After a long period of price declines on the European gas market, there was a sudden jump in prices on Monday following signs of demand recovery from Asia.

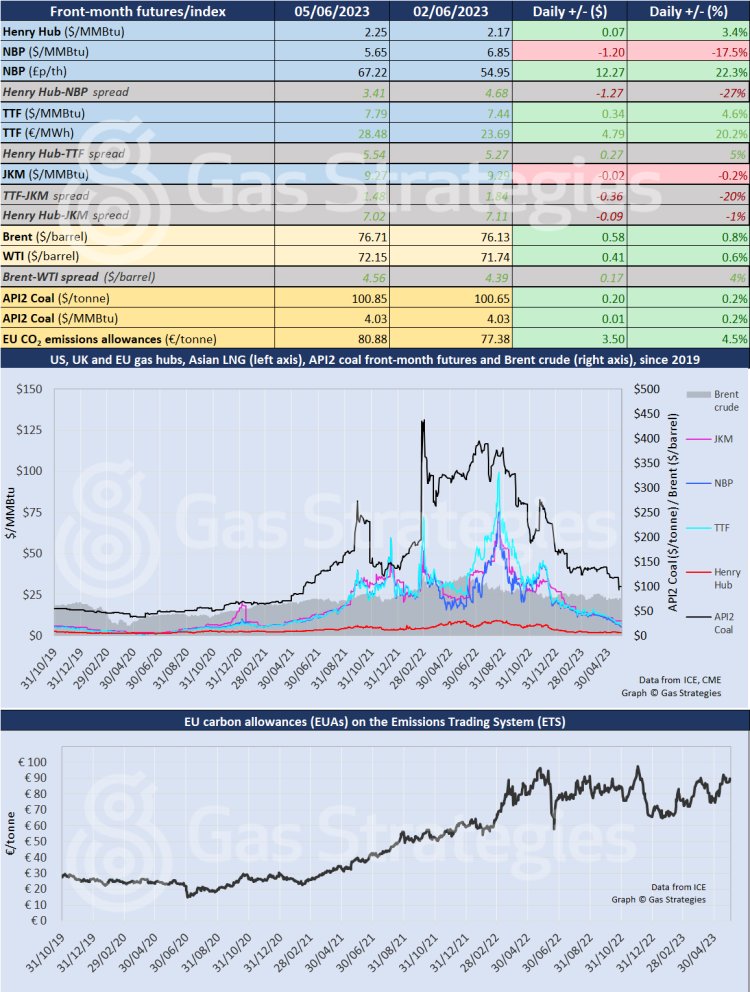

The front-month TTF price rose 4.6% to USD 7.79/MMBtu, while the jump in EUR/MWh was 20.2%. Meanwhile, NBP plunged 17.6% to USD 5.65/MMBtu, and in GBP/th the surge was 22.3%.

The price difference in the benchmarks’ native currencies was due to an overnight plunge in FX rates.

Energi Danmark said in its morning report: “The TTF front month contract climbed more than 20% amid signs that LNG demand in Asia is ramping up, something which means Europe would have to raise prices as well in order to continue to attract the LNG. Warm weather forecasts for Northern and Central Europe the coming weeks added to the upside.”

On Monday, Tim Partridge, director of energy markets at utilities consultancy Eyebright Ltd, was quoted as saying by Bloomberg: “A perfect storm hit gas hubs today.”

He added that additional factors behind the day’s move included an ongoing outage at the Norne field in Norway, bullishness filtering through from Saudi Arabia’s pledged oil-supply cuts and US shipments of LNG favouring Asia over Europe.

The Henry Hub rose 3.4% to USD 2.25/MMBtu, on easing production, as expectations for strong cooling demand and a cut to global oil supplies has provided potential support for LNG prices.

Saudi Arabia on Sunday agreed to curb crude supply further in July to help boost falling oil prices. As long-term LNG contracts are often linked to oil, buyers may now prefer spot shipments.

But crude markets were not too convinced by the news, as Brent on Monday gained a minor 0.8% and settled at USD 76.71/barrel. WTI was 0.6% higher, settling at USD 72.15/barrel.

Front-month futures and indexes at last close with day-on-day changes (click to enlarge):  Time references based on London GMT. Brent, WTI, NBP, TTF and EU CO2 data from ICE. Henry Hub, JKM and API2 data from CME. Prices in USD/MMBtu based on exchange rates at last market close. All monetary values rounded to nearest whole cent/penny. Text and graphic copyright © Gas Strategies, all rights.

Time references based on London GMT. Brent, WTI, NBP, TTF and EU CO2 data from ICE. Henry Hub, JKM and API2 data from CME. Prices in USD/MMBtu based on exchange rates at last market close. All monetary values rounded to nearest whole cent/penny. Text and graphic copyright © Gas Strategies, all rights.

Subscription Benefits

Our three titles – LNG Business Review, Gas Matters and Gas Matters Today – tackle the biggest questions on global developments and major industry trends through a mixture of news, profiles and analysis.

LNG Business Review

LNG Business Review seeks to discover new truths about today’s LNG industry. It strives to widen market players’ scope of reference by actively engaging with events, offering new perspectives while challenging existing ones, and never shying away from being a platform for debate.

Gas Matters

Gas Matters digs deep into the stories of today, keeping the challenges of tomorrow in its sights. Weekly features and interviews, informed by unrivalled in-house expertise, offer a fresh perspective on events as well as thoughtful, intelligent analysis that dares to challenge the status quo.

Gas Matters Today

Gas Matters Today cuts through the bluster of online news and views to offer trustworthy, informed perspectives on major events shaping the gas and LNG industries. This daily news service provides unparalleled insight by drawing on the collective knowledge of in-house reporters, specialist contributors and extensive archive to go beyond the headlines, making it essential reading for gas industry professionals.