Natural gas prices in Europe and Asia fell sharply on Thursday while prices in the US showed a muted fall as expectations of a storage build turned out to be correct. Crude prices edged down amid growing diplomatic pressure for a ceasefire in Gaza.

In continental Europe, the April TTF contract fell by 5.3%, from USD 8.88/MMBtu on Wednesday to USD 8.40/MMBtu Thursday – the second consecutive fall after a run of five consecutive rises.

Friday’s morning report from Energi Danmark comments that “mild conditions, high storage levels as well as some improvement in Norwegian flows set the tone … and put concerns about rising LNG demand in Asia into the background to some extent”.

Prices are now roughly where they were a fortnight ago, suggesting they are currently in a volatile plateau, sensitive to small changes but with the basic fundamentals – mild weather, comfortable supply and high storage levels – all priced in.

The trend is in contrast to the straight-line downwards trend seen between October and February.

The picture for NBP in the UK is very similar, underscoring how closely both markets are connected in physical terms. The April futures contract was down 5.2%, from USD 9.13/MMBtu on Wednesday to USD 8.65/MMBtu on Thursday.

Both TTF and NBP were on an upward trend on Friday morning.

Rising LNG demand in Asia is likely to be further fuelled by a 3.0% fall in JKM, from USD 9.57/MMBtu on Wednesday to USD 9.29/MMBtu on Thursday, widening the TTF-JKM spread to USD 0.88/MMBtu. It was the second substantial fall in as many days.

In the US, the Energy Information Administration (EIA) estimated working gas in storage at 2,332 Bcf as of 15 March, up 7 Bcf from the previous week and above both the five-year historical range and the five-year maximum-minimum range. Stocks were 411 Bcf higher year-on-year.

The injection was widely foreshadowed so Henry Hub fell by a muted 0.9%, from USD 1.70/MMBtu on Wednesday to USD 1.68/MMBtu on Thursday.

Crude oil prices fell for a second day, with Brent edging down 0.2% to USD 85.78 and WTI down 0.7% to USD 81.07/MMBtu.

The falls came amid growing international pressure for a ceasefire in Gaza, with UNICEF – the UN agency that provides aid for children – warning that famine is a growing threat unless Gaza is immediately flooded with humanitarian aid. It says over 600,000 children are trapped in Rafah with “nowhere safe for them to go”.

US secretary of state Anthony Blinken was back in Israel on Friday for more talks, after a visit to Cairo yesterday, where he said that gaps between the parties were narrowing.

Meanwhile, a draft resolution for a ceasefire is to be put to the UN Security Council by US diplomats.

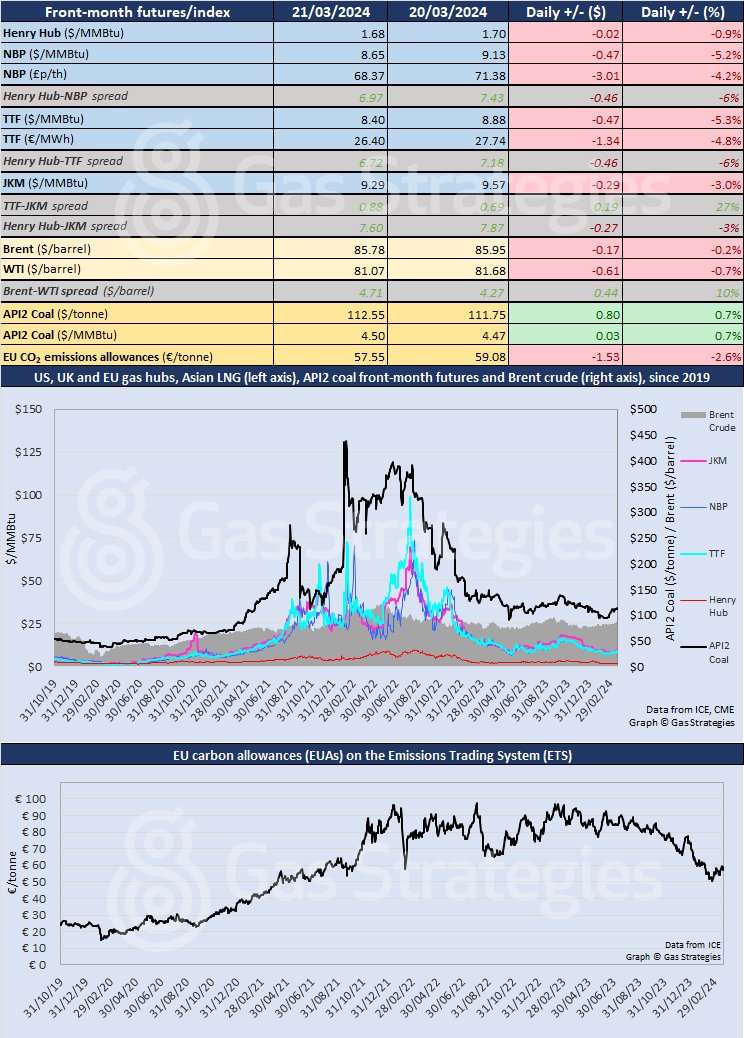

Front-month futures and indexes at last close with day-on-day changes:

Time references based on London GMT. Brent, WTI, NBP, TTF and EU CO2 data from ICE. Henry Hub, JKM and API2 data from CME. Prices in USD/MMBtu based on exchange rates at last market close. All monetary values rounded to nearest whole cent/penny. Text and graphic copyright © Gas Strategies, all rights.

Subscription Benefits

Our three titles – LNG Business Review, Gas Matters and Gas Matters Today – tackle the biggest questions on global developments and major industry trends through a mixture of news, profiles and analysis.

LNG Business Review

LNG Business Review seeks to discover new truths about today’s LNG industry. It strives to widen market players’ scope of reference by actively engaging with events, offering new perspectives while challenging existing ones, and never shying away from being a platform for debate.

Gas Matters

Gas Matters digs deep into the stories of today, keeping the challenges of tomorrow in its sights. Weekly features and interviews, informed by unrivalled in-house expertise, offer a fresh perspective on events as well as thoughtful, intelligent analysis that dares to challenge the status quo.

Gas Matters Today

Gas Matters Today cuts through the bluster of online news and views to offer trustworthy, informed perspectives on major events shaping the gas and LNG industries. This daily news service provides unparalleled insight by drawing on the collective knowledge of in-house reporters, specialist contributors and extensive archive to go beyond the headlines, making it essential reading for gas industry professionals.