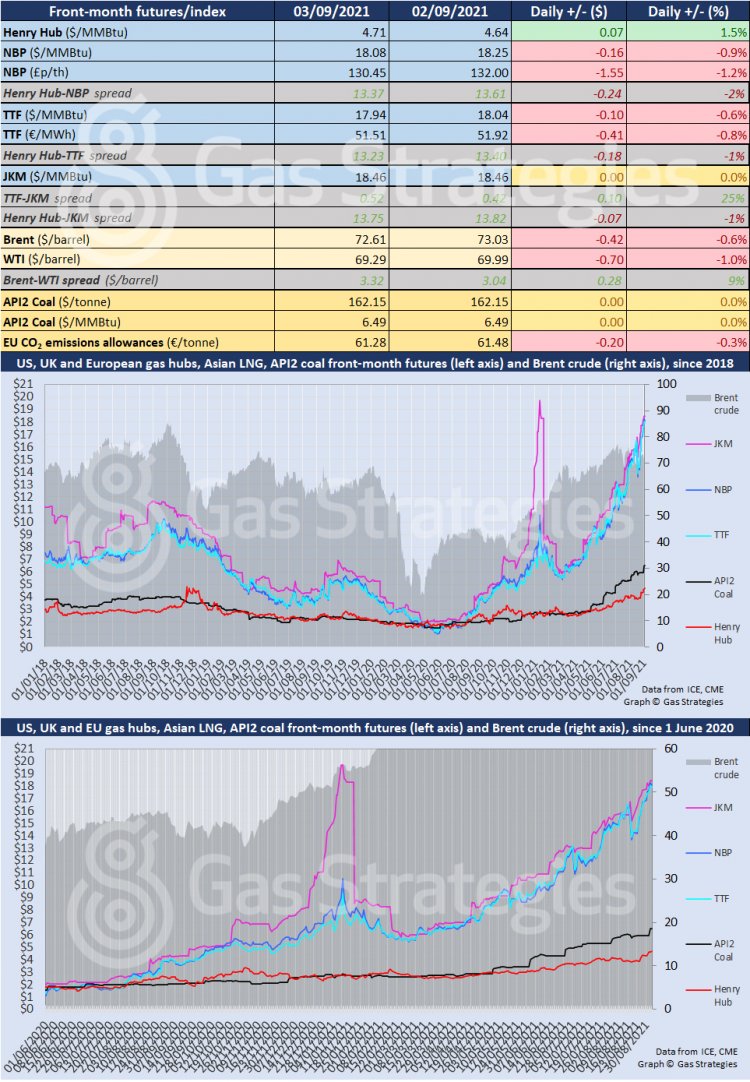

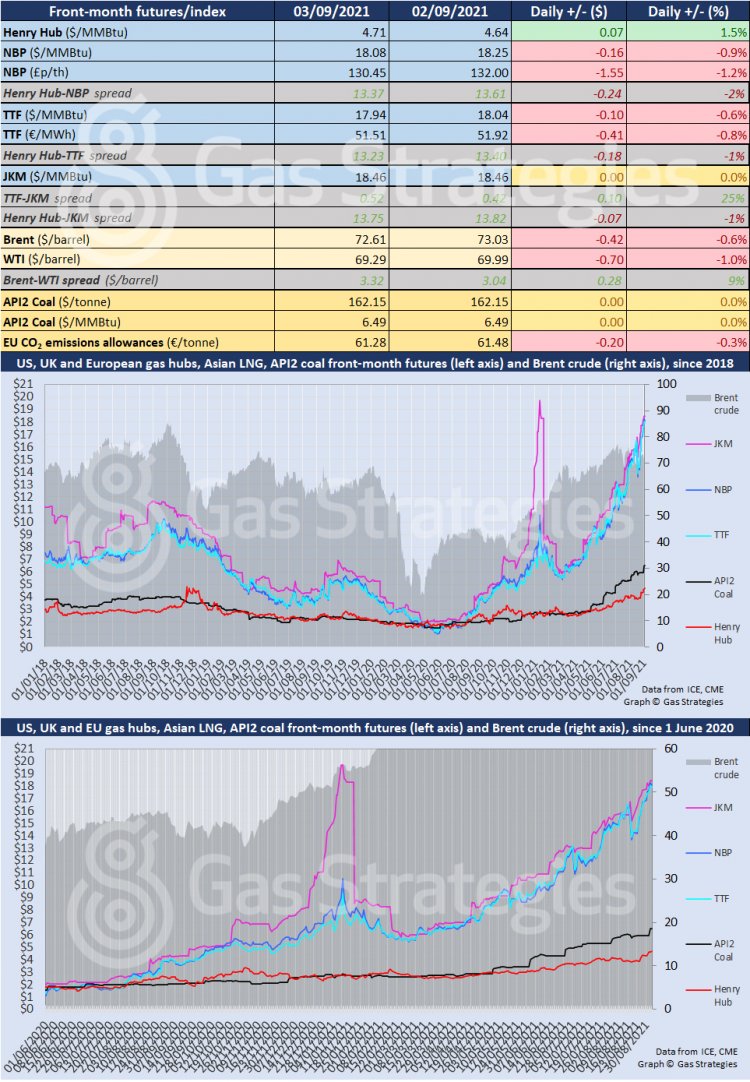

Front-month futures and indexes at last close with day-on-day changes (click to enlarge):

Time references based on London GMT. Brent, WTI, NBP, TTF and EU CO2 data from ICE. Henry Hub, JKM and API2 data from CME. Prices in USD/MMBtu based on exchange rates at last market close. All monetary values rounded to nearest whole cent/penny. Text and graphic copyright © Gas Strategies, all rights.