The front-month Brent crude oil contract closed above USD 90/barrel on Thursday for the first time in nearly six months, with most price drivers exerting upwards pressure that continued into Friday morning.

Expectations of growing demand combined with this week’s decision by OPEC+ to maintain output curbs and to persuade members who have exceeded quotas to submit plans to compensate. These factors are overlaid by the geopolitical complexities in the Middle East and drone attacks by Ukraine on Russian oil facilities.

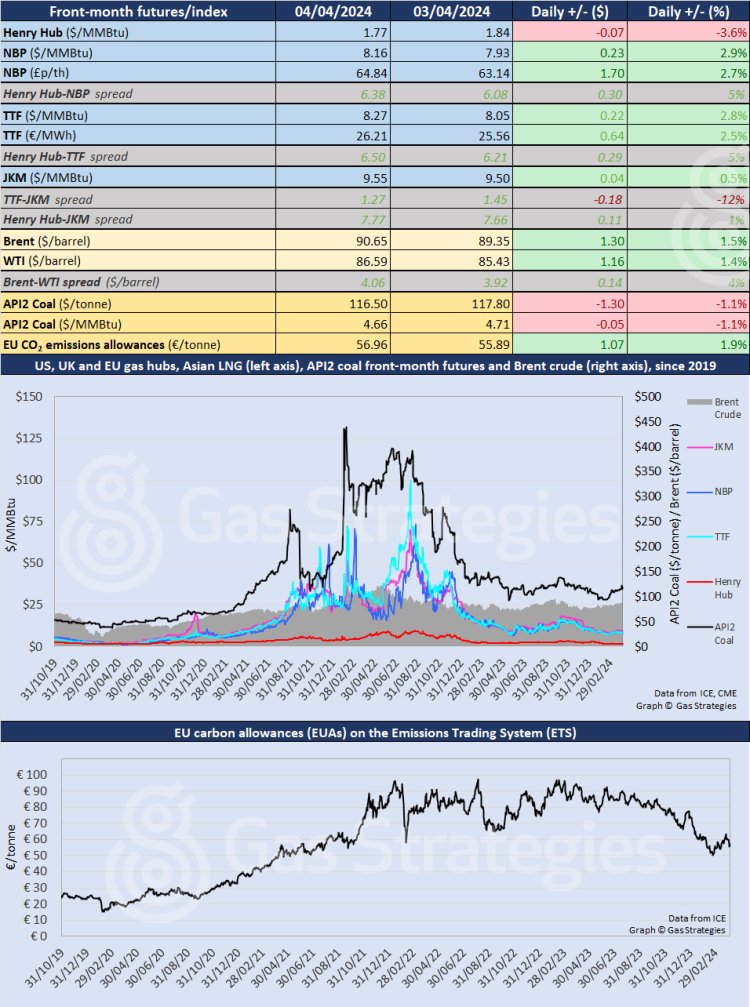

Brent crude climbed 1.5%, from USD 89.35/barrel on Wednesday to close at USD 90.65/barrel on Thursday, while WTI was up 1.4%, from USD 85.43/barrel to USD 86.59/barrel. Both prices were up again on Friday by lunchtime in London.

Questions over what will happen to desperately needed aid efforts in Gaza – following Monday’s attack on aid workers – were partially answered by a telephone meeting between the US president, Joe Biden, and the Israeli prime minister, Benjamin Netanyahu. Israel has agreed to allow more humanitarian aid into Gaza, where the UN has been warning of imminent famine.

In the US, natural gas prices fell for the second consecutive session on forecasts of warming weather and data showing high storage levels.

In yesterday’s weekly storage report, the US Energy Information Administration estimated working gas in storage at 2,259 Bcf as of 29 March, down 37 Bcf from the previous week and way above the five-year historical range. Stocks were 422 Bcf higher year-on-year and 633 Bcf – or 39% – above the five-year average of 1,626 Bcf for this time of year.

Unusually, the level of storage in the Lower 48 states remains well outside the five-year maximum-minimum range, though the gap has been closing in recent weeks.

The front-month Henry Hub contract was down 3.6%, from USD 1.84/MMBtu on Wednesday to close at USD 1.77/MMBtu on Thursday.

European natural gas futures continued their sawtooth pattern of recent weeks and, while individual swings can be dramatic, the underlying trend is flat.

In continental Europe, a 2.8% rise in the May TTF contract took the price to USD 8.27/MMBtu, very close to where it was on Tuesday. Similarly, NBP was up 2.9% to USD 8.16/MMBtu.

With spring now well into its stride, data from Gas Infrastructure Europe shows EU storage facilities to be 59% full. This compares with 56% a year ago and just 26% two years ago.

The trend is currently flat, with small withdrawals and injections, suggesting that levels are likely to start to rise in coming weeks. UK storage, now 40% full, has been drifting gently upwards for several weeks.

In Asia, the JKM LNG price continues to trade in a narrow range, up 0.5%, from USD 9.50/MMBtu on Wednesday to USD 9.55/MMBtu on Thursday. The TTF-JKM spread has narrowed to USD 1.27/MMBtu.

European coal prices fell for a second consecutive session, with API2 down 1.1% to USD 4.66/MMBtu.

Front-month futures and indexes at last close with day-on-day changes (click to enlarge):

Time references based on London GMT. Brent, WTI, NBP, TTF and EU CO2 data from ICE. Henry Hub, JKM and API2 data from CME. Prices in USD/MMBtu based on exchange rates at last market close. All monetary values rounded to nearest whole cent/penny. Text and graphic copyright © Gas Strategies, all rights.

Subscription Benefits

Our three titles – LNG Business Review, Gas Matters and Gas Matters Today – tackle the biggest questions on global developments and major industry trends through a mixture of news, profiles and analysis.

LNG Business Review

LNG Business Review seeks to discover new truths about today’s LNG industry. It strives to widen market players’ scope of reference by actively engaging with events, offering new perspectives while challenging existing ones, and never shying away from being a platform for debate.

Gas Matters

Gas Matters digs deep into the stories of today, keeping the challenges of tomorrow in its sights. Weekly features and interviews, informed by unrivalled in-house expertise, offer a fresh perspective on events as well as thoughtful, intelligent analysis that dares to challenge the status quo.

Gas Matters Today

Gas Matters Today cuts through the bluster of online news and views to offer trustworthy, informed perspectives on major events shaping the gas and LNG industries. This daily news service provides unparalleled insight by drawing on the collective knowledge of in-house reporters, specialist contributors and extensive archive to go beyond the headlines, making it essential reading for gas industry professionals.