Energy prices in markets across the globe rose across the board on Thursday – most notably in the US, where Henry Hub futures rallied strongly after six consecutive declines. Expectations that government gas storage data would show an early injection rather than a withdrawal failed to materialise.

The US Energy Information Administration (EIA) estimated working gas in storage at 2,325 Bcf as of 8 March, down 9 Bcf from the previous week and way above the five-year historical range. The impact of that surprise may, however, be short-lived, given how high stocks are at the end of winter.

Stocks were 336 Bcf higher year-on-year and 629 Bcf – or 37% – above the five-year average of 1,696 Bcf for this time of year.

Perhaps more significantly, the level of storage has now wandered well outside the five-year maximum-minimum range and – with astronomical spring now only a week away – the deviation looks set to grow, given current market fundamentals. The vernal equinox in the northern hemisphere happens on Wednesday next week.

One bullish factor was a growing expectation that Freeport LNG might soon restart the 5 mtpa liquefaction train that has been undergoing repairs.

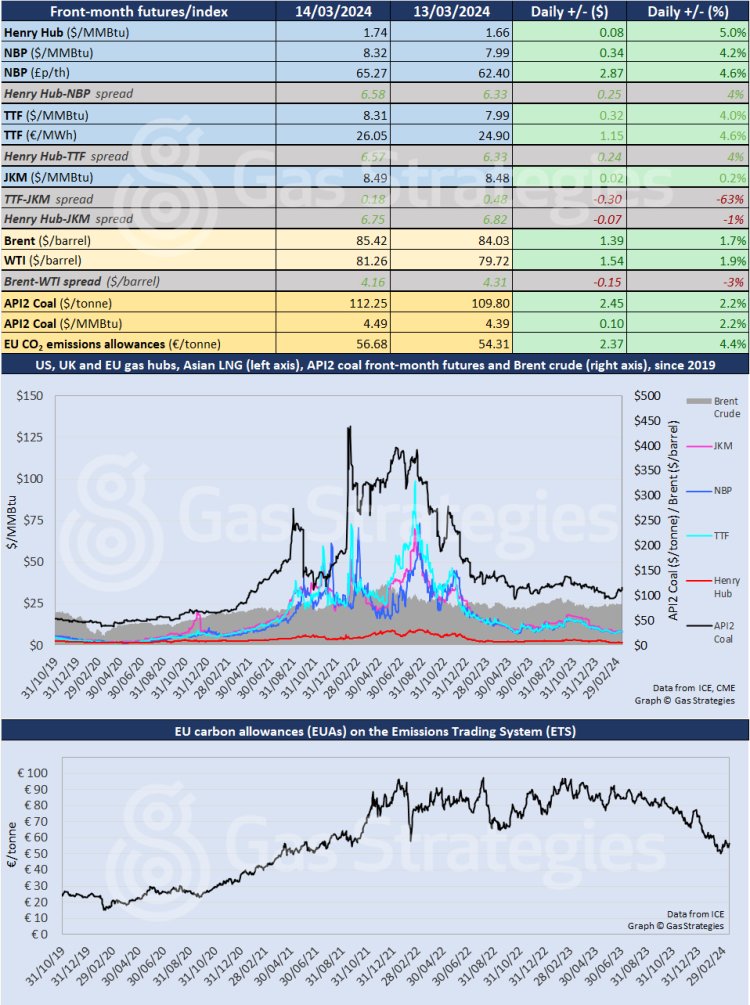

The front-month Henry Hub futures contract rose by 5.0%, from USD 1.66/MMBtu on Wednesday to USD 1.74/MMBtu on Thursday. It was climbing again, by around 1.5%, on Friday morning.

Natural gas futures were up strongly in Europe, with TTF rising by 4.0%, from USD 7.99/MMBtu on Wednesday to USD 8.31/MMBtu on Thursday, and NBP up 4.2%, from USD 7.99/MMBtu to USD 8.32/MMBtu.

In Asia, the JKM LNG price edged up 0.2%, from USD 8.48/MMBtu to USD 8.49/MMBtu, leading to a TTF-JKM spread of just USD 0.18/MMBtu.

Crude oil prices continued their rally, having well and truly broken out of their rangebound trading of recent weeks.

Front-month Brent crude was up 1.7%, from USD 84.03/barrel on Wednesday to USD 85.42/barrel on Thursday, the highest price since last October, while WTI was up 1.9%, from USD 79.72/barrel to USD 81.26/barrel, also the highest front-month price since last October.

European coal was up for the fourth consecutive session, with API2 rising by 2.2%, from USD 4.39/MMBtu on Wednesday to USD 4.49/MMBtu on Thursday.

European carbon prices rose with the tide, with EU emissions allowances up 4.4%, from EUR 54.31/tonne to EUR 56.68/MMBtu.

Front-month futures and indexes at last close with day-on-day changes:

Time references based on London GMT. Brent, WTI, NBP, TTF and EU CO2 data from ICE. Henry Hub, JKM and API2 data from CME. Prices in USD/MMBtu based on exchange rates at last market close. All monetary values rounded to nearest whole cent/penny. Text and graphic copyright © Gas Strategies, all rights.

Subscription Benefits

Our three titles – LNG Business Review, Gas Matters and Gas Matters Today – tackle the biggest questions on global developments and major industry trends through a mixture of news, profiles and analysis.

LNG Business Review

LNG Business Review seeks to discover new truths about today’s LNG industry. It strives to widen market players’ scope of reference by actively engaging with events, offering new perspectives while challenging existing ones, and never shying away from being a platform for debate.

Gas Matters

Gas Matters digs deep into the stories of today, keeping the challenges of tomorrow in its sights. Weekly features and interviews, informed by unrivalled in-house expertise, offer a fresh perspective on events as well as thoughtful, intelligent analysis that dares to challenge the status quo.

Gas Matters Today

Gas Matters Today cuts through the bluster of online news and views to offer trustworthy, informed perspectives on major events shaping the gas and LNG industries. This daily news service provides unparalleled insight by drawing on the collective knowledge of in-house reporters, specialist contributors and extensive archive to go beyond the headlines, making it essential reading for gas industry professionals.