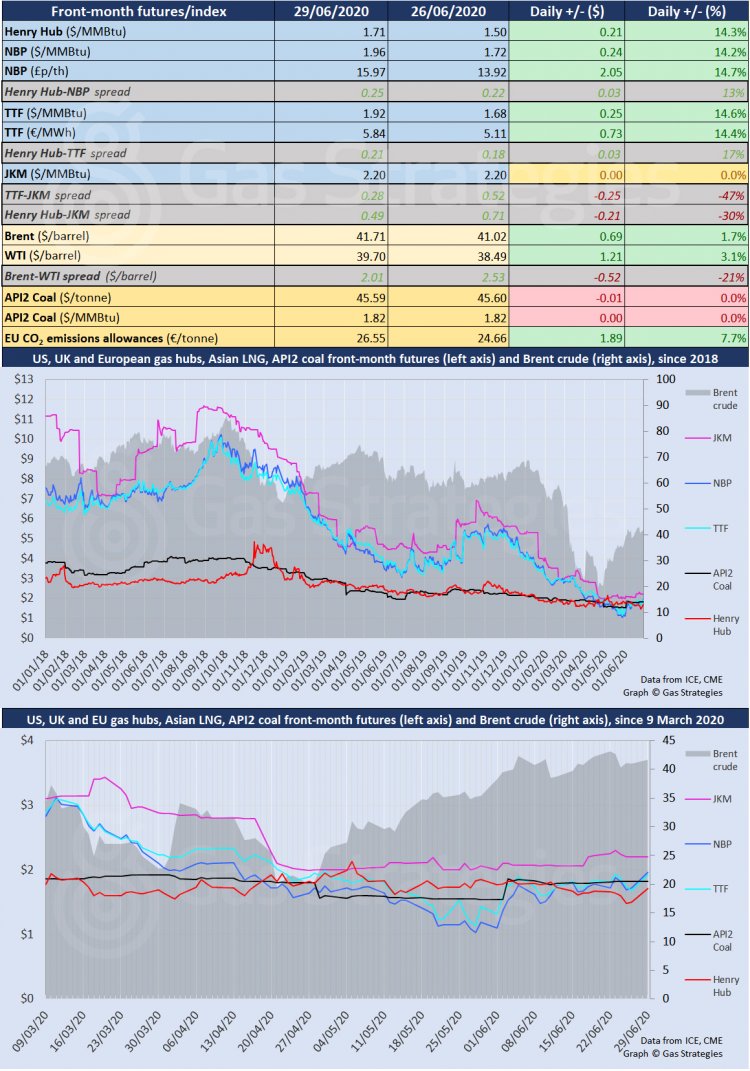

UK and European natural gas hubs roared back into life on Monday following weeks of record low pricing, as front-month NBP rose 14.7% to hit the equivalent of USD 1.96/MMBtu and Dutch TTF gained 14.4% to close at USD 1.92/MMBtu. These represent highs not seen since mid- and late-April 2020 for the month-ahead contracts on the UK and Dutch gas hubs, respectively. Prices rose after Slovakia’s gas transportation system operator Eustream announced it is offering extra interruptible transmission capacity at the Velke Kapusany exit point towards Ukraine, which could tighten the supply-demand balance in western Europe. A compounding factor was a 7.7% rise in the EU carbon price, with ETS allowances (EUAs) closing yesterday at USD 26.55/tonne – a fresh six-month high.

Another key factor was a 14.3% spike in US gas benchmark Henry Hub (HH), which occurred partly as a result of the front month contract rolling over into August. The August contract itself gained more than 10% in yesterday’s session to hit USD 1.71/MMBtu, which represents a 14.3% premium on Friday’s final closing price for the July contract. But the main driver for the price rise was forecasted warmer weather driving US cooling demand, plus lower production expectations following the bankruptcy of Chesapeake Energy.

Higher HH further undermines the economics of US LNG exports, which use HH to calculate feed gas prices. This fuelled speculation that US LNG cargo cancellations will be towards the higher end of the 35-45 cargo range, which would reduce the volumes of Atlantic basin supplies heading towards Europe and other markets.

Crude oil prices returned to growth on Monday, as global benchmark Brent and US benchmark WTI rose by 1.7% and 3.1% to close at USD 41.71/barrel and USD 39.70/barrel, respectively. Both benchmarks were trading down by more than 1% on Tuesday morning.

Front-month futures and indexes at last close with day-on-day changes (click to enlarge):

Time references based on London GMT. Brent, WTI, NBP, TTF and EU CO2 data from ICE. Henry Hub, JKM and API2 data from CME. Prices in USD/MMBtu based on exchange rates at last market close. All monetary values rounded to nearest whole cent/penny. Text and graphic copyright © Gas Strategies, all rights reserved.

Subscription Benefits

Our three titles – LNG Business Review, Gas Matters and Gas Matters Today – tackle the biggest questions on global developments and major industry trends through a mixture of news, profiles and analysis.

LNG Business Review

LNG Business Review seeks to discover new truths about today’s LNG industry. It strives to widen market players’ scope of reference by actively engaging with events, offering new perspectives while challenging existing ones, and never shying away from being a platform for debate.

Gas Matters

Gas Matters digs deep into the stories of today, keeping the challenges of tomorrow in its sights. Weekly features and interviews, informed by unrivalled in-house expertise, offer a fresh perspective on events as well as thoughtful, intelligent analysis that dares to challenge the status quo.

Gas Matters Today

Gas Matters Today cuts through the bluster of online news and views to offer trustworthy, informed perspectives on major events shaping the gas and LNG industries. This daily news service provides unparalleled insight by drawing on the collective knowledge of in-house reporters, specialist contributors and extensive archive to go beyond the headlines, making it essential reading for gas industry professionals.