News that yet another US natural gas producer is to curb output in response to low prices failed to prevent yet another fall in Henry Hub futures on Tuesday. Meanwhile, the Energy Information Administration (EIA) yesterday downgraded its price forecasts for the rest of 2024.

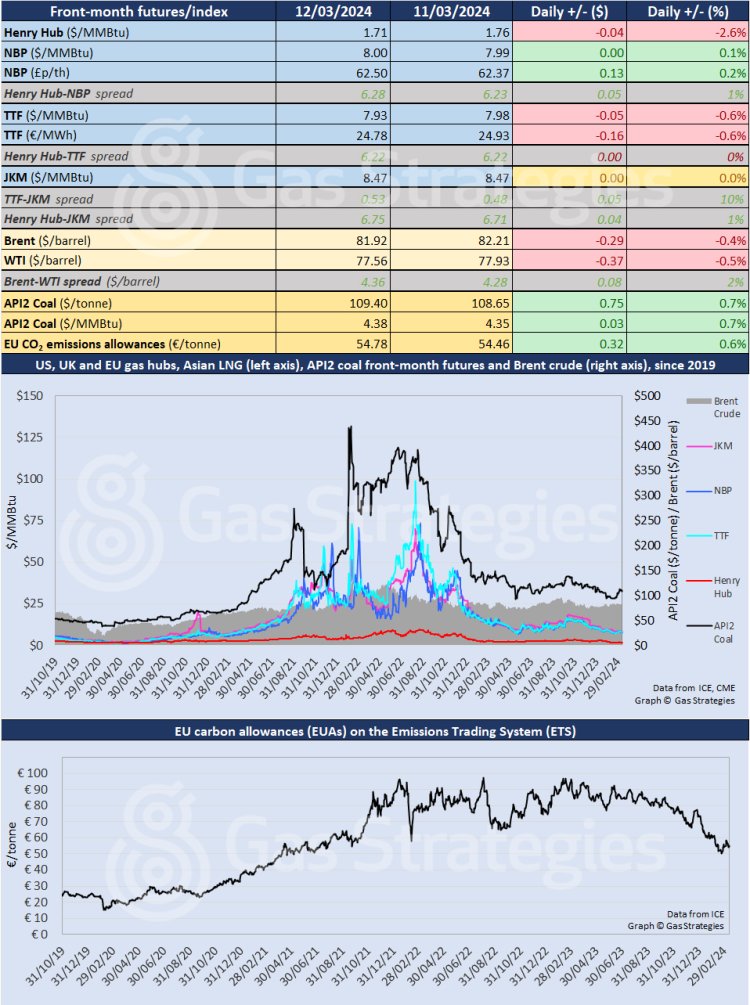

The front-month (April) Henry Hub contract fell by 2.6%, from USD 1.76/MMBtu on Monday to USD 1.71/MMBtu on Tuesday, the fifth consecutive decline since the price briefly exceeded USD 2/MMBtu in intra-day trading a week ago.

The price was down by another 1.5% early on Wednesday.

In an operational guidance update on Tuesday, CNX Resources Corporation said it would delay completions on three Marcellus Shale pads – in response to “the continued lower outlook for near-term natural gas prices” – to avoid putting more gas into the “current oversupplied market”.

This, it said, would reduce its 2024 output by around 30 Bcf, adding that it also expected this year’s capital expenditure to be USD 50 million lower than in previous guidance.

The EIA’s latest short-term energy outlook, released yesterday, forecast that spot Henry Hub prices would “remain below USD 2/MMBtu in the second quarter of 2024 as the winter heating season ends, with natural gas inventories 37% above the five-year average”.

The Henry Hub spot price averaged USD 1.72/MMBtu in February – 30% lower than predicted in the agency’s February outlook – a “record low adjusted for inflation”. Drivers included lower consumption in the residential and commercial sectors over the winter just gone.

The EIA expects lower prices to cause “slight declines” in production for the rest of 2024, with dry gas output averaging 103 Bcf/d. Output is forecast to rise to 105 Bcf/d next year, partly because of higher demand from LNG exports.

Price movements were muted in other markets.

European gas futures diverged, with April TTF down 0.6% to USD 7.93/MMBtu and NBP up 0.1% to USD 8.00/MMBtu. In Asia, JKM was unchanged at USD 8.47/MMBtu.

Crude oil prices extended their run of stability, with Brent down 0.4% to USD 81.92/barrel and WTI down 0.5% to USD 77.56/barrel.

In its outlook, the EIA has reduced its forecast for oil production growth in 2024, as a result of OPEC+ extending production curbs, leading to a decline in global inventories. This, in turn, causes the Brent spot price to average USD 88/barrel in the second quarter – USD 4 higher than the forecast made last month.

The EIA now expects spot Brent to average USD 87/MMBtu in 2024.

Front-month futures and indexes at last close with day-on-day changes:

Time references based on London GMT. Brent, WTI, NBP, TTF and EU CO2 data from ICE. Henry Hub, JKM and API2 data from CME. Prices in USD/MMBtu based on exchange rates at last market close. All monetary values rounded to nearest whole cent/penny. Text and graphic copyright © Gas Strategies, all rights.

Subscription Benefits

Our three titles – LNG Business Review, Gas Matters and Gas Matters Today – tackle the biggest questions on global developments and major industry trends through a mixture of news, profiles and analysis.

LNG Business Review

LNG Business Review seeks to discover new truths about today’s LNG industry. It strives to widen market players’ scope of reference by actively engaging with events, offering new perspectives while challenging existing ones, and never shying away from being a platform for debate.

Gas Matters

Gas Matters digs deep into the stories of today, keeping the challenges of tomorrow in its sights. Weekly features and interviews, informed by unrivalled in-house expertise, offer a fresh perspective on events as well as thoughtful, intelligent analysis that dares to challenge the status quo.

Gas Matters Today

Gas Matters Today cuts through the bluster of online news and views to offer trustworthy, informed perspectives on major events shaping the gas and LNG industries. This daily news service provides unparalleled insight by drawing on the collective knowledge of in-house reporters, specialist contributors and extensive archive to go beyond the headlines, making it essential reading for gas industry professionals.