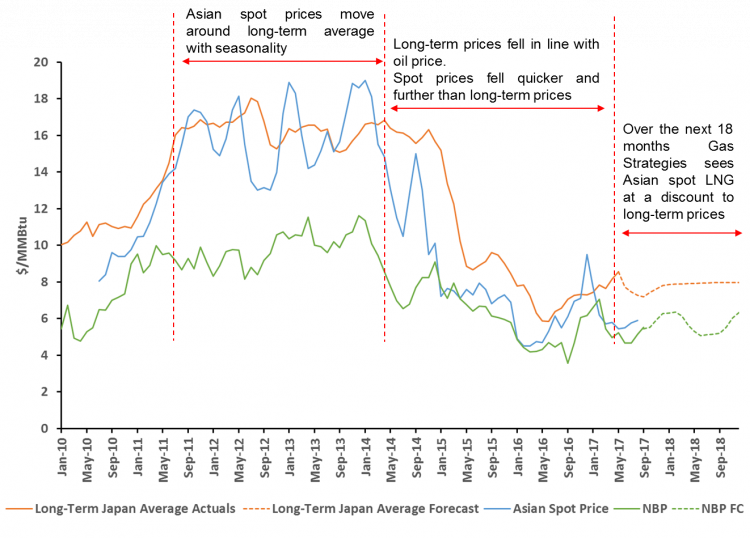

With the exception of a brief 2 month period in Winter 2016/17, Asian spot LNG prices have been below average long-term Japanese LNG contract prices for a period of three and a half years. This is quite a significant statistic. There is the brief disclaimer that throughout this blog average long-term Japanese LNG contracts have been used as a benchmark for Asian long-term contracts and Reuters Eikon Asian spot price for spot prices. There are of course other benchmarks that can be used.

What was also surprising is that Asian spot prices being below average long-term contract prices is not a new phenomenon. The difference has just become more stark. In the period 2011 – 2013, in a tight LNG market, Asian spot prices tended to vary seasonally around long-term LNG prices, exhibiting a seasonal premium in the winter and summer due to increased demand for heating and cooling, and a discount in the off-peak demand months of Spring and Autumn. In those off-peak periods Asian spot prices were on average $0.52/MMBtu (or 3%) below average long-term LNG prices.

Whilst long-term contract prices in Asia, which remain predominantly linked to oil prices, have fallen sharply in the last three years, spot prices have fallen faster and further (see chart below). Since the start of 2015 Asian spot LNG prices have been much closer to European LNG prices and on average $1.95/MMBtu or 21% below average long-term Asian LNG contract prices.

Source: Gas Strategies, Reuters Eikon, ICE

This raises the question of how long the difference between spot prices and long-term contract prices might continue and for how long is it sustainable?

On the first question, Gas Strategies view is that Asian spot LNG prices will remain low for at least the next three years. Asian spot LNG prices have been around $0.50/MMBtu to $1/MMbtu above the UK NBP price on average for the last two years. Taking the forward NBP forward curve and adding $0.75/MMBtu provides a high level price projection of $6.48/MMBtu. This compares to an expectation of average long-term contract prices being around $7.85/MMBtu (based on the Brent forward curve). There is also the potential for further downward pressure on spot LNG prices as new liquefaction capacity (which is already under construction) continues to ramp up in Australia, the US and Russia over the next three to four years.

Looking further forward to (say) 2025, there is likely to be strong competition from new LNG supply projects, notably from Qatar and the US. This could mean that the market continues to be well supplied at relatively low prices.

In theory, this provides an economic incentive for buyers to turn down long-term oil indexed contractual volumes towards take-or-pay levels and instead purchase spot LNG cargoes.

We’ve seen a similar type of situation before in Europe - The current decoupling between spot and long-term contract prices being observed in Asia occurred in Northwest Europe in the period 2009 to 2012. Long-term contract prices were in the region of 11% of the Brent price and NW European spot gas prices were around 25% lower. This triggered two things: a big wave of price renegotiations between buyers and sellers of long-term oil-indexed gas contracts; and a fairly rapid development of liquid traded gas hubs based on strong gas-on-gas competition.

Asia is by no means Europe but continued low LNG spot prices could trigger further LNG market evolution – The big difference between Asia and Europe is the lack of liberalised and interconnected gas markets which could stimulate gas-on-gas competition and traded gas/LNG hub development. The continued differential between long-term contract prices and spot LNG prices is therefore not, on its own, expected to be enough to a move long-term contracts away from oil-indexation towards hub or spot price indexation.

We have however already seen, and are likely to continue to see, a resistance from many Asian buyers to sign new long-term contracts when spot prices remain so low. The slopes in Asian LNG contracts also look like they are coming down from recent levels of circa 14.5%[1] of the JCC price to perhaps as low as 12 – 13% of JCC.

The big question is whether Asian buyers will seek to renegotiate LNG prices in long-term contracts with higher slopes? The large number of long-term contracts signed in the period 2011 – 2014, particularly with Australian projects, could come under severe pressure. Many of these contracts will include price review provisions, though buyers are likely to have to wait for at least five years after LNG supply commences to trigger price negotiations under the terms of the contract. If this is the case then there could be a wave of price renegotiations in the early 2020’s if spot prices remain low and there is continued downwards pressure on the level of oil indexation in new long-term contracts.

If you would like more information about how Gas Strategies can help your business with Consulting services across the value chain or provide industry insight with regular news, features and analysis through Information Services or help with people development through Training services, please contact us directly.