European gas prices bounced back on Wednesday, with TTF settling at its highest level since March and UK marker NBP closing at a two-month high.

The front-month NBP and TTF contracts rolled over to August on Wednesday, with TTF closing 7.9% higher compared to the closing price of the July contract on Tuesday. NBP was up over 46% compared to the close of the July contract on Tuesday, with the UK marker settling at the equivalent of USD 29.74/MMBtu – its highest close since 8 April.

The Dutch marker closed at USD 43.03/MMBtu, its highest close since 9 March.

The rally was pinned on ongoing supply concerns, with Gazprom set to carry out annual maintenance on the Nord Stream 1 pipeline from 11-21 July. The Russian firm has capped NS1’s capacity by 60% in recent weeks, citing the need for kit Siemens sent to Canada for maintenance.

Gazprom has said sanctions have prevented the return of the equipment needed for the turbines at gas compressor stations, with reports suggesting Russia, Germany and Canada have not resolved the issue.

Some market observers suggest Gazprom will halt NS1 flows completely, citing technical reasons.

Competition between European and Asian LNG buyers is also expected to pick up amid heatwaves in Japan and China, with supply tightening as Freeport LNG remains offline and exports from Shell’s Prelude FLNG facility off the coast of Western Australia are expected to grind to halt on Friday due to workers striking. Shipments from Prelude are not expected to resume until 15 July at the earliest.

Japanese firms are offtakers from both plants, with JERA and Osaka Gas having announced earlier this month that they will need to procure alternative LNG supplies due to the Freeport outage. Japan's storage levels are likely to have dropped following record heat in the country this week, which led to the government issuing a blackout warning amid high demand and tight power supply.

US gas benchmark Henry Hub fell back into the red, closing 0.8% lower at USD 6.5/MMBtu.

As for oil, prices dipped amid ongoing recession fears. An increase in US gasoline and distillate inventory levels also weighing on prices.

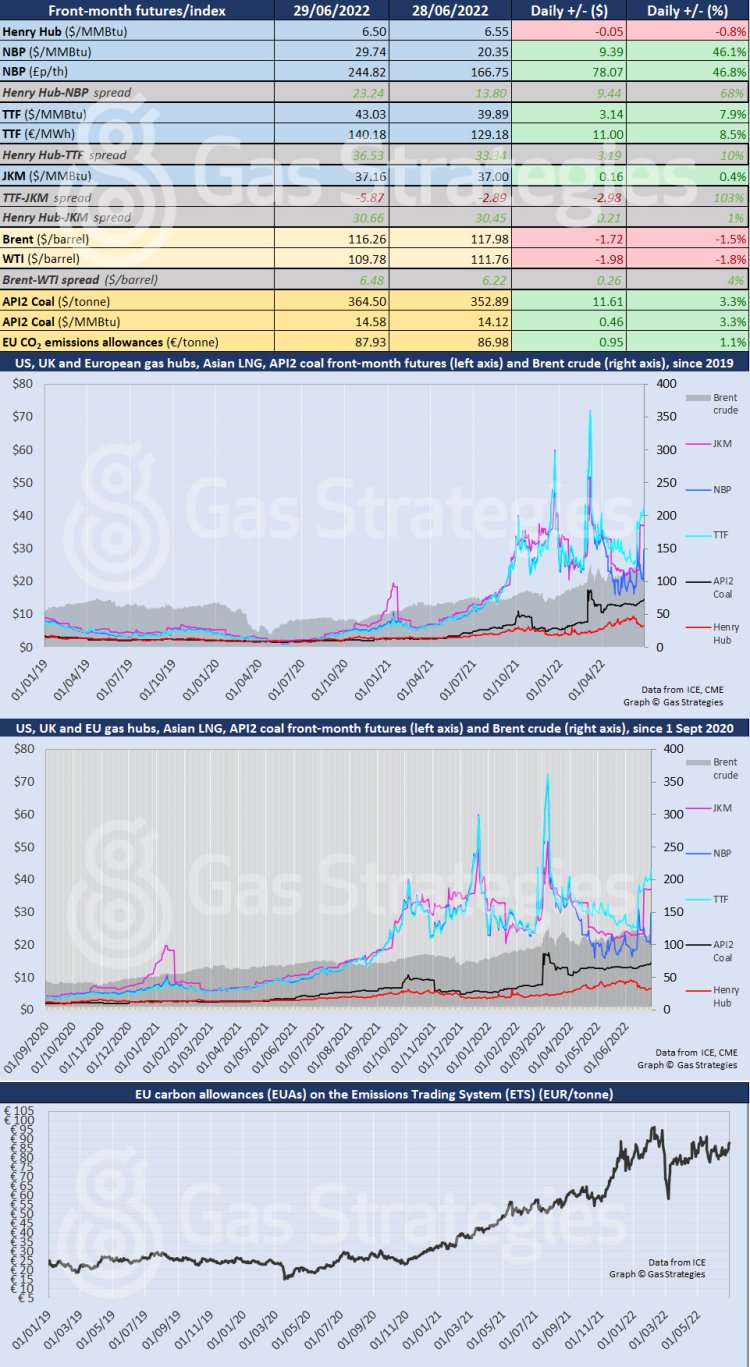

Front-month futures and indexes at last close with day-on-day changes (click to enlarge):

Time references based on London GMT. Brent, WTI, NBP, TTF and EU CO2 data from ICE. Henry Hub, JKM and API2 data from CME. Prices in USD/MMBtu based on exchange rates at last market close. All monetary values rounded to nearest whole cent/penny. Text and graphic copyright © Gas Strategies, all rights.

Subscription Benefits

Our three titles – LNG Business Review, Gas Matters and Gas Matters Today – tackle the biggest questions on global developments and major industry trends through a mixture of news, profiles and analysis.

LNG Business Review

LNG Business Review seeks to discover new truths about today’s LNG industry. It strives to widen market players’ scope of reference by actively engaging with events, offering new perspectives while challenging existing ones, and never shying away from being a platform for debate.

Gas Matters

Gas Matters digs deep into the stories of today, keeping the challenges of tomorrow in its sights. Weekly features and interviews, informed by unrivalled in-house expertise, offer a fresh perspective on events as well as thoughtful, intelligent analysis that dares to challenge the status quo.

Gas Matters Today

Gas Matters Today cuts through the bluster of online news and views to offer trustworthy, informed perspectives on major events shaping the gas and LNG industries. This daily news service provides unparalleled insight by drawing on the collective knowledge of in-house reporters, specialist contributors and extensive archive to go beyond the headlines, making it essential reading for gas industry professionals.