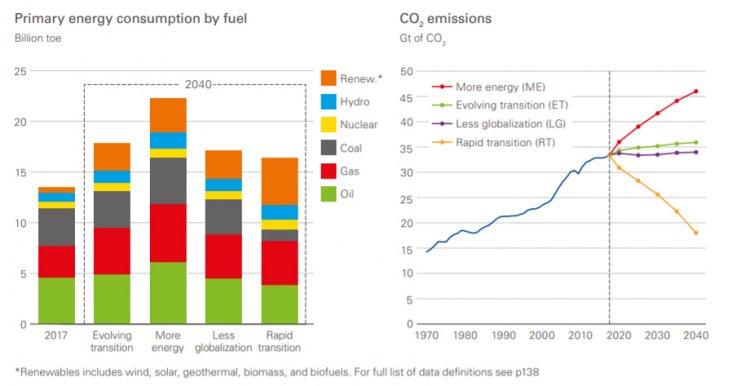

Last week BP issued its Annual Energy Outlook 2019 which provides an analysis of the different pathways for future global energy supply and demand to 2040.[1] The report’s authors are careful not to pick a “base case” but focus instead on two main scenarios: Evolving Transition (ET) and Rapid Transition (RT). As the names suggest, ET sees energy demand continuing to rise across the globe with a steady increase in the share of renewable energy, while RT sees a lower rise in demand accompanied by a much more rapid adoption of renewable energy, greater energy efficiency, use of technologies such as Carbon Capture Utilisation and Storage (CCUS), and the almost total phasing out of coal.

Source: BP Energy Outlook 2019, pg 7

Source: BP Energy Outlook 2019, pg 7

Also last week we saw what may be the first in a series of protests by school children in the UK against climate change, with thousands of pupils taking the day off school to protest against the UK government’s lack of action on climate change. These protests are inspired by the Swedish teenager Greta Thunberg who protests weekly outside the Swedish parliament and who spoke at the Katowice COP 24 conference late last year, berating global leaders for doing nothing about climate change.

Whilst it is clearly headline grabbing to see a 15-year-old stand up in front of world leaders and accusing them of failing to act, it is a significant distortion of reality and dramatizes the debate over how to deal with climate change. Governments across the world have been and continue to take action on climate change – for instance the British government was the first in Europe to institute legally binding carbon budgets and Green House Gas Emissions there have been reduced by over 40% on 1990 levels. Across Europe governments have invested billions of Euros in subsidies to support the development of renewable energy such that the EU will meet its 2020 targets for renewable energy penetration and CO2 emission reduction. Elements of policy that have not worked (such as the European ETS scheme) have been reformed and we have seen ETS prices rise over the last 18 months, creating new economic incentives to reduce carbon emissions.

The major oil and gas companies, including BP, are now actively planning for a future where fossil fuels take a smaller share of overall energy. Companies are investing in the energy transition through research and development and through renewable energy businesses directly. Concurrently, financial investors are signing up to global standards that will see them reduce investments in fossil fuel production and supply in order to facilitate the energy transition.

So the real question to governments, the energy industry and investors is not “why aren’t you doing anything?” but rather “are you doing enough, are you doing it quickly enough, and are you sufficiently clear about what you are trying to do?”. Framing the question this way should help wider society understand the huge number of trade offs that need to be considered in the energy transition, as well as the implications for the daily lives of people around the world.

For the gas industry there is a lesson in all of this: the debate on climate change is highly politicised, polarised and backed by huge vested interest on all sides. In this environment it is very easy for companies to avoid the debate or worse retreat to a defence of the industry from the battlements of “fortress gas” – the cleanest fossil fuel.

The future is uncertain, and policy, technology and economics could each drive the development of the energy mix down any number of different pathways. It’s important to realise that some of these could lead to an existential threat for gas in the longer term. So stay tuned, keep your business agile and be prepared to get down from the battlements and work with your competition (new and old) to keep your business relevant for the future.

[1] https://www.bp.com/en/global/corporate/energy-economics/energy-outlook/energy-outlook-downloads.html

If you would like more information about how Gas Strategies can help your business with Consulting services across the value chain or provide industry insight with regular news, features and analysis through Information Services or help with people development through Training Services, please contact us directly.