Oil prices recorded their biggest one-day slump in six months on Thursday amid bearish news on demand in major consuming regions.

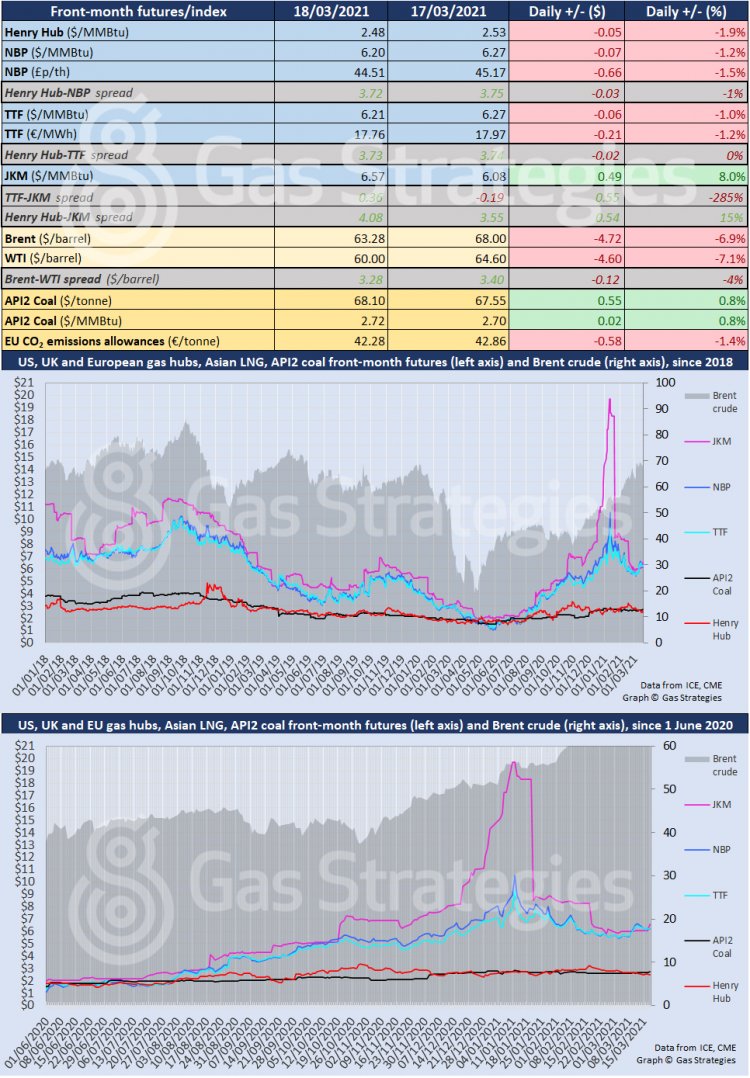

Brent and WTI futures fell for a fifth straight day on Thursday, with both falling by ~7% - marking their largest one-day drop since September 2020. The front-month Brent contract settled in the USD 63/barrel range, with WTI closing at USD 60/barrel.

Bearish news on demand is gathering pace, with rising Covid-19 cases and subsequent lockdowns in Europe leading the charge. On Thursday, France announced new lockdown measures for the Paris region. Earlier in the week Italy placed half of the country’s regions into lockdown in a bid to stop rising Covid-19 cases.

Several European nations have also stopped administering the Oxford-AstraZeneca vaccine, with the UK this week also warning that it is expecting a “significant reduction in the weekly supply” of vaccines in April due to delay in a shipment of the Oxford-AstraZeneca jabs from India. The UK government has played down the delay and said it will not affect people getting a second dose of Covid-19 vaccines and it will not impact England’s timeline to end lockdown in June.

Concerns over demand in China – the world’s largest crude consumer – also weighed on prices on Thursday with Beijing reportedly looking to crackdown on imports of heavy emissions fuels, according to the Financial Times.

European gas prices fell into the red on Thursday. The front-month UK NBP contract fell by 1.2% and the month-ahead Dutch TTF contract fell by 1% with both markers settling at the equivalent of USD ~6.2/MMBtu.

CME’s JKM futures contract rolled over to April, with the price up 8% compared to the final day of the March-date contract. JKM now holds a USD 0.36/MMBtu premium over TTF and USD 0.37/MMBtu premium over NBP, with the European markers having traded higher than the Asian LNG marker over the last six days.

In the US, gas benchmark Henry Hub continued to slide, with the marker falling by 1.9% to close at USD 2.48/MMBtu.

The European carbon price fell from a record high but remained in the EUR 42/tonne range after slumping by 1.4% on Thursday.

Front-month futures and indexes at last close with day-on-day changes (click to enlarge):

Time references based on London GMT. Brent, WTI, NBP, TTF and EU CO2 data from ICE. Henry Hub, JKM and API2 data from CME. Prices in USD/MMBtu based on exchange rates at last market close. All monetary values rounded to nearest whole cent/penny. Text and graphic copyright © Gas Strategies, all rights

Subscription Benefits

Our three titles – LNG Business Review, Gas Matters and Gas Matters Today – tackle the biggest questions on global developments and major industry trends through a mixture of news, profiles and analysis.

LNG Business Review

LNG Business Review seeks to discover new truths about today’s LNG industry. It strives to widen market players’ scope of reference by actively engaging with events, offering new perspectives while challenging existing ones, and never shying away from being a platform for debate.

Gas Matters

Gas Matters digs deep into the stories of today, keeping the challenges of tomorrow in its sights. Weekly features and interviews, informed by unrivalled in-house expertise, offer a fresh perspective on events as well as thoughtful, intelligent analysis that dares to challenge the status quo.

Gas Matters Today

Gas Matters Today cuts through the bluster of online news and views to offer trustworthy, informed perspectives on major events shaping the gas and LNG industries. This daily news service provides unparalleled insight by drawing on the collective knowledge of in-house reporters, specialist contributors and extensive archive to go beyond the headlines, making it essential reading for gas industry professionals.