From historical lows to unprecedented highs, natural gas and LNG prices have in the last two years been on a roller coaster ride, with rapid swings of a magnitude that would have been impossible to predict in 2019.

As the global gas and LNG market continues to come to terms with the current level of spot prices and the possibility that they may be here to stay for a big part of 2022, it is worth asking: have we witnessed a once-in-a-lifetime perfect storm of disruptions? Is a return to the status quo imminent? Or are we seeing the symptoms of structural changes to the market that are here to stay?

Many commentators have described the current circumstances as a transitory and exceptional event. While some of the drivers of the last two years, such as the global pandemic, cannot reasonably be expected to become the norm, Gas Strategies’ view is that we should not rush to call the current gas and LNG price environment temporary.

Firstly, we must consider the short-term: forward prices remain at high levels for the next 12 months, while structural factors suggest that this may stay the case for longer. To begin, Europe needs an urgent boost in supply, as gas storage is at its lowest levels in recent memory, coal and nuclear shut-downs continue across the continent, and indigenous production declines. Meanwhile, Asian demand has been growing at breakneck speed and is unlikely to slow down for the rest of this decade.

As Gas Strategies was working on the yearly update of its price scenarios, the above factors meant that, to make our models balance, we were forced to increase the assumption of Russian gas flows into Europe to its highest ever. But against the backdrop of heightened tensions between the Kremlin and Western governments, not to mention stagnating, if not diminishing, Russian exports to Europe over the last 12 months, the idea of Russia coming to the aid of Europe to bring prices down seems far-fetched. Accordingly, it is easy to see the market remaining very tight, at least for the next three years, before significant new LNG supply arrives.

As far as new medium-term supply is concerned, projects other than the Qatar expansion have been struggling to take FID over the last two years. With ever-growing uncertainty over future gas demand, commercial buyers find it increasingly difficult to commit to the long-term contracts that have historically underpinned the financing of new liquefaction. With very few projects expected to be sanctioned in 2022, and limited new capacity expected to come online after 2027, this will have a significant impact on the supply/demand balance in the second half of the decade. At the same time, strong demand growth is unlikely to slow down at any point in the 2020s.

While the market is likely to see some relief for a couple of years in the middle of the 2020s, as the record amount of capacity sanctioned in 2019 and the Qatar expansion enter the market, this is now set to be shorter lived, quickly turning into a renewed prolonged period of tightness at the end of the decade. Combined with the short-term outlook already discussed, the result is a generally higher outlook for prices across the rest of the 2020s.

There are more reasons to believe that the volatility seen in the last two years may not go away soon. While Europe has historically been able to respond quickly to LNG prices thanks to its flexible gas demand for power generation, vast regasification and gas storage capacity and liberalised market, this may be challenged in the future. By the end of the 2020s, there may be limited remaining scope for coal-to-gas switching in Europe’s biggest gas markets, as coal is phased out. Also, a rapid growth in renewables may lead to gas-fired generation increasingly taking a balancing role, rendering its activity less flexible. Coupled with the rapidly decreasing outlook for indigenous production and the potentially continued highly political nature of Russian flows to Europe, the conclusion is that the future may see a much more volatile LNG market than ever before, with small disruptions on supply and demand causing large swings in spot prices.

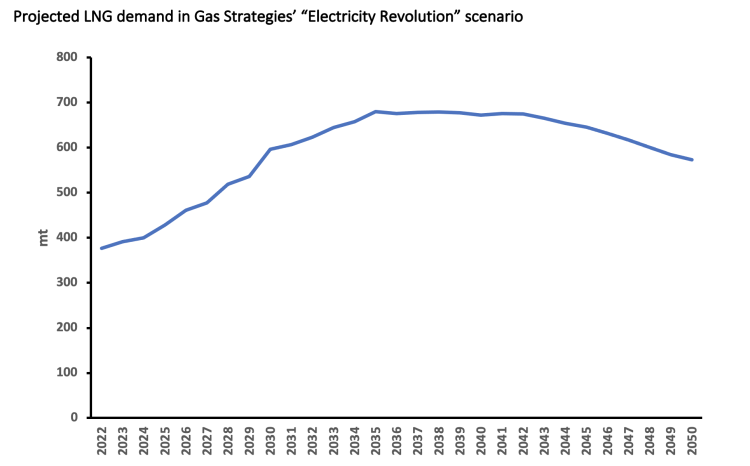

Looking long term, from the middle of the 2030s onwards, demand growth in developing markets – especially India and south-east Asia – will need to make up for the expected reductions in Europe and the established Asian markets. But the long-term outlook for these newer, price-sensitive markets may be seriously impacted by a period of higher and more volatile prices in the 2020s, as the development of critical infrastructure to underpin their rising gas demand could be delayed to a point when lower carbon alternatives become more economic and reliable than LNG. It is not unreasonable to believe that the LNG industry could price itself out of the transitional fuel role it so often ascribes to itself in developing markets.

All of this points to the fact that the LNG market is not just going through a short-lived perfect storm but is instead seeing a revolution in what drives it. What was perceived to be a steady route towards increased liberalisation may have come to a sharp break, to be replaced with a growing role played by political rationales on both the supply and the demand side of the market.

On the other hand, purely commercial considerations can be expected to play a progressively less important role. The most obvious evidence of this is the fact that high spot prices are no longer a significant driver in stimulating the sanctioning of new gas and LNG production, and cost-competitiveness is no longer the main factor in deciding what supplies reach the market. The growing exposure to political rationales, by their nature unpredictable, has made the market structurally more volatile than ever before.

At the same time, the LNG industry’s reliance on long-term commitments means that the uncertainty brought by decarbonisation pledges, and the expectation that the status quo will not continue, is already changing the shape of the industry, rather than being something that will impact the industry in a far distant future when demand will actually peak and begin to decline. The resulting impact of these transformations on prices is likely to lead to a market that is structurally tighter and more volatile than ever expected.

With a market that may now be stuck on a mad roller coaster ride, it is easy to understand why only the bravest may be willing to jump on it from now on. Those that found the ride a little too adventurous have already tried to climb off as fast as they can, and more exits can be expected as these new dynamics become clearer. Some, however, may decide they like the thrill of this ride, while realising that there is still a lot of value to be had from the LNG industry.

Just buckle up and enjoy the ride.