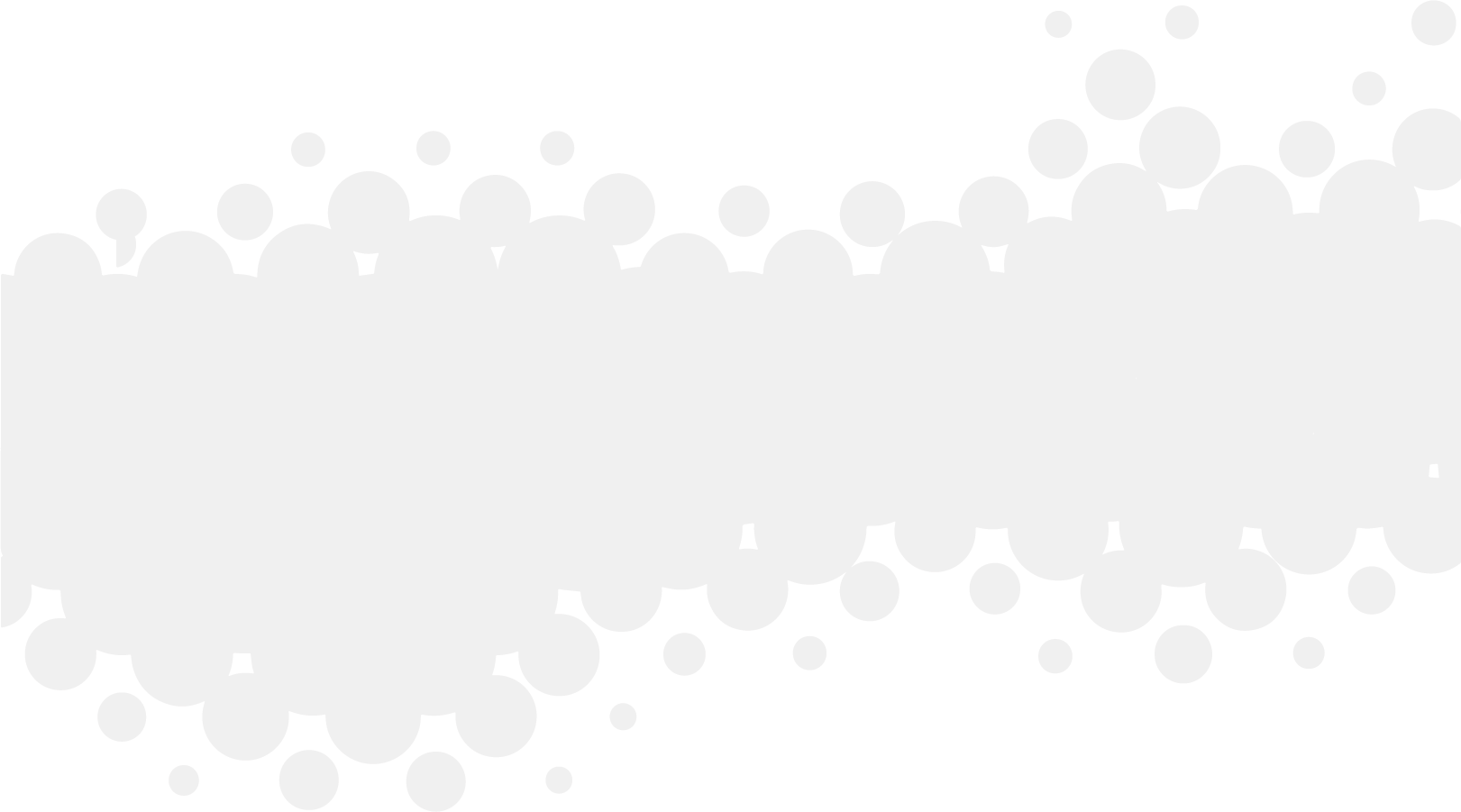

European gas benchmarks TTF and NBP returned to the green on Tuesday, lifted by concerns over the future of Russian gas flows to Europe via the Nord Stream pipeline and Ukraine.

TTF and NBP rallied yesterday, closing 7.1% and 6.7% higher respectively.

Prices were lifted by news of leaks on the Nord Stream 1 and Nord Stream 2 pipelines, with European leaders and the Kremlin refusing to rule out sabotage. The leaks are widely seen as ending any hope of a return of NS1 flows this winter.

The rally was also prompted by Gazprom announcing that the Kremlin could impose sanctions on Naftogaz in response to the Ukrainian firm lodging an arbitration claim against the Russian firm. The proposed sanctions could ban all financial transactions with Naftogaz, raising concerns that the Russian firm could halt gas transits through Ukraine.

While prices in Europe ticked higher, across the pond US gas benchmark Henry Hub dipped 3.7% to close at USD 6.65/MMBtu. The loss was largely pinned on demand concerns due to Hurricane Ian.

Asian LNG marker JKM continued to rally, closing 12.7% higher at USD 42.47/MMBtu.

As for crude, Brent and WTI recovered after settling at nine-month lows on Monday, with Tuesday’s rally prompted by shut-ins across the US Gulf of Mexico as Hurricane Ian approaches the Florida coast.

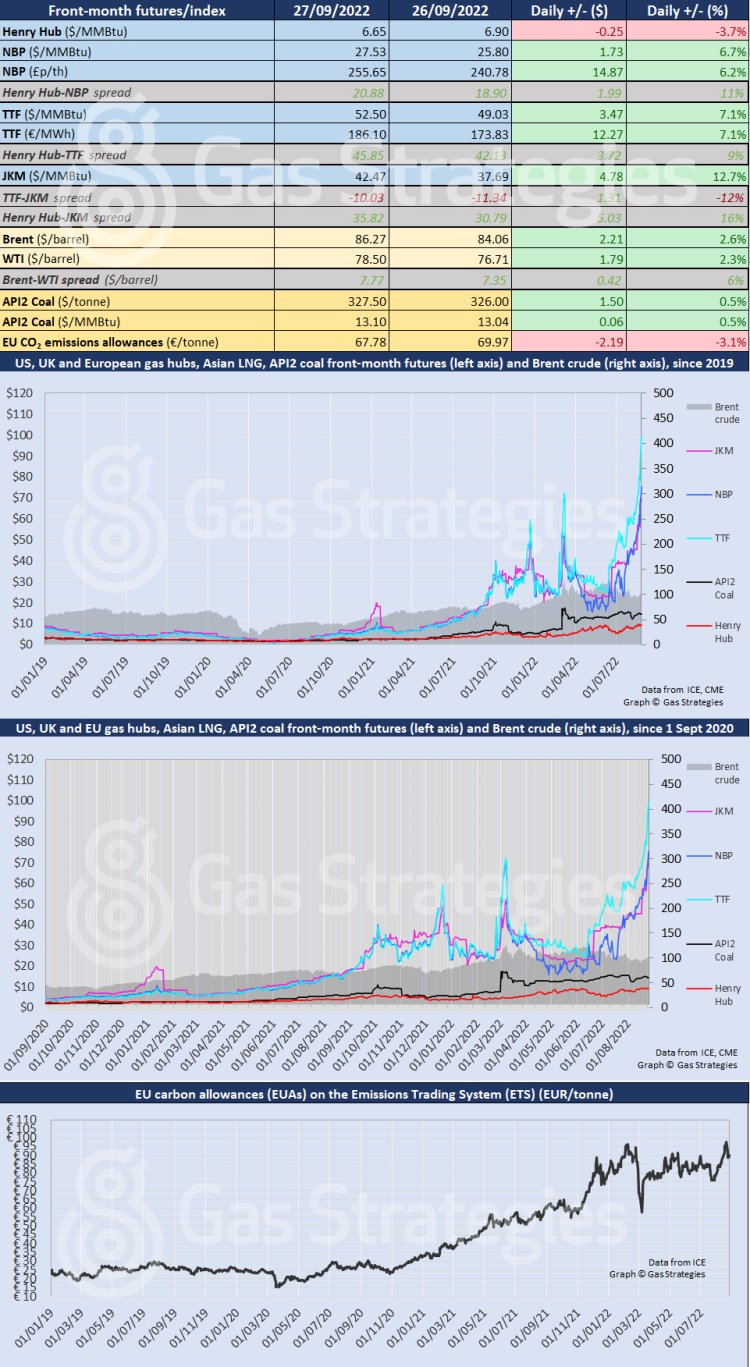

Front-month futures and indexes at last close with day-on-day changes (click to enlarge):

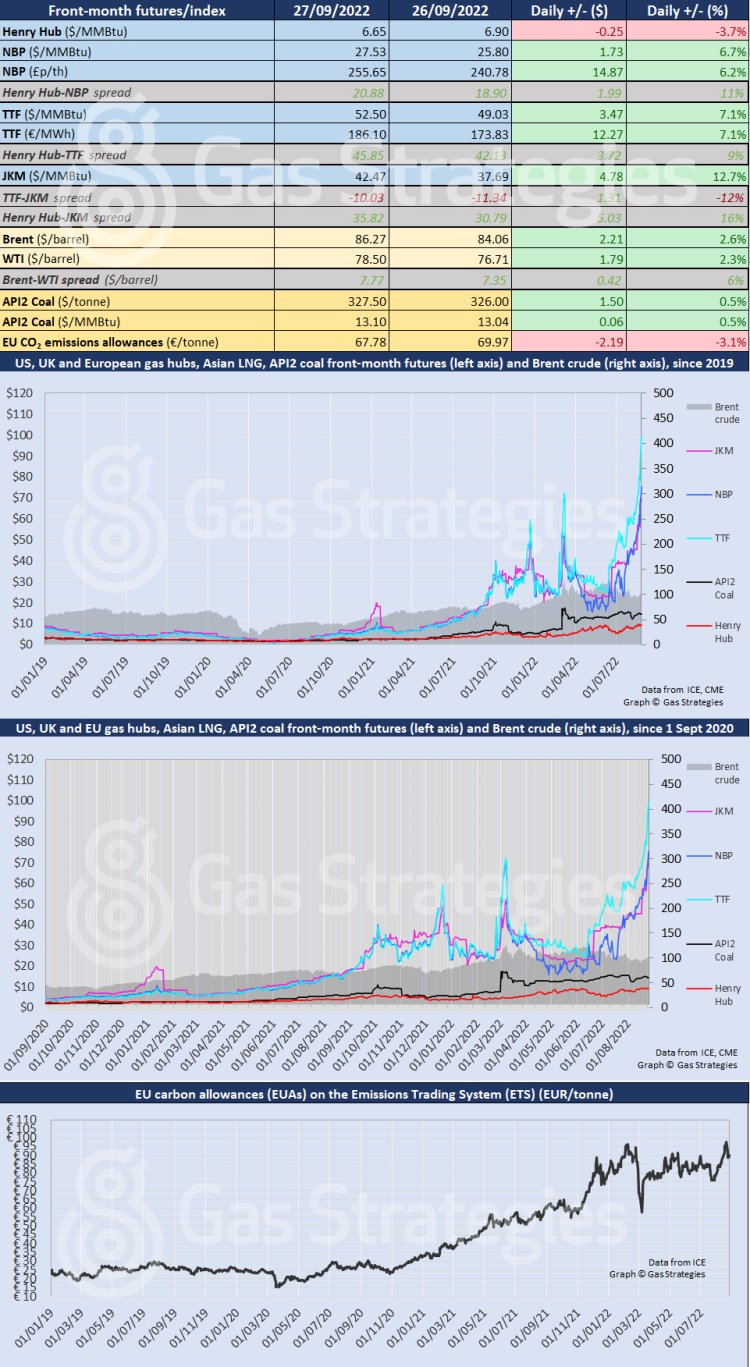

Time references based on London GMT. Brent, WTI, NBP, TTF and EU CO2 data from ICE. Henry Hub, JKM and API2 data from CME. Prices in USD/MMBtu based on exchange rates at last market close. All monetary values rounded to nearest whole cent/penny. Text and graphic copyright © Gas Strategies, all rights.