At an oil and gas event in Buenos Aires last December, Argentina’s energy secretary Flavia Royon announced what seemed like a breakthrough: Brazil’s state-owned development bank, BNDES, and the Development Bank of Latin America (CAF) had agreed to finance the construction of the remaining phase of a key gas pipeline from the Vaca Muerta shale play. The banks would provide loans of USD 689 million and USD 540 million respectively to build the second section of the President Nestor Kirchner pipeline.

The cash-strapped Argentinian state is funding the first, 563-km section of the route. On a visit to Argentina in January 2023, Brazil’s president Luiz Inacio Lula da Silva referred to the BNDES when he said his government would “create the conditions” to finance the remaining phase. Argentina has declared the infrastructure project to be of “national public interest” and says it could also help pave the way to energy self-sufficiency and eventually more gas exports, including to Brazil.

However, neither of the apparent funding pledges to build the pipelines appear to be forthcoming. In a statement to Gas Matters, the BNDES flatly contradicted Royon. “The BNDES has not received any formal request for funding regarding this project,” the bank’s press office said. “We inform that there is no demand or forecast, on the part of the BNDES, to finance infrastructure service projects abroad,” the statement said. The bank appears to be open to the possibility of facilitating the use of Brazilian goods in such projects, however: “The BNDES’ efforts are aimed at leveraging the export of products and goods produced in Brazil, generating jobs and income in our country and strengthening the regional integration of production chains.”

For its part, the CAF announced two loans to Argentina on 7 March 2023. They comprised funds for a social programme and a USD 540 million loan for an important but separate project, the reversion of the North Gas Pipeline. With the first phase of the President Nestor Kirchner pipeline due to be completed in June 2023, there is no confirmation that funding has been secured for the route’s second stage. Argentina’s Secretariat of Energy did not return a request for comment on how the project’s second stage would be financed.

“It’s not clear,” says Julian Rojo, an economist at the General Mosconi Argentina Energy Institute. “In general Argentina has problems securing financing.” So far there are no signs that Brazilian investors will be coming to the rescue. Argentina has reportedly begun talks with funds from China and Saudi Arabia about financing the pipeline’s second stage.

There are other concerns with the project. “With this pipeline, there are at least no known, published environmental and feasibility studies,” Rojo tells Gas Matters. “What is the transport tariff that will recoup the cost of the investment? It’s not known. This is bad international practice. Countries that carry out infrastructure projects have to disclose the studies, especially when public resources are used.”

Argentina has been largely cut off from international capital markets since it defaulted on its debt in May 2020. In March 2023, the IMF and Argentina agreed on the fourth review of the country’s USD 44 billion loan programme. Despite the difficult macroeconomic backdrop, there are encouraging signs in its energy sector. Rojo believes Argentina’s gas production this year could exceed the previous record of 143 MMcm/d achieved in 2006. “The productivity in Vaca Muerta now in some cases is even higher than in the Permian basin,” says Roberto Brandt, an international energy consultant.

Potential cooperation

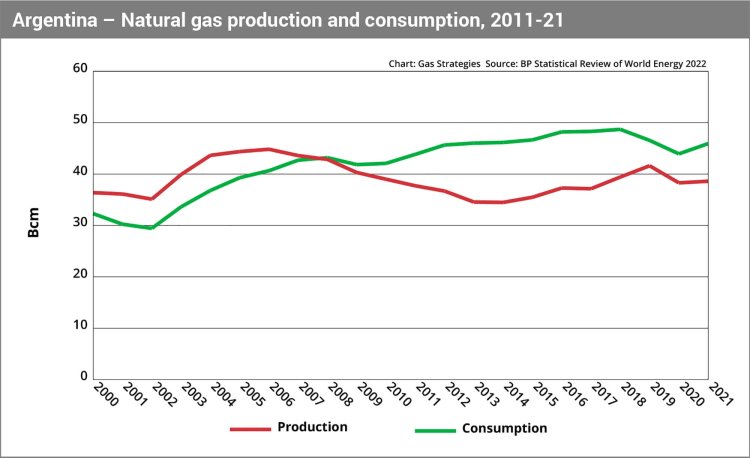

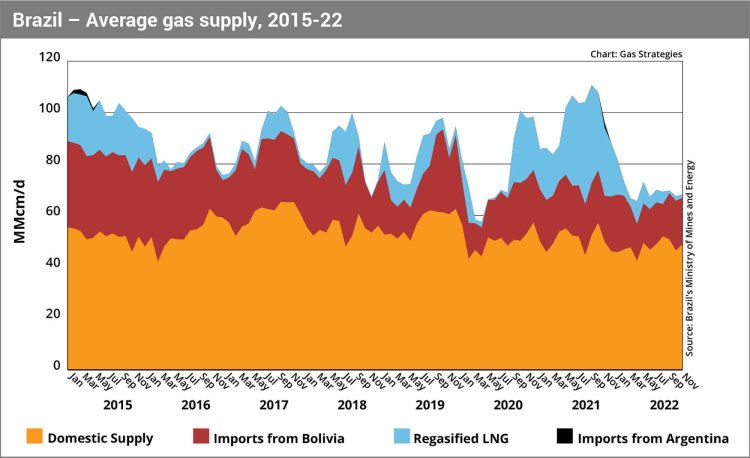

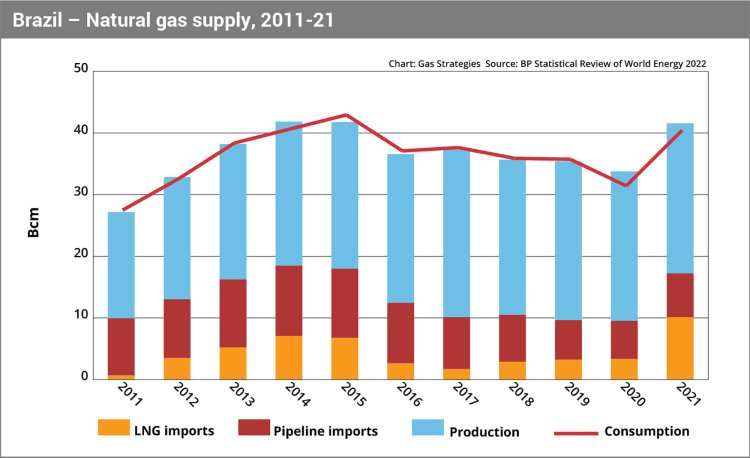

Brazil has imported barely any piped gas or LNG from Argentina in recent years, while its imports from Bolivia stood at 7 Bcm in 2022. Closer energy cooperation between the two neighbours makes sense: Argentina’s unconventional gas production has boomed, Brazil needs gas imports and Bolivian exports to both countries have declined. In August 2022, unconventional gas accounted for 57% of Argentina’s total output of 141 MMcm/d, having made up only 7% a decade ago.

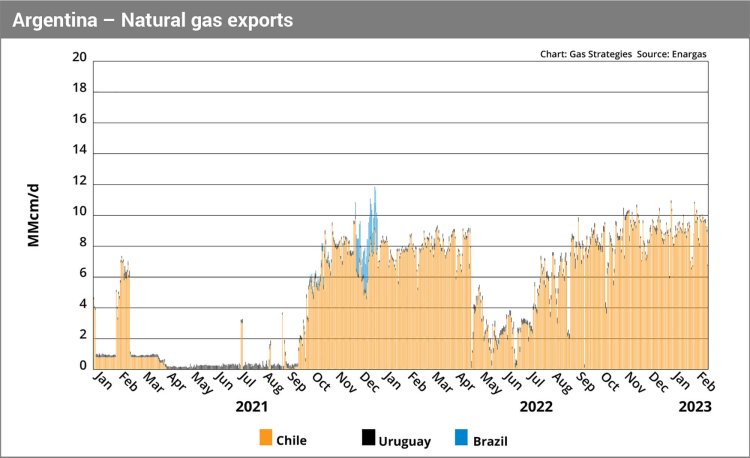

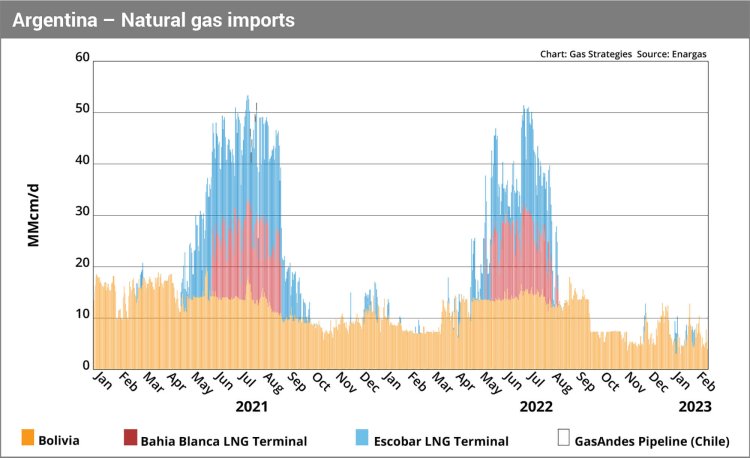

In September 2018, Argentina resumed gas exports to Chile for the first time in over a decade. In June 2019, Argentina exported its first LNG cargo via the Tango FLNG in Bahia Blanca, but lost its LNG exporter status in 2020. However, it remains a net gas importer. Argentina’s gas output is unable to match domestic demand in the colder winter period between May and September. Further development of Vaca Muerta is limited by a lack of takeaway capacity.

A series of investments under Argentina’s Transport.Ar National Production plan are expected to boost gas transport capacity, replace LNG imports with domestic output and increase exports. The first phase of the President Nestor Kirchner pipeline, which spans connects Tratayen in Neuquen Province with Salliquelo, Buenos Aires Province, will increase gas transport capacity from Vaca Muerta by 11 MMcm/d when it becomes operational in the coming months.

This will rise to 22 MMcm/d in early 2024 with the installation of compression plants, according to a recent presentation by Royon. The second phase of the pipeline, spanning 521 km from Salliquelo to San Jeronimo, Santa Fe Province, would increase the capacity to 44 MMcm/d. The government ambitiously expects the second section to be completed during 2024.

“Is there a market [for Argentinian gas] in Brazil? My automatic response is yes,” says Adrianno Lorenzon, head of natural gas at Abrace Energia, the Brazilian association of energy intensive consumers. “It’s clear that they have huge reserves of natural gas in Vaca Muerta and it is also clear that this gas is very competitive, in the sense that it can be extracted at a very low cost,” he says. Brazil’s domestic gas supply is being throttled by its own infrastructure issues, notably a lack of takeaway capacity from its pre-salt fields.

Export routes

There is no consensus as to how Argentina should deliver gas to its neighbour. In Brazil, the initial sections of a route that could have linked Argentina to its integrated pipeline network were built over two decades ago. However, Argentina defaulted on its debt in 2001 and its gas production subsequently went into sharp decline. As a result, Argentina restricted and then eventually cut all gas exports to negligible volumes in 2007.

Argentina is able to send piped gas to Brazil via the first section of the proposed Uruguaiana-Porto Alegre pipeline. This section spans only 25 km and is connected to a backup 640 MW thermal power plant near the border. When fully operational, the plant can be supplied with a maximum of 2.8 MMcm/d. The third section connects to the Gasbol pipeline, which forms part of Brazil’s integrated network. However, the almost 600-km middle stage of the route was never built, leaving the dream of closer gas integration unrealised.

Provided Argentina can increase its takeaway capacity from Vaca Muerta, there are three main possibilities for supplying larger quantities of Argentine gas to Brazil. Firstly, completing the Uruguaiana-Porto Alegre pipeline would require a capex of BRL 4.6 billion (USD 872 million), the EPE, the research unit of the Brazilian Ministry of Mines and Energy, estimated in a study in 2019. It proposes a pipeline capacity of 15 MMcm/d and estimates a potential industrial anchor demand of around 5 MMcm/d. Work would also be required to increase transport capacity on Argentina’s side of the border.

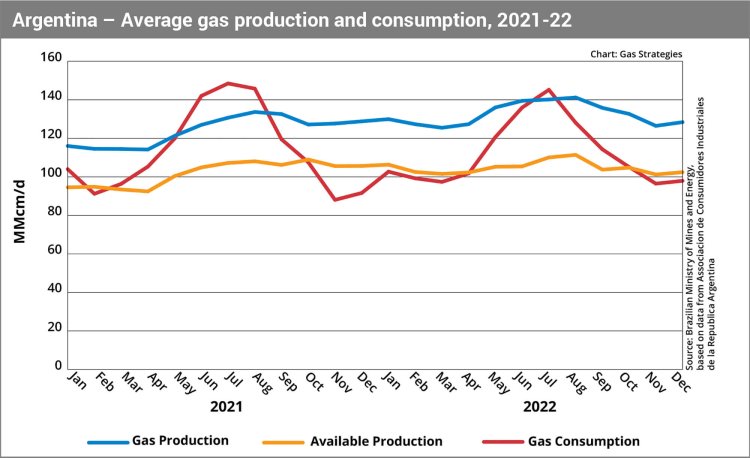

“For this pipeline to be viable, we need to have a long-term and firm gas supply contract,” according to Lorenzon. “Particularly once the second stage of the President Nestor Kirchner pipeline is completed, some of its gas could be exported. However, Brandt says that further investments may be needed as Argentina’s ability to deliver long-term firm exports of gas “will not necessarily be secured only by the Nestor Kirchner expansion.” Last year, Argentina’s gas imports spiked at over 51.4 MMcm/d on 7 July 2022.

As for the second option, one of the Transport.Ar projects – the reversion of the North Gas Pipeline – opens the possibility of sending Argentinian gas to Brazil via Bolivia. Once completed, it will allow gas from Vaca Muerta to be transported to northern Argentina. The reversion could be extended to the border with Bolivia, allowing the gas to be transported via the Gasbol pipeline to Brazil.

A recent presentation by Royon noted that reversion work on the North Gas Pipeline’s full capacity of 29 MMcm/d would take 14 months. Reaching a deal between the three countries would be far from given. “I think the negotiation of molecules between countries always involves geopolitics in addition to the negotiation of gas,” says Augusto Salomon, the executive president of Abegas, the Brazilian association of gas distributors.

LNG exports are a third option. Lorenzon thinks this could be a more feasible way for Brazil to import gas from its neighbour. “Perhaps it would be easier at first to export gas from Vaca Muerta as LNG to the world and to Brazil by meeting specific demands such as the spot market and smaller contracts than trying to start with an international gas pipeline and a long-term contract.”

Rojo cautions that large-scale LNG projects “would require considerable investments with much more risk.” In September 2022, YPF and Malaysia’s Petronas signed a memorandum of understanding (MoU) for a potential LNG export project in Argentina. In a Q4 ‘22 earnings call, YPF’s CEO Pablo Iuliano said the project would include a liquefaction facility with an eventual capacity of 25 mtpa. According to Iuliano, “the bulk capacity of the first stage would probably not be ready for commercial operation before 2028.”

Natural gas is expected to continue to play an important role in Brazil’s energy and electricity matrices over the coming decade. Domestic gas output and piped Bolivian imports meet Brazil’s relatively stable industrial demand. However, neither country’s gas supply is very responsive to spikes in demand. Therefore, during periods when drought cuts its hydroelectric output, Brazil has turned to LNG to feed its thermal power plants.

Brazil’s dry season, when extra gas for backup power plants is more likely to be needed, typically occurs between May and September. These months coincide with Argentina’s own gas supply crunch. Argentina’s difficulty in exporting gas throughout the year with firm delivery commitments therefore weighs on the feasibility of investments in infrastructure to export or receive the gas.

Another opportunity?

Argentina will hold a general election in October this year, and the ruling coalition is unlikely to win. However, Brandt says both the government and the opposition acknowledge the potential for gas to increase the country’s exports. The government intends to submit a bill to Congress to strengthen the legal framework for LNG investments. “If I had to say will the gas exports to Brazil happen? My answer would be yes. If I had to answer when, I have a big question mark,” says Brandt.

Argentina’s high country risk premium poses a threat of more delays to its gas projects. This raises the question of whether the country could miss a window of opportunity in the energy transition. “If, for instance, an LNG plant were to be built in Argentina within this decade, it would still have room,” says Brandt. “If we lose another decade and we have this conversation, let’s say in 2033, maybe we would be out of the game,” he says.

For a project of such significance, there is ambiguity surrounding the President Nestor Kirchner pipeline, including its funding and absence of data on how it might boost Argentina’s gas exports. The contradictory messages over the role of the BNDES illustrate the difficulties facing long-held ambitions of greater gas integration between Argentina and Brazil. There is political will. Argentina’s gas infrastructure buildout is making it increasingly feasible. However, there is no evidence of a clear, coordinated strategy in Brasilia and Buenos Aires to turn it into reality. – EO

This material was first issued to subscribers of Gas Strategies Information Services (Gas Matters, LNG Business Review and Gas Matters Today). Much more than gas, Information Services covers a broad variety of topics across the global energy transition.

To find out more about how Gas Strategies can support your organisation with any of the points in this blog or regarding any aspect of the energy transition, then get in touch today.