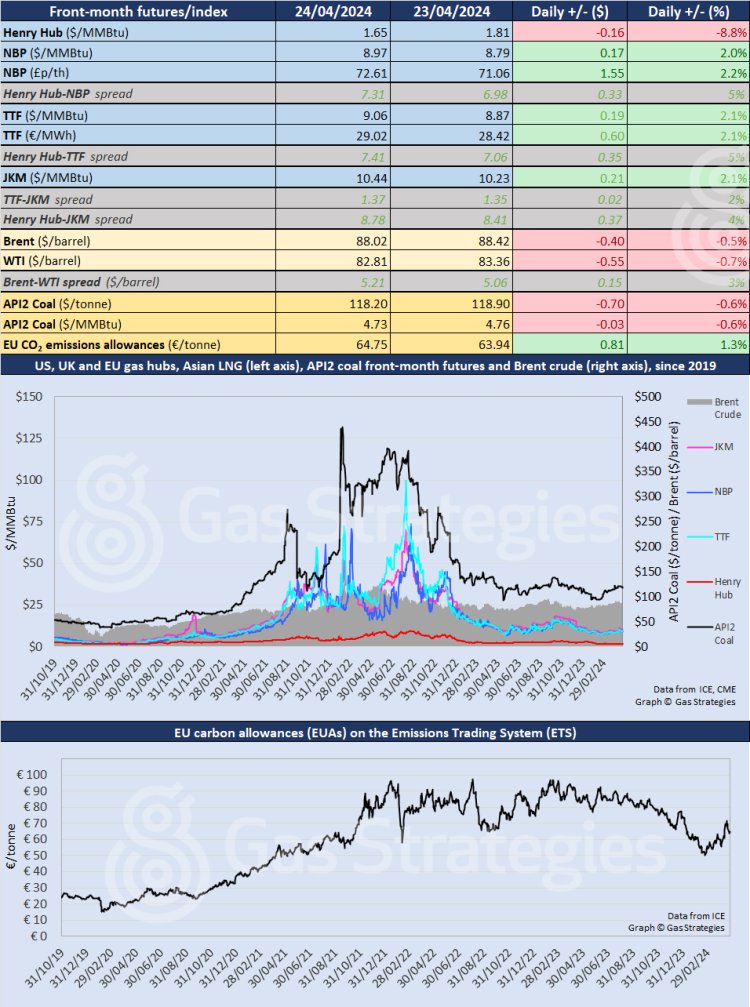

US natural gas prices tumbled yesterday on news of further troubles at the Freeport LNG export plant and expectations of bearish government data on storage, due out later today. The May Henry Hub contract fell by 8.8%, from USD 1.81/MMBtu on Tuesday to close at USD 1.65/MMBtu. Gas producer EQT Corporation said it would maintain its 1 Bcf/d output cut into May.

European natural gas futures ended three days of decline with a late rally that left TTF and NBP around 2% up on the previous day. The rally was matched by the Asian JKM LNG price, which ended up by around the same amount.

In the US, President Joe Biden wasted no time signing into law a bill approving economic and military aid to Ukraine, Israel and Taiwan – insisting that aid shipments to Ukraine would begin “literally in a few hours”. Meanwhile, protests at US universities over the Israel-Gaza war are spreading across the country, with calls for a ceasefire and numerous arrests.

In continental Europe, the May TTF contract closed up 2.1%, from USD 8.87/MMBtu on Tuesday to USD 9.06/MMBtu on Wednesday. The price opened higher on Thursday, remaining volatile.

In the UK, NBP was up 2.0%, from USD 8.79/MMBtu to USD 8.97/MMBtu, and higher again on Thursday morning.

A report from Bloomberg noted that traders at the Flame conference in Amsterdam are already focusing on what the next winter might bring, serving as a reminder that Europe’s gas crisis over the past two-and-a-half years would have been much worse had it not been for mild winters.

Concerns are also rising that Europe may take firmer action to reduce or ban imports of Russian LNG, supplies of which have helped to take the sting out of reduced pipeline flows from Russia, while Ukraine looks set against allowing Russian gas to transit its territory when the current agreement expires at the end of 2024.

In the context of rising appetites for LNG in Asia – with Chinese imports in the first quarter up a fifth on the same period last year – there could be a resurgence of competition for LNG cargoes of the kind that helped drive prices to unprecedented peaks in the summer of 2022.

With so many moving parts, there is much to worry about – more so for consumers rather than traders, who tend to thrive in a volatile environment.

In Asia, the JKM LNG price was up 2.1%, from USD 10.23/MMBtu on Tuesday to USD 10.44/MMBtu on Wednesday, with little change in the TTF-JKM spread, up 2% to USD 1.37/MMBtu.

Crude oil prices remained stable, with Brent edging down 0.5%, from USD 88.42/barrel on Tuesday to USD 88.02/barrel on Wednesday and WTI down 0.7%, from USD 83.36/barrel to USD 82.81/barrel.

In the US, the Energy Information Administration said in its weekly petroleum report that commercial crude oil inventories fell by 6.4 million barrels to 454 million barrels, 3% below the five-year average for the time of year.

Front-month futures and indexes at last close with day-on-day changes (click to enlarge):

Time references based on London GMT. Brent, WTI, NBP, TTF and EU CO2 data from ICE. Henry Hub, JKM and API2 data from CME. Prices in USD/MMBtu based on exchange rates at last market close. All monetary values rounded to nearest whole cent/penny. Text and graphic copyright © Gas Strategies, all rights.

Subscription Benefits

Our three titles – LNG Business Review, Gas Matters and Gas Matters Today – tackle the biggest questions on global developments and major industry trends through a mixture of news, profiles and analysis.

LNG Business Review

LNG Business Review seeks to discover new truths about today’s LNG industry. It strives to widen market players’ scope of reference by actively engaging with events, offering new perspectives while challenging existing ones, and never shying away from being a platform for debate.

Gas Matters

Gas Matters digs deep into the stories of today, keeping the challenges of tomorrow in its sights. Weekly features and interviews, informed by unrivalled in-house expertise, offer a fresh perspective on events as well as thoughtful, intelligent analysis that dares to challenge the status quo.

Gas Matters Today

Gas Matters Today cuts through the bluster of online news and views to offer trustworthy, informed perspectives on major events shaping the gas and LNG industries. This daily news service provides unparalleled insight by drawing on the collective knowledge of in-house reporters, specialist contributors and extensive archive to go beyond the headlines, making it essential reading for gas industry professionals.