- Summer slowdown in Chinese gas demand in sight as economy struggles for traction after lockdown slump

- Economic uncertainties to weigh on gas consumption, but growth in transport and power sectors a bright spot

- Housing market doldrums to curb industrial gas demand potential, but lower gas costs may provide upside

- Contracted term LNG to grow faster than demand, limiting spot appetite, while piped gas supply also grows

China’s natural gas demand growth looks on course to slow this summer due to a weak economic outlook, and although Beijing is targeting ~5% GDP growth again for 2024, this may be challenging to meet. LNG imports will grow slower than pipeline volumes amid sluggish demand and competition from cheaper gas sources, but there could be upside potential in the case of continued declines in Asian spot prices and a hotter-than-normal summer.

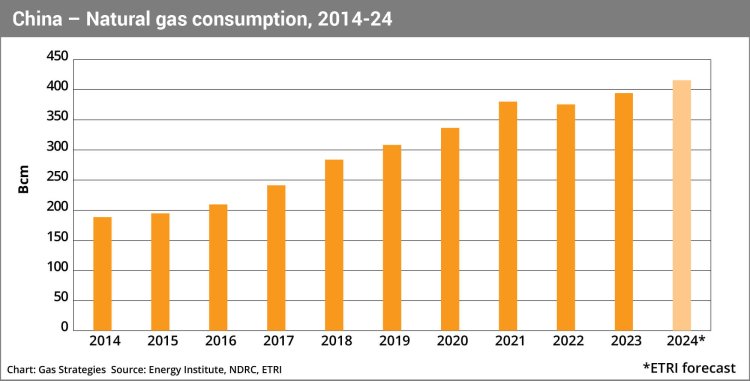

China’s gas consumption in 2024 is forecast to rise 6.1% year on year to 415.7 Bcm in 2024, CNPC’s Economies and Technology Research Institute (ETRI) said in a recent briefing attended by Gas Matters. This prediction would represent a deceleration from last increase’s of 6.6%, which outpaced 2023 GDP growth of 5.2%.

The outlook is for gas demand to once again outpace middling economic growth this year. While Beijing achieved its headline financial objectives in 2023, economic momentum at the end of last year was less strong than the headline numbers suggest. China set an annual growth target of around 5% this month – a goal that may add pressure on top leaders to unleash more stimulus as the government tries to boost confidence in an economy that has been hampered by a prolonged property slump and entrenched deflation.

The base-case situation is for Chinese gas demand during the coming summer – from April to September – to reach 194.9 Bcm. This is 6.7% more than last summer thanks to anticipated lower gas costs against the backdrop of declining spot LNG prices. But downside potential to gas demand persists as China’s economic growth forecasts are trending low in 2024 at around 4.5%, despite Beijing’s official target of 5%.

Though the country is struggling to shake off economic problems weighing on demand, such as deflation and the property crisis, the government has refused to resort to a massive stimulus. The slumping housing sector – which accounts for one-fifth of GDP – is expected to last until 2025 and is dragging on the world’s second-biggest economy.

Transport drive

Transport sector gas consumption is projected to see the fastest growth among all sectors due to record high sales of gas-fuelled heavy-duty commercial vehicles. Thanks to lower gas prices compared with diesel in 2023, the share of natural gas vehicles in total heavy-duty commercial vehicle sales reached 16% last year, up from just 4% in 2022.

The trend is likely to continue in 2024 based on the current futures curve. Gas consumption by vehicles may surge by 17.6% to 24 Bcm this summer compared to the same period last year as low LNG prices incentivise more uptake of the fuel, according to CNPC ETRI president Lu Ruquan.

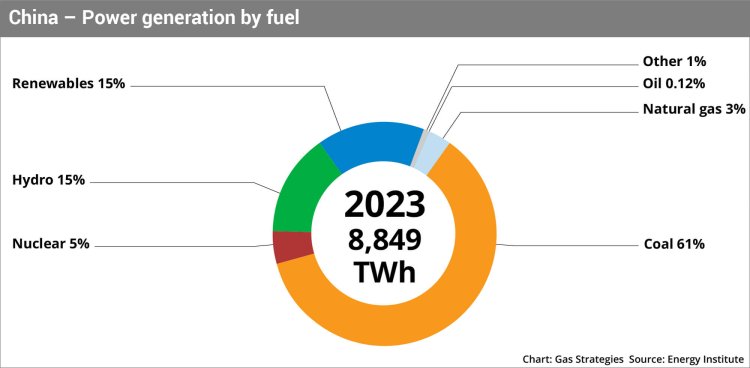

CNPC expects gas demand from power generation to expand the most this year, increasing by 7.5% year on year compared with 6.8% for industry, 6.1% for city gas and just 1% for chemicals, predicted Duan Zhaofang, director of the Gas Market Research Institute under the ETRI, at the briefing.

This would mark an easing from last year, when power generation gas demand climbed by 9.6%. Gas-fired power generation is set to increase on the back of overall electricity demand growth – which clocked a 11% jump in January-February – and a persistent gap in peak shaving power capacity.

Power sector consumption may grow by 7.1% this summer compared with last year, reaching 35.4 Bcm. Although the share of gas in power stood at just 3% in 2023, China has accelerated a gas-to-power capacity expansion in recent years and 2024 could see record capacity additions of more than 25 GW. Most new capacity will come online in the southern province of Guangdong and Sichuan province in south-west China. Lower gas prices, which represent around 80% of variable costs, are estimated to boost gas burn in power plants.

Guangdong has the largest concentration of installed gas-fired power capacity in China, standing at 34.23 GW at the end of 2022 that represented 30% of the national total. Gas-fired power plants make most revenues in deregulated markets, followed by spot and regulated markets, Tang Xin, an industry analyst at SCI International, tells Gas Matters. For a typical combined-cycle gas power plant to remain profitable in 2023, the maximum gas costs ranged largely between USD 11/MMBtu and USD 15/MMBtu, depending on revenue source.

For most of last summer and late December 2023, imported spot LNG costs fell below the higher end of the maximum gas costs range. The annual power contract price in Guangdong for this year will enable profits if gas costs are less than USD 12/MMBtu. The JKM LNG price plus regasification and transmission costs are forecast to remain below this threshold until November, which will support gas demand in power generation.

Gas burn in the power sector still depends on the availability and economics of other electricity sources, such as hydro. Uncertainties loom as weather extremes may derail gas power demand growth. China is more likely to see floods along and to the south of the Yangtze River this summer following the El Niño weather pattern last year, according to the National Climate Center. Greater hydropower generation will lower the need for gas-fired power burn.

Property market drags

Industry sector gas demand may see limited growth at 5.6% year on year this summer. China’s housing sector slump is likely to persist – worsening severe spillover effects on industrial gas demand, which expanded by 6.1% last year. Major gas consumption sectors that account for 42% of total industrial gas burn – including the manufacture of non-metallic mineral products such as ceramics and glass, and smelting and pressing of ferrous metals like steel – are closely associated with the property market.

China is constructing fewer buildings than before, as indicated by a 7.2% contraction in the floor space of buildings under construction last year. Reduced demand from the property sector has crimped output in related industry sectors. For instance the output of ceramics in H1 ‘23 declined by 15.1% from the same period in 2022, with less than 60% of production lines operational, according to data from local industry consultancy Ceramics Information Net.

Property investment eased by 9% in the first two months of 2024 from a year earlier, according to figures released on 18 March by the National Bureau of Statistics (NBS). The housing market is “still in a state of adjustment and transition,” but policies outlined at China’s annual legislative session earlier this month will promote “stable and healthy development,” said NBS spokesperson Liu Aihua.

But declining gas costs may provide upside to industrial gas consumption. Ceramics plants started to burn gas when the fuel price fell below USD 13/MMBtu and stopped operating when gas prices exceeded USD 18/MMBtu, based on observations last year. With lower spot LNG prices expected in 2024, China’s industrial users are likely to consume more gas.

Restrained spot demand

China’s total gas supply for this year, excluding storage withdrawals, is anticipated to stand at 427.6 Bcm, comprising 248.5 Bcm of domestic output and 179.1 Bcm of imports, according to Duan. Supply for the coming summer is expected to be 6% higher year on year, reaching 206.5 Bcm. Domestic production will maintain steady year-on-year growth at 5% to reach 116 Bcm this summer as China’s relentless push for energy supply security will continue to drive robust growth of local gas output.

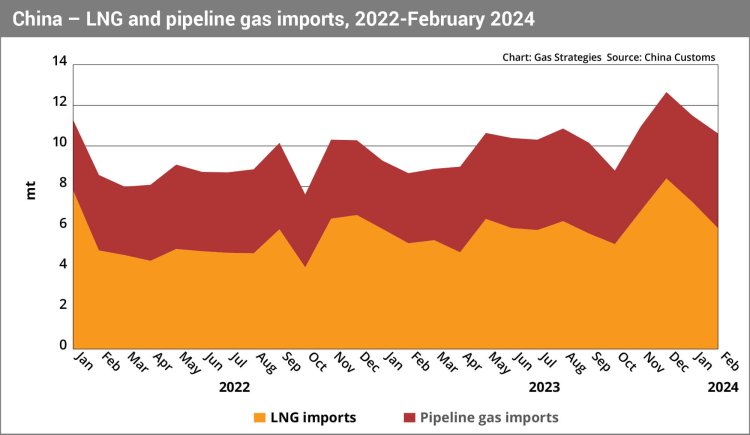

LNG imports are tipped to grow by 8.1% from 2023 to 77.11 mt this year, equivalent to 106.4 Bcm and slightly trailing an 8.2% increase in pipeline flows to 72.6 Bcm. Contracted supply to China is set to outpace demand given Chinese companies have struck numerous long-term LNG deals in recent years.

Two sale and purchase agreements (SPAs) for China commenced in January, namely Guangdong Energy Group’s decade-long 1 mtpa deal with QatarEnergy signed in December 2021 and a 15-year agreement between UK utility Centrica and Shenergy Group for 0.5 mtpa struck in September 2020. The new contracts will increase term LNG supplies to China to 66.9 mtpa, about one-third of which are destination-free cargoes. This excludes long-term sales linked to Novatek’s Arctic LNG 2 project in Russia and Venture Global’s Calcasieu Pass facility on the US Gulf coast.

Gazprom is contracted to deliver 30 Bcm of gas to CNPC this year through the Power of Siberia pipeline, equivalent to nearly 80% of the project’s 38 Bcm/year capacity and up by nearly one-third from 22.7 Bcm in 2023. The jump in term volumes and Russian piped volumes should restrain Chinese demand for spot cargoes, which has collapsed since 2021.

Weak spot prices for this time of the year in the Asian market has spurred opportunistic buying by second-tier Chinese importers, which have purchased more than 40 spot cargoes since January. The procurement activity may ease going forward due to rising temperatures from spring weather.

LNG upside potential

LNG imports this summer are expected to expand by 6.1% year on year to 36.4 mt, the equivalent of 50.2 Bcm, and up from 34.3 mt last summer. Nonetheless LNG intake is projected to be lower than 2021 peak levels as a result of the weak economic outlook, robust domestic output and surging Russian gas deliveries.

The growth is also set to be lower than the 21.2% spike seen last summer. But there is still upside potential in the case of faster-than-expected economic growth or hotter-than-normal weather. Chinese LNG players are likely to continue reselling cargoes to other markets with lower LNG demand growth at home and new contract supply coming.

Pipeline imports are estimated to increase by 10.5% to 40.1 Bcm during the coming summer, mostly driven by the surge in Russian gas deliveries. But a potential downside risk is a drop in exports from Uzbekistan due to falling domestic production and growing domestic demand.

China’s LNG importers have so far shown little interest in third-party access slots at domestic import terminals operated by PipeChina, the national midstream infrastructure operator. Available regasification capacity at PipeChina’s seven terminals is on course to hit 30.9 mtpa this year – a jump of 10.4 mt over that may be potentially down to slower LNG demand growth and the expected commissioning of new import capacity.

China is tipped to add 60 mtpa of new regasification capacity this year, bringing the total up by 52% to 176 mtpa, according to CNPC ETRI. However, upside to Chinese spot LNG demand may come if prices fall more from current levels. Spot LNG futures in late March for summer 2024 delivery are trading below estimated average contracted LNG prices in 2024, based on China customs data.

The appetite of Chinese LNG buyers for spot LNG may persist if already-low prices continue to drop, but domestic gas and pipeline imports from Russia and Central Asia should remain cheaper than spot LNG and limit the upside potential for spot volumes. - JX

Subscription Benefits

Our three titles – LNG Business Review, Gas Matters and Gas Matters Today – tackle the biggest questions on global developments and major industry trends through a mixture of news, profiles and analysis.

LNG Business Review

LNG Business Review seeks to discover new truths about today’s LNG industry. It strives to widen market players’ scope of reference by actively engaging with events, offering new perspectives while challenging existing ones, and never shying away from being a platform for debate.

Gas Matters

Gas Matters digs deep into the stories of today, keeping the challenges of tomorrow in its sights. Weekly features and interviews, informed by unrivalled in-house expertise, offer a fresh perspective on events as well as thoughtful, intelligent analysis that dares to challenge the status quo.

Gas Matters Today

Gas Matters Today cuts through the bluster of online news and views to offer trustworthy, informed perspectives on major events shaping the gas and LNG industries. This daily news service provides unparalleled insight by drawing on the collective knowledge of in-house reporters, specialist contributors and extensive archive to go beyond the headlines, making it essential reading for gas industry professionals.