Managing Consultant David Drury, recently participated in a hydrogen panel session at the 2023 World LNG Summit in Athens. The following blog is based on David’s opening remarks.

Hydrogen continues to attract huge interest – particularly in Europe – as a way of reducing emissions in hard to decarbonise sectors. Hydrogen would substitute for natural gas in these sectors, and so, at first sight, this looks like hydrogen would be a threat to LNG. But this is not necessarily the case if one considers blue hydrogen as a source of clean hydrogen. Indeed, blue hydrogen may offer opportunities for LNG producers to continue exporting energy, even in decarbonisation scenarios.

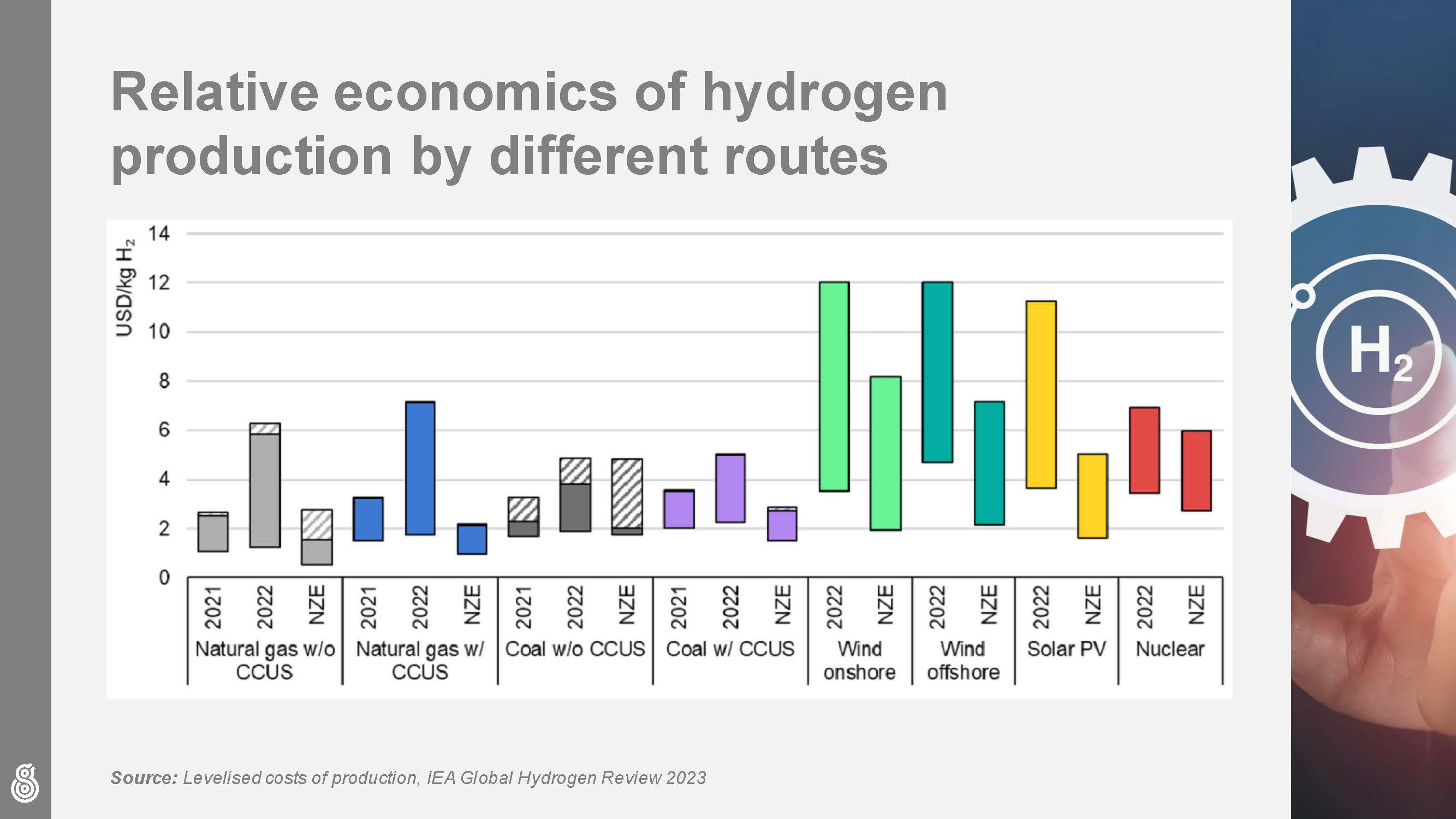

The conventional wisdom, however, is that green hydrogen based on electrolysis will emerge as the preferred method of hydrogen production, because technological advances together with deployment at scale will drive down costs. But if you look at the range of costs quoted by, for example, the IEA then you would have to question how certain you can be of this out-turn.

Given the range of possible costs, it seems entirely possible that blue hydrogen could maintain its current cost advantage over green hydrogen. And cost is going to be paramount because, whatever the route to hydrogen production, it is an expensive fuel. The IEA’s baseline is a cost of around $2/kg, which is equivalent to $17.6/MMBtu, but at the higher end of the IEA’s cost range we are easily into energy prices comparable to some of those achieved during the 2022 gas crisis which led to significant demand destruction, with the upper end of the cost range of green hydrogen from offshore wind in 2030 being an eye-watering $62/MMBtu.

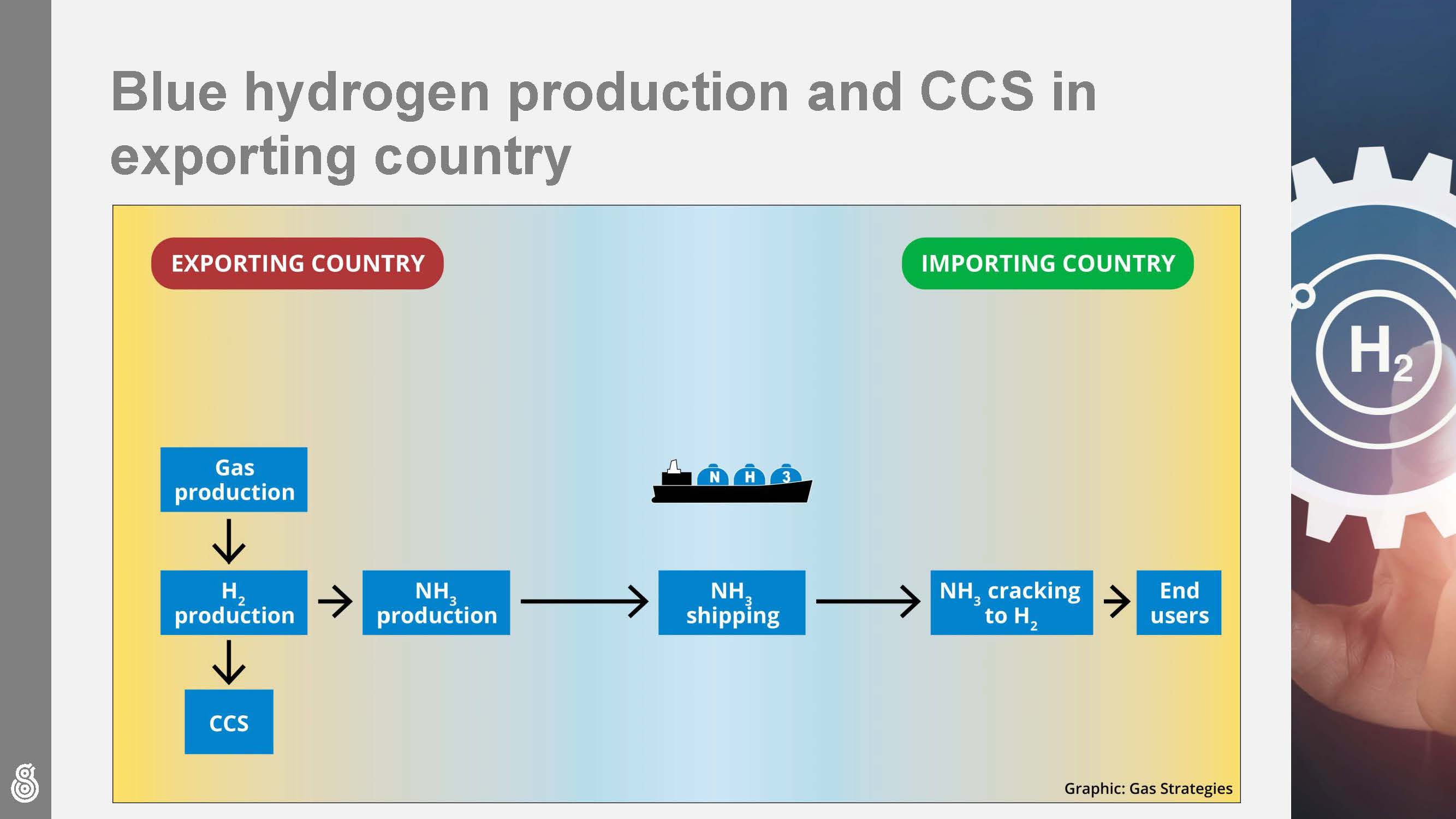

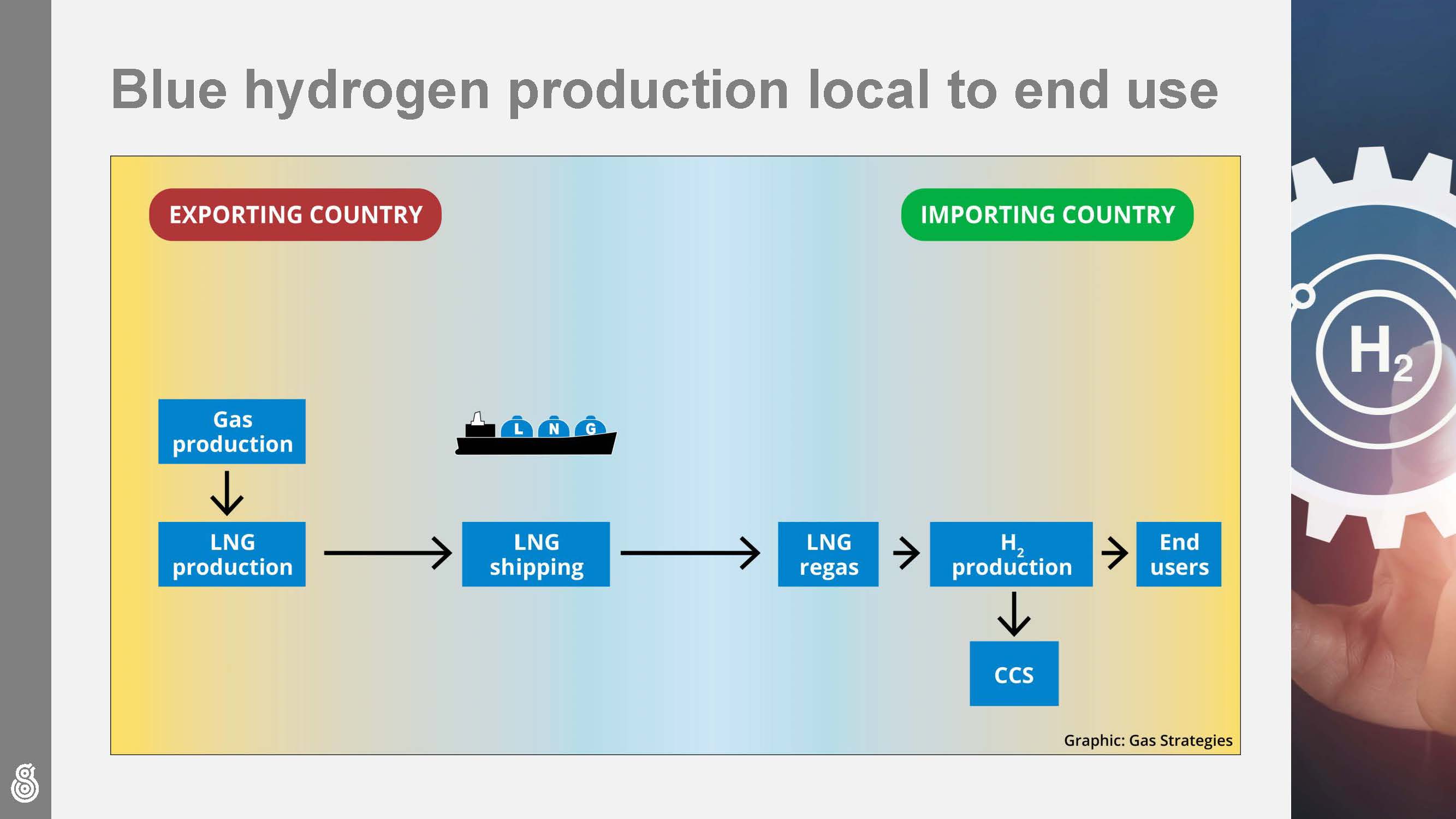

If blue hydrogen can maintain its competitiveness, then several potential seaborne value chains can be envisaged – either with hydrogen production in the gas producing country and transported most likely via a hydrogen carrier such as ammonia, or with conventional transport of the gas as LNG, and then blue hydrogen production in the importing country (which would seem to be a simpler option if the geology is suitable for carbon capture and storage (CCS)).

However, opponents of blue hydrogen will be quick to point out the emissions along the current gas production chain, and some calculations have been advanced to show that blue hydrogen is in reality no cleaner than currently produced grey hydrogen. But such calculations rely on the most pessimistic of assumptions particularly regarding methane emissions along the supply chain and also, crucially, do not take into account measures that can be put in place to reduce emissions.

The to-do list is significant. The efforts to reduce chain emissions, such as methane reduction initiatives, CO2 capture and storage, use of electric compressor drives etc. have to be pushed forward. Also, CCS needs to be made to work reliably and economically, learning perhaps from the lessons of the Gorgon project, where the CCS facility has not always worked well. Improved reforming processes for hydrogen production will also likely be needed to get carbon capture close to 100%. There may still be emissions that are hard to reduce, such as in shipping, and this maybe where offsetting comes in.

But all this is in line with the direction of travel of the oil and gas industry, and this was reinforced by the pledges which have been made at COP28 by 50 of the world’s leading fossil fuel companies to accelerate their efforts to reduce emissions from their own operations, including essential elimination of methane emissions.

Of course, there is uncertainty about what can be achieved. But, objectively, one would have to say that the uncertainty surrounding whether blue hydrogen can be produced economically and with a very low emissions profile is perhaps no greater – and arguably less than – the uncertainty around assumptions on the feasibility of large-scale green hydrogen.

Get in touch today to find out more about how Gas Strategies can support your organisation with any of the points in this blog or regarding any aspect of the energy transition. Contact us.