European gas prices surged to fresh record highs on Monday, lifted by Gazprom opting to book only a small portion of the capacity offered via Mallnow for October and none of the capacity offered via Ukraine for next month.

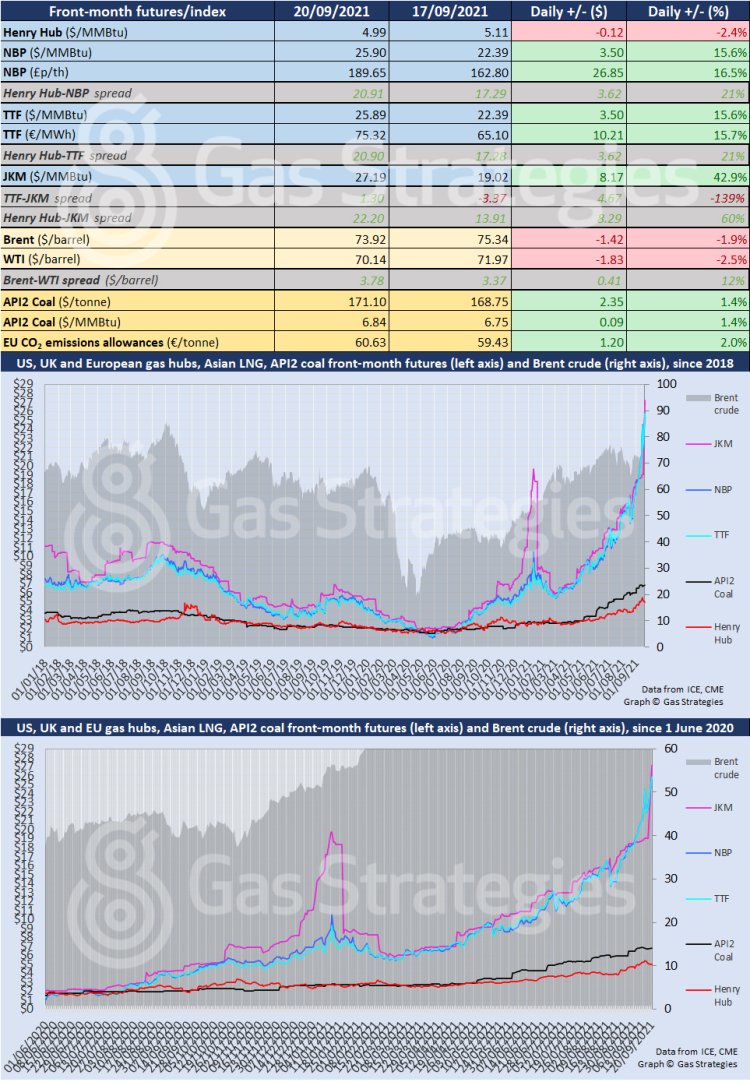

The front-month TTF and NBP contracts soared by 15.6% on Monday, to close at the equivalent of ~25.9/MMBtu.

Prices jumped following the results of capacity auctions on Monday. Gazprom opted to book only 28 MMcm/d of the 85 MMcm/d of capacity offered into Mallnow in Germany. The Russian firm once again opted not to book any capacity offered via Ukraine.

The result adds to ongoing supply concerns ahead of winter, with Europe’s gas storage levels ~72% full ahead of the storage withdrawal season, starting next month. However, Gazprom may opt to book additional capacity via daily auctions.

The rally was mirrored by Asian LNG marker JKM, which jumped by ~43% as the October contracted rolled over to November. The November-dated JKM contract settled at USD 27.17/MMBtu, highlighting the difficulty that European buyers may face in drawing LNG volumes away from the premium priced Asian market. The November-dated NBP contract settled at the equivalent of ~USD 26.6/MMBtu on Monday, with the November-dated TTF contract closing at USD 25.9/MMBtu.

The strengthening gas price helped lift the European carbon price, which settled 2% higher at EUR 60.63/tonne.

In the US, Henry Hub continued to slide amid forecasts for mild weather and softening demand from the LNG sector as the Cove Point LNG plant is down for scheduled maintenance. The front-month contract closed below USD 5/MMBtu for the first time since 13 September.

As for oil, prices fell further amid a strengthening US dollar, with recovering production across the US Gulf of Mexico also weighing on prices.

On Monday, the US Bureau of Safety and Environmental Enforcement (BSEE) reported that ~18% of US Gulf of Mexico oil production remained shut-in following Hurricane Ida which made landfall in Louisiana on 29 August. As for gas, ~26% of production remained offline. On Friday, 23% of GoM oil production was offline and 34% of gas production was shut-in, according to the BSEE.

Brent closed 1.9% lower at USD 73.92/barrel, with WTI down 2.5% to close at USD 70.14/barrel.

Front-month futures and indexes at last close with day-on-day changes (click to enlarge):

Time references based on London GMT. Brent, WTI, NBP, TTF and EU CO2 data from ICE. Henry Hub, JKM and API2 data from CME. Prices in USD/MMBtu based on exchange rates at last market close. All monetary values rounded to nearest whole cent/penny. Text and graphic copyright © Gas Strategies, all rights.

Subscription Benefits

Our three titles – LNG Business Review, Gas Matters and Gas Matters Today – tackle the biggest questions on global developments and major industry trends through a mixture of news, profiles and analysis.

LNG Business Review

LNG Business Review seeks to discover new truths about today’s LNG industry. It strives to widen market players’ scope of reference by actively engaging with events, offering new perspectives while challenging existing ones, and never shying away from being a platform for debate.

Gas Matters

Gas Matters digs deep into the stories of today, keeping the challenges of tomorrow in its sights. Weekly features and interviews, informed by unrivalled in-house expertise, offer a fresh perspective on events as well as thoughtful, intelligent analysis that dares to challenge the status quo.

Gas Matters Today

Gas Matters Today cuts through the bluster of online news and views to offer trustworthy, informed perspectives on major events shaping the gas and LNG industries. This daily news service provides unparalleled insight by drawing on the collective knowledge of in-house reporters, specialist contributors and extensive archive to go beyond the headlines, making it essential reading for gas industry professionals.