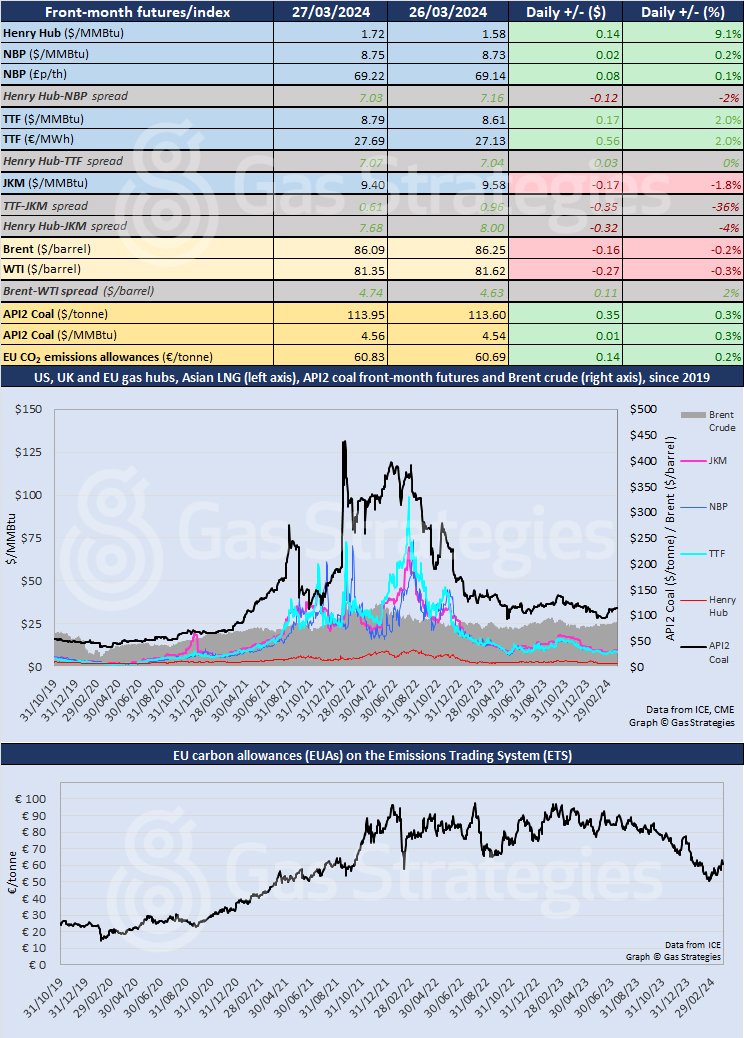

Global energy markets had a respite from recent volatility on Wednesday, except in the US where month-ahead gas was up more than 9% as the May futures contract became the front month.

The April Henry Hub contract expired on Tuesday at USD 1.58/MMBtu after significant intra-day volatility. On Wednesday, the May contract closed 9.1% up on that, at USD 1.72/MMBtu, but down from its Tuesday close of USD 1.79/MMBtu.

That fall of 7 cents, or around 4%, was not too much of a surprise given the bearish fundamentals of the US market – at least in the short term – with demand tepid, supply strong and storage way above seasonal norms.

Also not surprising is that the May price continued to fall into Thursday morning, down by more than 1% in early trading. Traders now await the usual weekly gas storage figures, due out later today.

In Europe, TTF and NBP natural gas futures converged, with TTF up 2.0%, from USD 8.61/MMBtu on Tuesday to USD 8.79% on Wednesday, and NBP edging up just 0.2%, from USD 8.73/MMBtu to USD 8.75/MMBtu. On Tuesday, EU storage witnessed another withdrawal while the UK experienced an injection of gas.

Both prices were moving downwards on Thursday morning.

In Asia, the JKM LNG price moved downwards amid news that Tokyo Electric had applied for regulatory approval to load fuel into one of the reactors at the world’s largest nuclear power plant, Kashiwazaki-Kariwa.

The Kashiwazaki-Kariwa plant shut down in 2012 following the 2011 Fukushima accident that led eventually to a complete shut-down of commercial nuclear power in Japan, but had already had a troubled history. That said, nuclear restarts have been having a dampening effect on LNG demand in Japan, which remains the world’s second-largest market after China.

With TTF up and JKM down, the spread narrowed from almost a dollar to USD 0.61/MMBtu.

Crude oil prices remained elevated, Brent edging down by 0.2%, from USD 86.25/barrel to USD 86.09/barrel, and WTI down 0.3%, from USD 81.62/barrel to USD 81.35/barrel.

Baltimore bridge collapse

The startling collision of a container ship with a bridge in the city of Baltimore in the US state of Maryland on Tuesday has led to a sharp rise in the price of US coal after suppliers and traders scrambled to adjust to the impacts of a near-total destruction of a key component of infrastructure. The collapse of the Francis Scott Key Bridge is preventing exports from coal terminals in Baltimore.

That said, the impact on Europe coal was muted, with API2 up just 0.3%, from USD 4.54/MMBtu on Tuesday to close at USD 4.56/MMBtu on Wednesday.

According to a report from DBX Commodities, “much of the coal exported from the port has high sulphur content, which is not suitable for European power stations and not relevant for the API2 prices”. The impact will be felt more in Asian markets, adds DBX.

Front-month futures and indexes at last close with day-on-day changes:

Time references based on London GMT. Brent, WTI, NBP, TTF and EU CO2 data from ICE. Henry Hub, JKM and API2 data from CME. Prices in USD/MMBtu based on exchange rates at last market close. All monetary values rounded to nearest whole cent/penny. Text and graphic copyright © Gas Strategies, all rights.

Subscription Benefits

Our three titles – LNG Business Review, Gas Matters and Gas Matters Today – tackle the biggest questions on global developments and major industry trends through a mixture of news, profiles and analysis.

LNG Business Review

LNG Business Review seeks to discover new truths about today’s LNG industry. It strives to widen market players’ scope of reference by actively engaging with events, offering new perspectives while challenging existing ones, and never shying away from being a platform for debate.

Gas Matters

Gas Matters digs deep into the stories of today, keeping the challenges of tomorrow in its sights. Weekly features and interviews, informed by unrivalled in-house expertise, offer a fresh perspective on events as well as thoughtful, intelligent analysis that dares to challenge the status quo.

Gas Matters Today

Gas Matters Today cuts through the bluster of online news and views to offer trustworthy, informed perspectives on major events shaping the gas and LNG industries. This daily news service provides unparalleled insight by drawing on the collective knowledge of in-house reporters, specialist contributors and extensive archive to go beyond the headlines, making it essential reading for gas industry professionals.