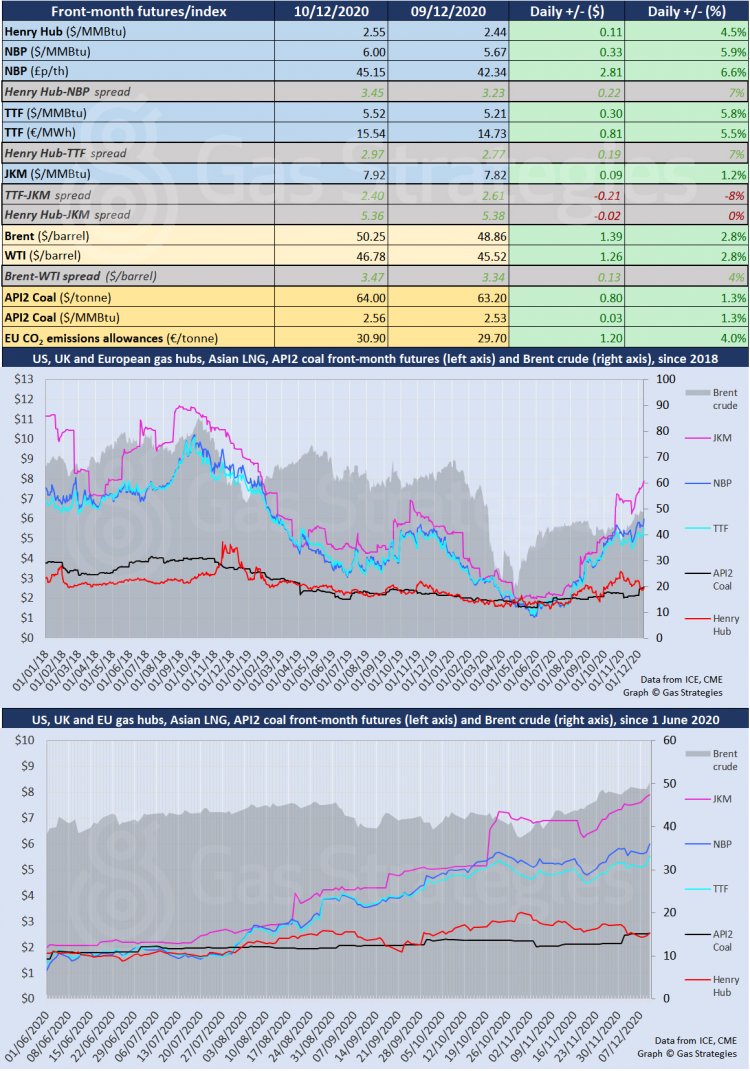

Brent crude leapt back into life yesterday to break through the psychologically significant threshold of USD 50/barrel, shaking off near-term concerns that depressed upward momentum in the previous two sluggish trading sessions. ICE Brent and WTI futures both rose 2.8% to close the session at USD 50.25/barrel and USD 46.78/barrel, respectively, representing highs not seen since the oil crash in early March. The gains were underpinned by sustained optimism over the global rollout of Sars-Cov-2 vaccines, even though widespread distribution is still many months away and the market is expected to remain oversupplied throughout the first three months of 2021 and potentially beyond.

The European carbon price notched up strong gains yesterday as EU leaders met to agree a more stringent bloc-wide 2030 carbon reduction target of 55%, compared to 40% previously. The front-month EUA futures contract rose 4% to EUR 30.90/tonne, setting a new 13-year high that is within touching distance of the all-time high of EUR 31/tonne. This price is expected to be surpassed before long as the EU Commission enacts policies to achieve the 2030 CO2 target, with some analysts forecasting a price of EUR 90/tonne by the end of the decade.

Natural gas prices also made strong gains yesterday as northern hemisphere economies brace for a cold winter. European gas hubs NBP and TTF rose 6.6% and 5.5%, respectively, to close at the equivalent of USD 6/MMBtu and USD 5.52/MMBtu – prices not seen since early 2019. The gains were supported by a 4.5% uptick in Henry Hub to USD 2.55/MMBtu, which increasingly drives global gas prices amid record output from US LNG export facilities.

Meanwhile, the Asian spot LNG bull run shows no signs of abating, with the JKM price this week breaching USD 10/MMBtu for February-dated cargoes. CME’s JKM futures contract, a financial instrument used to bet on the future JKM price, yesterday gained 1.2% to close at USD 7.92/MMBtu for January delivery, while the February contract soared by 7% to close at USD 9.20/MMBtu.

Front-month futures and indexes at last close with day-on-day changes (click to enlarge):

Time references based on London GMT. Brent, WTI, NBP, TTF and EU CO2 data from ICE. Henry Hub, JKM and API2 data from CME. Prices in USD/MMBtu based on exchange rates at last market close. All monetary values rounded to nearest whole cent/penny. Text and graphic copyright © Gas Strategies, all rights reserved.

Subscription Benefits

Our three titles – LNG Business Review, Gas Matters and Gas Matters Today – tackle the biggest questions on global developments and major industry trends through a mixture of news, profiles and analysis.

LNG Business Review

LNG Business Review seeks to discover new truths about today’s LNG industry. It strives to widen market players’ scope of reference by actively engaging with events, offering new perspectives while challenging existing ones, and never shying away from being a platform for debate.

Gas Matters

Gas Matters digs deep into the stories of today, keeping the challenges of tomorrow in its sights. Weekly features and interviews, informed by unrivalled in-house expertise, offer a fresh perspective on events as well as thoughtful, intelligent analysis that dares to challenge the status quo.

Gas Matters Today

Gas Matters Today cuts through the bluster of online news and views to offer trustworthy, informed perspectives on major events shaping the gas and LNG industries. This daily news service provides unparalleled insight by drawing on the collective knowledge of in-house reporters, specialist contributors and extensive archive to go beyond the headlines, making it essential reading for gas industry professionals.